2 Career Planning and Financing Your Education

Chapter Two Learning Objectives

- Understand the career decision process.

- Explore your own values, interests, personality traits.

- Research career opportunities.

- Understand Financial Aid Awards.

- Identify different types of federal student loans.

- Understand the impact of accrued versus capitalized interests.

- Compare the differences between various student loan repayment plans.

Popular personal finance advice often emphasizes managing debt and spending. These are important topics and will be explored in detail in future chapters. An equally important factor that contributes to your financial well-being is your sources of income. This chapter concentrates on individuals whose main source of income is derived from their employment. This encompasses a wide range of professions and job types, including salaried and hourly workers in various industries and sectors.

In addition to its financial impact, employment also plays a vital role in your social and emotional well-being, making career choice one of the most important decisions you make in your lifetime[1]. It is perhaps not surprising that many young people find choosing a career a daunting task. They should know that they are not alone nor is this a new challenge. Parsons analyzed this problem over 100 years ago[2]. He proposed three key principles for making a career choice: (1) a clear understanding of yourself, (2) knowledge of different potential careers, and (3) how these two are related. One hundred years later, the process of making career decisions is still a popular research topic for vocational psychologists[3].

Know Thyself

Understanding yourself includes knowing your values, interests, personality, and skills. Let us take a look at each of these. Psychologists have studied personal values and developed tools to help pinpoint what is truly important to you. One such tool is the “Personal Values Card Sort” exercise[4] Figure 2.1 shows 83 common personal values identified in a research study. This list is a good place to start. You should add values that are important to you but not on this list. The next step in the exercise is to sort these values into 3 piles: “not important to me”, “important to me”, and “very Important to me”. The objective is to narrow down 5 to 10 values that are most important to you[5]. If you have more than 10 cards in the “very important to me” pile, sort the cards in this pile into 3 piles again. Repeat this step until you have at most 10 cards that are “very important to me.” The “Personal Value Card Sort” exercise is a great way to tease out values that are deeply meaningful to you. Knowing your core values can assist in making decisions and prioritizing actions.

Exercise 2.1: Find your values

Print out the Common Personal Values cards from Appendix 2.1. Remember to add your values that are not on the cards. Sort these cards into 3 piles: Not Important, Important, Very Important. If you have more than 10 cards in the ‘Very Important’ pile, re-evaluate the cards in this pile until you have at most 10 cards that are ‘Very Important.’

When considering your interests, review your hobbies, favorite school subjects, past job experiences, books and entertainment themes. Examine which jobs, volunteer roles, or school projects you find most fulfilling. What do you enjoy doing in your free time? Do you have a passion for woodworking, playing music, engaging in sports, or playing computer games? Which classes did you excel in or find most engaging? Taking a variety of classes early in college is a good way to explore your interests and get more insights into a subject area. Your academic strengths and preferences can point you towards fields that align with your natural abilities and interests. Past job experiences can also offer insights into your interests. Think about the tasks and responsibilities you found most fulfilling and those you disliked. Did you enjoy working with people, solving problems, or being creative? Reflecting on your past work experiences can help you identify the type of work environment and job duties that suit you best.

By examining these various aspects of your life, you can start to identify patterns and connections between your interests and values. For instance, if caring and justice are very important values to an individual, they will likely remember fondly their alternative spring break working with Habitat for Humanity. Another person may find hiking the Appalachian Trail a fulfilling activity because adventure and challenge are important to them.

Remember that your interests and values may evolve over time, so it is important to stay open to new experiences and opportunities. Taking courses, attending workshops, or shadowing professionals in different fields can help you explore your interests and gain a deeper understanding of different career paths. Ultimately, the goal is to find work that aligns with your interests, values, and skills. When you are interested in what you do, you are more likely to be successful and fulfilled in your career.

You Are Not Ruled by Your Personality

The field of pop psychology attempts to use personality type models to categorize people into different groups based on common traits. There are many popular models, dating back to Dr. Carl Jung who posited the introvert versus extrovert model in 1923. Later models included the Myers-Briggs indicators, the Enneagram model, and the type A, type B, type C, and type D personality model.[6]. None of these models completely describes a person because each of us is unique. It is more useful to view personality as a spectrum. Most people relate to more than one personality type.

Studies have shown that these types of personality models are not consistent and are not especially useful in predicting how people will respond to specific situations[7]. Nonetheless personality quizzes are very popular. They can be entertaining and they are useful in helping to identify your strengths as well as traits that you can improve on. For instance, if you fit the Extrovert Type A personality, you can be confident that you can persevere through challenges and take on leadership roles. At the same time, you need to work on reigning in your competitiveness and cultivating humility and open-mindedness. Alternatively, if you find that you fit the “Helper” description, you can work on setting boundaries and saying no. Knowing your values, interests, and personality can help you find a starting point to explore career options. However, do not rule out a career simply based on a personality or career quiz. The next section explores resources and strategies to find out information about a career field.

It was Jordan’s first semester in college and time flew by quickly. In the blink of an eye, it was time to register for classes for the next semester and their academic advisor suggested that Jordan should think about choosing a major. Their roommates were in the same boat and their dinner talks were consumed with the topic. The task of choosing a major and a career felt overwhelming to them all. Their college’s career services offer many resources and they all felt that was a good place to start. They made an appointment to meet with a career coach. Prior to the appointment, Jordan did a personal values card sort exercise and took a personal strength inventory quiz. They discovered that they valued:

- Accuracy

- Caring

- Compassion

- Cooperation

- Dependability

- Health

- Knowledge

- Service

The descriptions of an introvert and a ‘Helper’ seemed to describe them well. Jordan remembered they enjoyed volunteering at the college’s food pantry and they liked going to the gym with friends and watching nature documentaries. Given their values, interests, and personal traits, they think that careers in healthcare, science education, or environmental science may be a good fit. The career coach agreed with Jordan’s self assessment and suggested that Jordan research occupations in these fields.

Researching Careers

Even if wealth is not a top priority for you, the economic reality is that your future earnings are a critical part of your financial plan. However, you should not choose your career based on earnings alone. If you faint at the sight of blood, pursuing a career as a surgeon is not a good fit even if the pay is excellent and the occupation saves lives. You should choose a career that will be enjoyable and pays well enough for you to achieve your financial goals in the long run. If you like your job, you are more likely to perform well and advance in your career. The Bureau of Labor Statistics (BLS) and job placement websites are good places to gather information about different vocations. The BLS Occupational Outlook Handbook website provides detailed information on job opening forecasts, pay, education and certifications requirements, duties and responsibilities, work environment, and how to get into a specific vocation. For example, the work environment page covers job locations, typical work schedules, and even risks of injuries and illnesses. You can evaluate an occupation based on your personal values, opportunities for growth, and family situation. Some useful factors to consider include:

- Entry level education requirements

- Licenses, certifications, registrations requirements

- Work experience requirements

- Continuing education requirements

- Work environment and work hours

- Job outlook

- Salary range

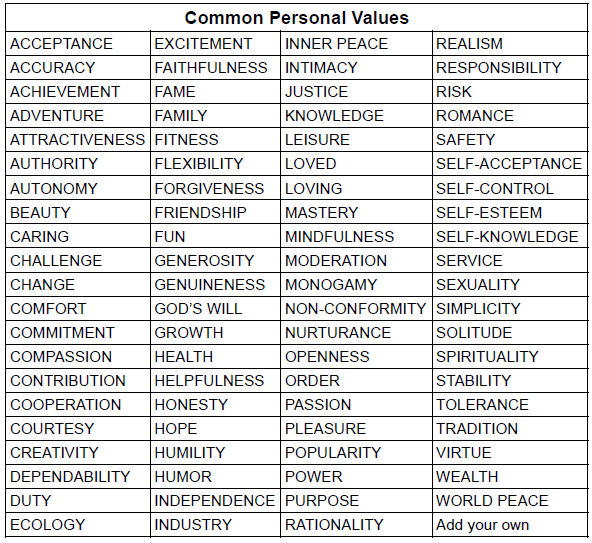

In addition to information on individual vocations, the BLS compiles a wide range of employment data. Figure 2.2 shows the occupations with the largest expected number of job openings over the next 10 years. The first column contains the number of projected job openings and the second column contains the annual median earnings of these occupations in 2023. Median earnings means that half of workers in that occupation earn less than the median amount and half earn more than the median amount. It is likely that someone with less experience working in a smaller firm may earn less than the median amount. For example, the national median pay for software developers was $132,270 in 2023 but the bottom 10 percent earned only around $80,000. Geographic location is also an important factor. In 2023 the median earnings for software developers was $147,000 in Massachusetts and $128,000 in New Hampshire, a neighboring state. Therefore, when researching career information, take into account your own preferences on geographic location and corporate (organizational) environment. This will help you set a more realistic expectation.

Exercise 2.2: Research career fields

Go to the Bureau of Labor Statistics website, http://www.bls.gov. Navigate to the Occupational Outlook Handbook. (Hint: you can find it easily by using the search term “occupation finder” in the search bar on the BLS website.) Review two careers in the Occupational Outlook Handbook that interest you. Collect the following information:

- Job title (occupation)

- Entry level education requirements

- License, certification, registration requirements

- Work experience requirements

- Continuing education requirements

- Brief description of work environment and work hours

- Brief description of how to enter the career

- Job outlook

- Salary range in your geographic area

Job descriptions alone do not provide a complete picture of what the actual working life will be like. Part-time jobs and internships in the industry are the best ways to gain valuable hands-on experiences. For instance, if you are interested in becoming a pharmacist, you can get a front row seat by working in a drug store or a hospital. Some professions, such as accounting, offer internships to first and second year college students. Explore career options as early as possible. Do not wait until you need an internship or a job.

Use your network of friends and family, school alumni, and professors to connect with someone currently working in the field. Join student clubs and attend career events at your school. Another good resource is professional organizations, which often have student chapters. For instance, if you are interested in financial planning as a career, the Financial Planning Association (FPA) and the Chartered Financial Analysts (CFA) Institute both have student chapters and events designed to introduce students to the profession. People are often happy to talk about their career paths. Request an informational interview to learn more about the field. Here are some tips you can use to get the most out of such an interview.

Talking to Someone Working in a Field (An Informational Interview)

An informational interview is an informal conversation with someone working in a profession that interests you. It is not a job interview. Through an informational interview, you can gain advice about how to prepare for and enter the field, find out about career paths, learn what the workday and work environment is like, and expand your professional network. Keep the interview short, between 15 to 30 minutes. You can ask to meet in person or via video chat.

Before contacting someone, find out basic information about the field. Develop a short introduction about yourself (20-30 seconds). Practice your introduction. Write down 5 to 10 open-ended questions to ask. Below are some sample questions you can use as reference.

Sample Informational Interview Questions

- What is a typical day (or week) like for you?

- What excites you about your work?

- What aspects of your work are you less excited about?

- How does your position fit within the organization (or industry)?

- How does your job affect your general lifestyle?

- What is your work-life balance like?

- What are some current issues and trends in the field?

- What are some common career paths in this field?

- What kinds of accomplishments tend to be valued and rewarded in this field?

- What related fields do you think I should consider looking into?

- How did you become interested in this field?

- How did you begin your career?

- How do most people get into this field? What are common entry-level jobs?

- What kind of education, training, or background does your job require?

- What skills, abilities, and personal attributes are essential to succeed in your job?

- What are the most effective strategies for seeking a position in this field?

- What advice would you give someone who is considering this type of job (or field)?

Contact the person by email or phone call. Explain how you found their name and emphasize that you are looking for information about the field, not about getting a job. Ask for a 15 to 30 minute appointment for a chat at a time that is convenient to them. If the request is by email, list times that you are available. If you call the person, be ready with your questions if they say it is a good time to talk now.

When conducting the interview, have the written questions with you. Listen and take notes. Respect the other person’s time. Remember that they are doing you a favor. Start and end the interview on time. Follow up with a thank you note (email) to express appreciation for the information and their time.

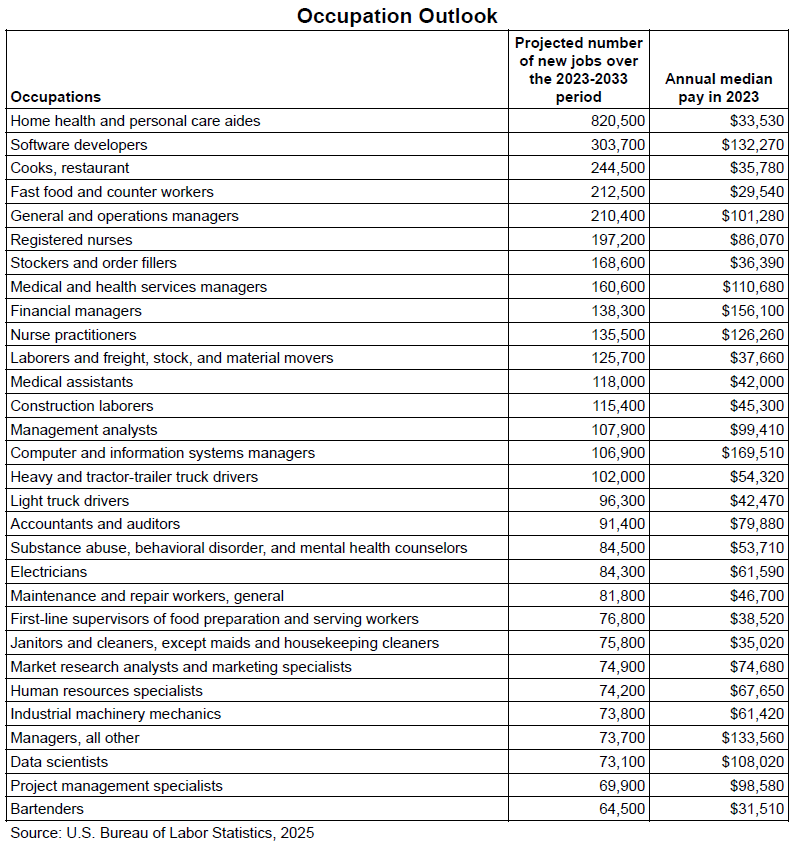

After researching occupation options, you may discover that your current skills or education are not sufficient to pursue your career and financial goals. In general, the more education you have, the higher your earnings will likely be. Figure 2.3 shows that the median income for people with a bachelor’s degree is much higher than for those without. Those with a professional degree such as doctors, dentists, lawyers, or those with a doctorate degree earn even more.

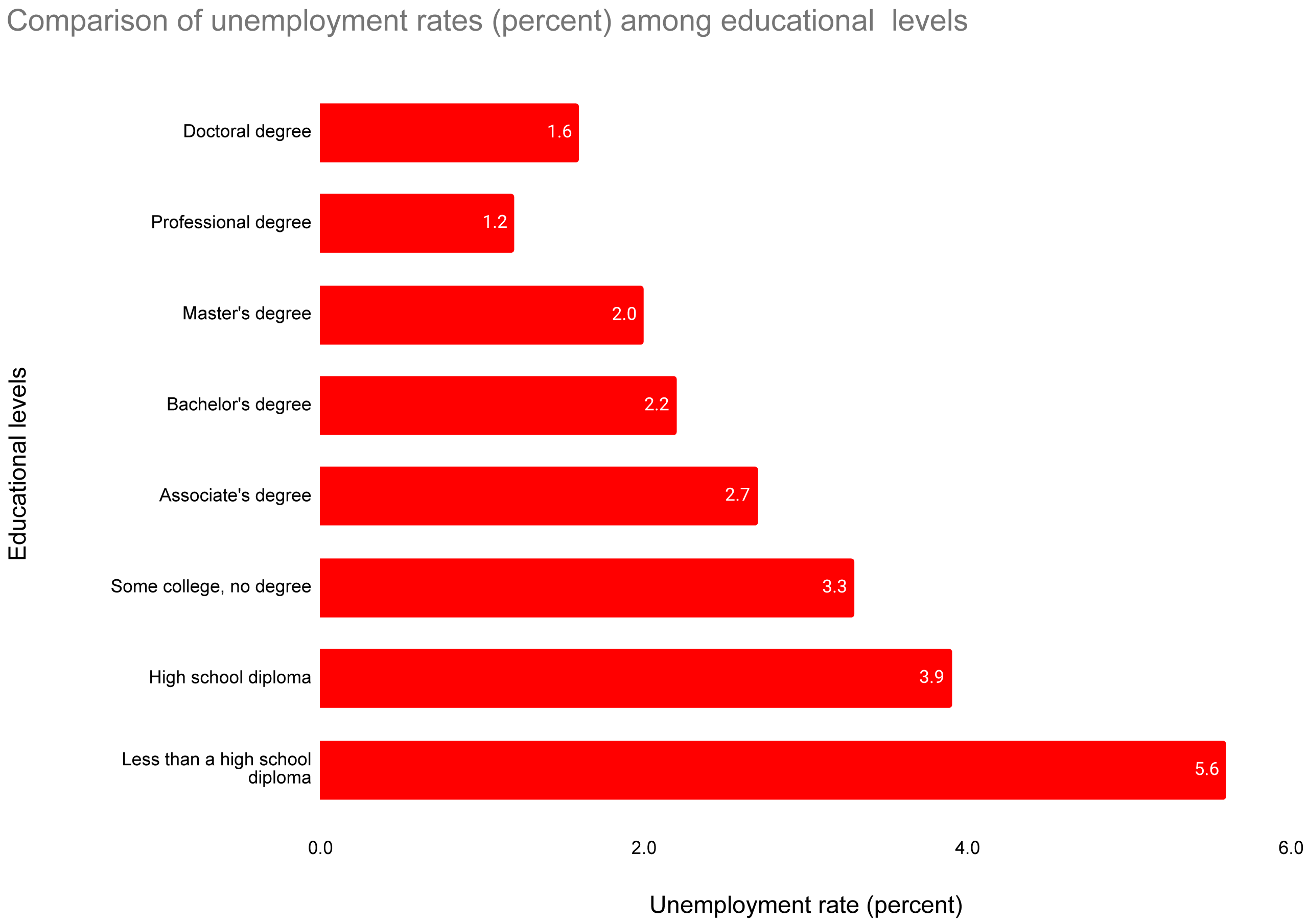

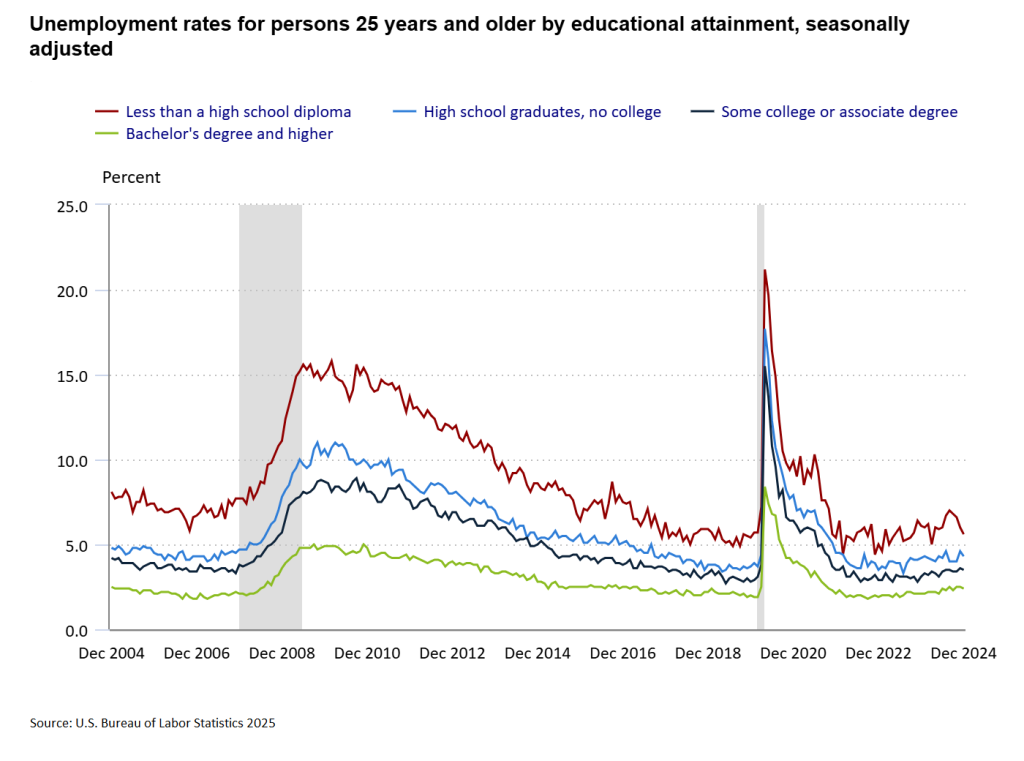

In addition to higher earnings, education also increases employment opportunities. Figure 2.4 shows that the unemployment rate for those with a bachelor’s degree is much lower than those without one. The advantage of having a bachelor’s or higher degree remain stable over the past two decades and is especially pronounced during economic downturns (Figure 2.5).

Even though choosing a career is one of the most important life decisions, you may find that you need to reevaluate your career choice later in life. In fact, many people change their career over time. Changing technology and economic conditions will affect the demand for different occupations, creating new jobs and eliminating others. The recent advances of generative artificial intelligence (AI) created many speculations about its impact on the future of work. Disruption to the labor market due to technology has happened many times before. Research has found that while technological breakthroughs often occurred quickly, new technology got adopted gradually and the disruption of labor markets took decades[8]. Early evidence suggested that low-skilled and middle-skilled jobs had declined in recent years (2016 to 2022) while high-skilled occupations increased. Entry-level roles are especially at risk according to the 2025 World Economic Forum Future of Jobs Report. The report projected that 170 million new jobs will be created while 92 million jobs will be displaced this decade. Life-long learning, training, and reskilling are as important as choosing a particular career. The next section addresses the costs of and methods to finance additional education.

Financing Your Education

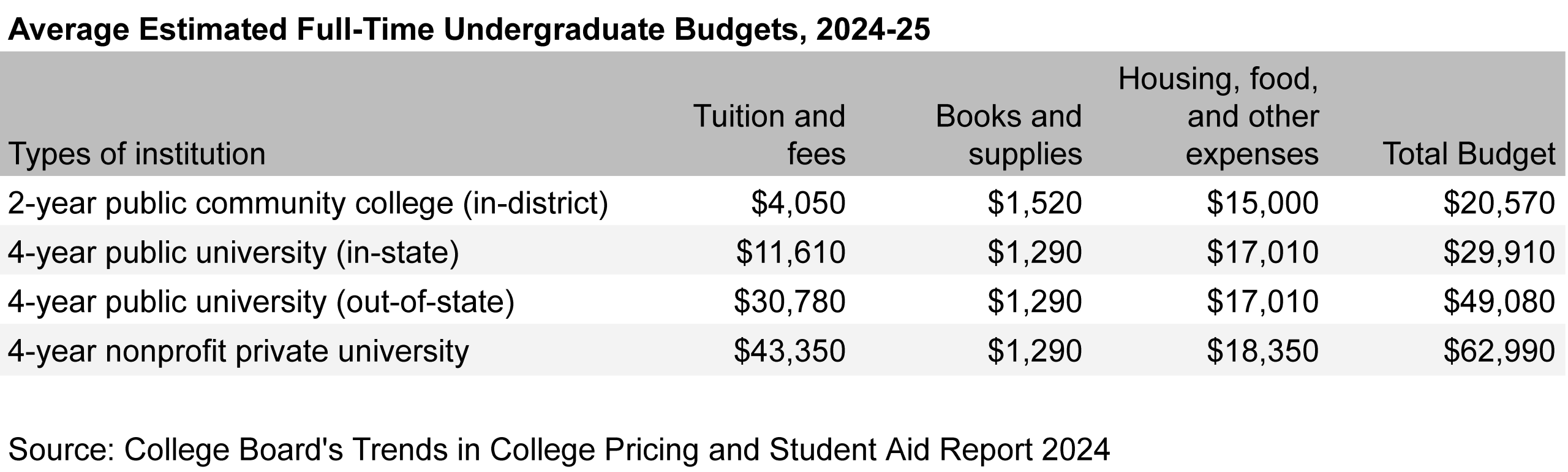

The costs of higher education vary greatly depending on your choice of school. Figure 2.6 shows the estimated national average costs to attend 2-year and 4-year colleges. In general, 2-year community colleges have the lowest tuition and fees. A number of states have special programs that make community colleges free to qualified students. Many community colleges have curriculum and majors specifically designed for transferring to 4-year universities. If you live in a state with a strong community college and public university system, they are good options to consider. When budgeting for college, keep in mind the total costs, which include books, supplies, housing, and food. These non-tuition costs are similar across different institutions. Of course, cost is not the only criteria for selecting a college. Your preferred field of study and options to explore other fields should be the focus. It is quite common for students to change their majors so having options is important. Academics is part of the overall college experience. Learning to live independently on your own among your peers is very valuable. On campus housing is one item community colleges often lack. Another important thing to consider is that the tuition and fees in Figure 2.6 do not take into account scholarships, grants, and aid that do not need to be repaid. Evaluate your college costs based on your individual acceptance letter and financial aid package, not just the published amounts. Beware of for-profit colleges. Many of them may have lower tuition and fees but studies have found that they have a long history of manipulative behavior and deceptive marketing.[9] Evidence showed that for-profit colleges yield higher debts and poorer job placement outcomes for students. In 2009 for-profit colleges only enrolled 10 percent of students in the U.S. but they accounted for half of all student-loan defaults over the next five years.

When you apply for college, you will need to fill out the college application form and FAFSA (Free Application for Federal Student Aid). If you need help with these forms, your high school counselors and the financial aid counselors at your target colleges are good resources. When you are accepted by a college, you will receive a letter of acceptance and the financial aid award letter. This letter will include a list of the financial aid that you have been offered and the dollar amount. There are four common types of aid: need-based grants, merit-based scholarships, student loans, and work study. Need-based grants include federal grants such as Pell Grants and Federal Educational Opportunity Grants (FSEOG) and private grants from the college. These grants do not need to be repaid and the amount awarded depends on the financial information reported on your FAFSA. Merit-based scholarships are awarded by the college and private organizations and also do not need to be repaid. Work study is different from other types of aid in that it is not guaranteed. You need to find a work study job and apply for it. Wages from work study are paid directly to the student instead of reducing the balance on your school bill. Most work study jobs are on campus and the work hours are structured with students’ academic schedule in mind. Work study jobs still take time but are usually easier to juggle than off-campus jobs unrelated to your field of study. You do not need to accept every aid offered in the award letter. You can choose to accept/reject part or all of each aid individually. Since need-based grants and merit-based scholarships do not need to be repaid, they are a great way to help you finance your education. We will discuss federal student loans in detail in the next section to help you make an informed decision on how much, if any, to borrow.

Example: Jordan’s Financial Aid Awards

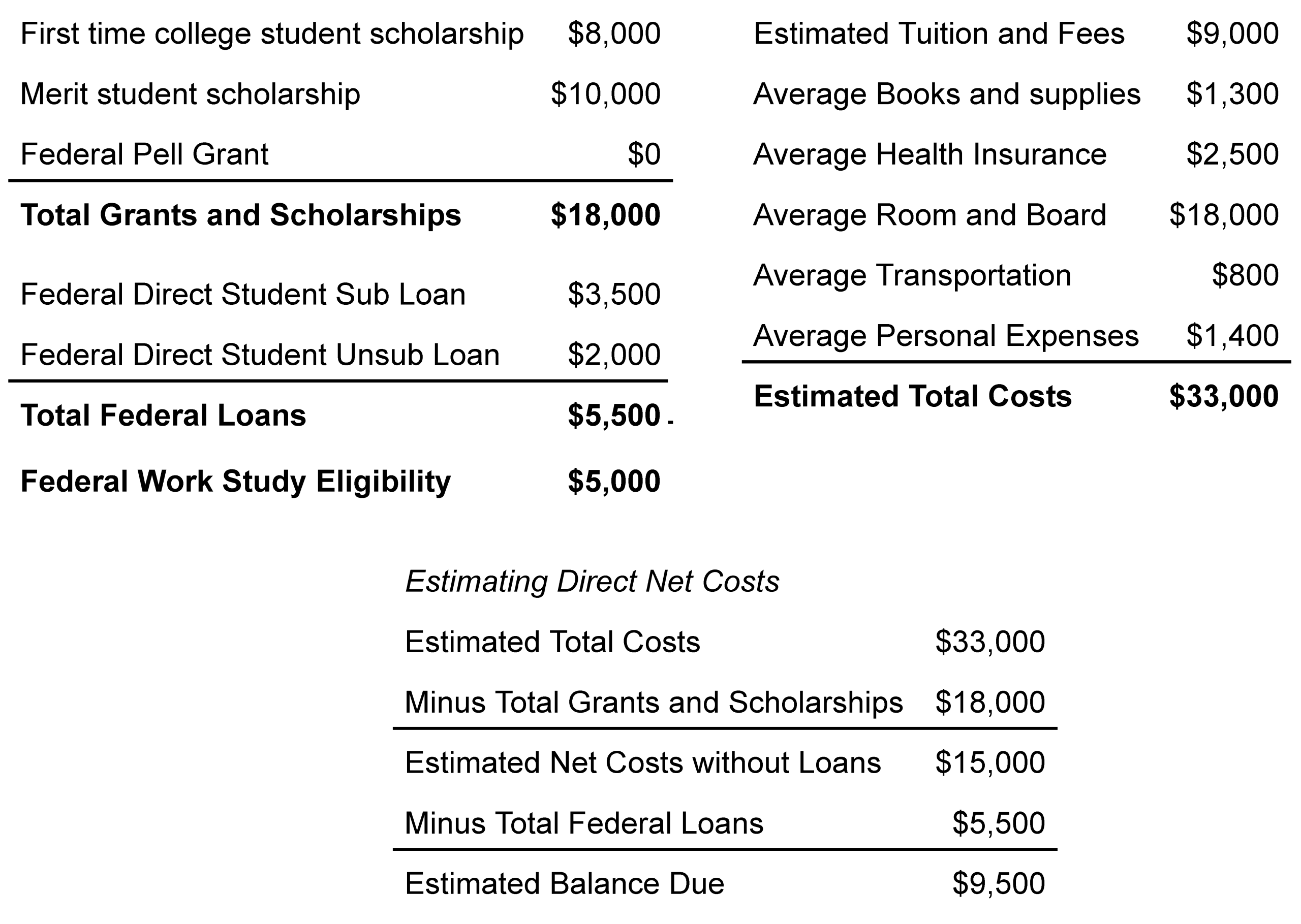

After researching career options and interviewing three professionals, Jordan decided to pursue a degree in nursing. They applied to several universities and were accepted by all but one. Jordan was very excited about going to college. They started reviewing the acceptance letters and financial aid awards. Figure 2.7 shows the financial aid award from their top choice school.

Jordan was very happy about the $18,000 in grants and scholarships. These were money they would not have to pay back. This meant Jordan’s estimated net costs without loans was $15,000. Jordan’s parents offered to pay $5,000 per year, meaning Jordan needed to come up with the remaining $10,000. Jordan did not like debt and wanted to borrow as little as possible. They decided to take the work study option which would provide another $5,000. Since interest on Federal Direct Sub Loan does not start until a student graduates, it is a better option than the Federal Direct Unsub Loan. The financial aid award offered $2,000 in Unsub Loan but Jordan did not have to accept the entire amount. In Jordan’s case, they only needed $1,500 in Unsub Loan. Jordan accepted $3,500 in Sub Loan and $1,500 in Unsub Loan.

Student Loans

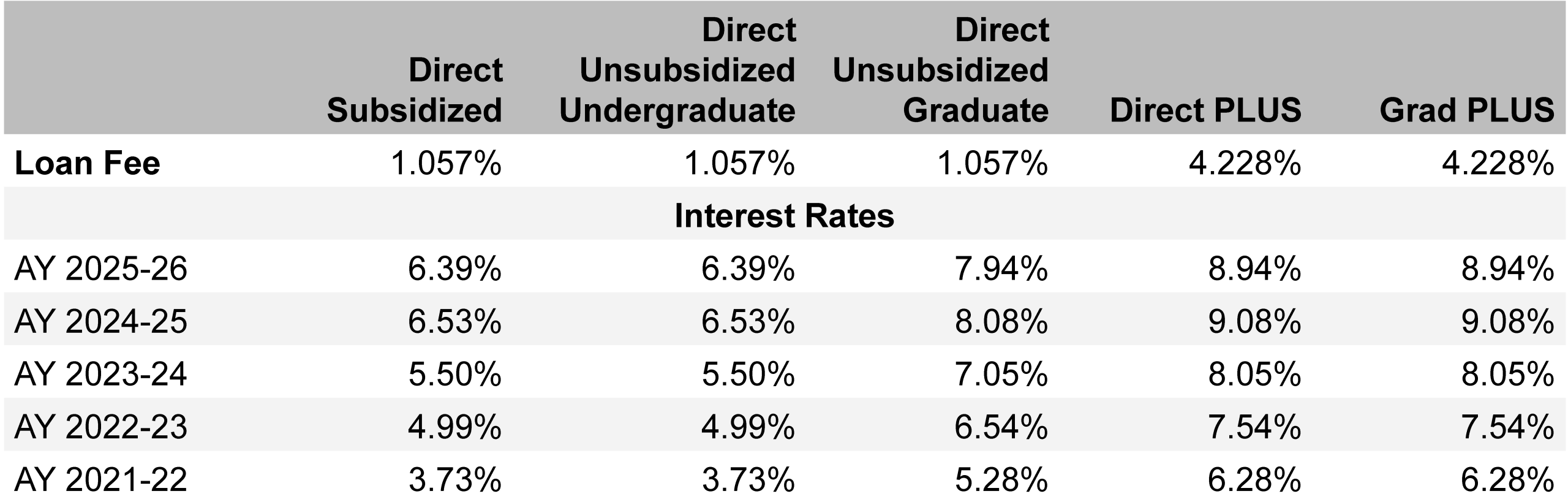

Understanding the different types of student loans and how interests on them are calculated will help you decide how to finance your college education. In general, federal student loans have lower interest rates than private student loans and have more flexible repayment plans. This section focuses on federal student loans. Chapter 6 will discuss other types of loans, consumer credits, and credit scores. The federal student loan website (www.studentaid.gov) is a useful resource and has information on the latest laws governing federal student loans. Direct Subsidized (Sub) Loan is a need-based federal loan for undergraduate students with demonstrated financial need. Direct Unsubsidized (Unsub) Loan is for undergraduate, graduate, and professional students. Professional institutions include law schools, medical schools, etc. Direct PLUS loan is for parents borrowing money for their dependent children in undergraduate programs. Grad PLUS loan is for graduate or professional students. The different loan programs differ in interest rates, fees, maximum loan amount allowed, and how interest amounts are computed. Interest rates on all federal student loans are set by Congress each spring for the next academic year and interest rate is fixed at the time the loan is given out (disbursed). Interest rates can fluctuate quite a bit from year to year. Loan fees and the maximum loan amounts are also set by Congress. The actual loan amount offered depends on each student’s financial situation reported in their FAFSA. Figure 2.8 shows the loan fees and interest rates for the academic year (AY) 2021-22 through 2025-26.

How Loan Fees and Interests Affect Your Student Loan Payments

When you borrow money, you need to pay them back plus interest in the future. For federal student loans, repayment is postponed (deferred) until the student graduates, leaves schools, or drops below half-time based on their chosen program of study, plus a grace period. The current grace period is 6 months, meaning repayment starts 6 months after graduation. The method for computing interest before repayment starts differs depending on the loan type. For Direct Subsidized Undergraduate loan, no interest is accrued while the student is in school, up to 1.5 times the published length of the academic program. If the published length is 4 years, the students can be in school up to 6 years plus the grace period with no interest on the Direct Sub loan.

For all other federal unsubsidized loans, including Direct Unsub, Direct Plus and GRAD Plus, interest is computed (accrues) as soon as the loan is given out (disbursed). Federal student loans are “daily interest” loans. This means that interest accrues every day. You can compute the interest amount using the following formulas:

Daily Interest Amount = Outstanding balance x (Interest rate per year / number of days in the year)

Accrued Interest Amount = Daily Interest Amount x number of days in the accrual period

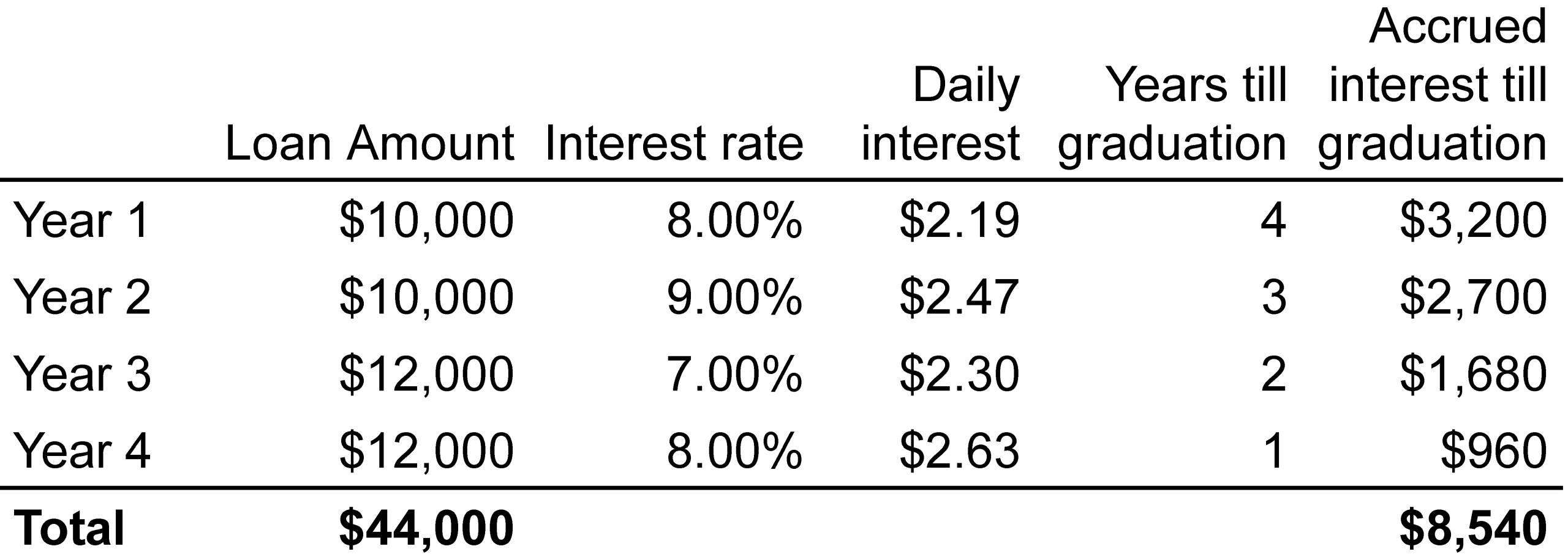

Figure 2.9 shows an example of a student taking out federal unsubsidized loans over 4 years. Notice that the loan taken out each year is treated as a separate loan with its own interest rate. The $10,000 loan taken out in year one has a daily interest amount of $2.19 ($10000 x 0.08 / 365). Over 4 years, the total accrued interest on this loan will be $3,200 ($2.19 x 365 days x 4 years). If this student does not make any payment while in school, the outstanding balance at graduation will be $52,540, the loan amounts plus accrued interest ($44000 + $8540).

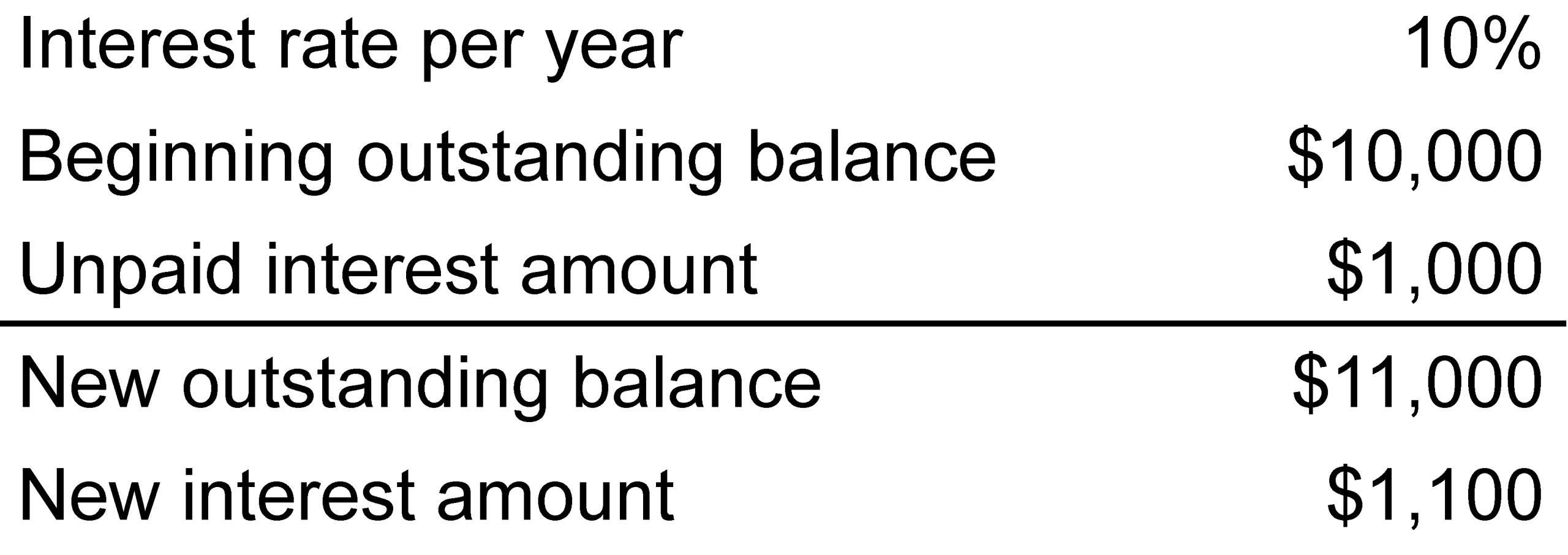

Once the repayment period starts, all federal loan interest is capitalized. Capitalized interest means that unpaid interests are added to the outstanding balance, increasing the interest amount for the next period. Let us look at a simple illustration in Figure 2.10. The initial outstanding balance for this loan was $10,000 with a 10 percent per year interest rate. The interest due at the end of the year was $1,000 ($10000 x 0.1). When this interest amount is not paid, it is added to the outstanding balance, increasing it to $11,000 ($10000 + $1000). The interest due next year will be $1,100 ($11000 x 0.1).

Capitalized interest is also called compounding. Chapter 5 will explain in detail how compounding works, the concept of time value of money, and tools to simplify their calculations. The key takeaway here is that if your payment is less than the interest due, the outstanding balance will keep increasing at a faster and faster rate. If your payment is greater than the interest due, you will pay down the loan balance over time. Since Direct Sub loan does not accrue interest during the deferment and grace period, the outstanding balance when the student leaves school is just the loan amount. For all other Direct Unsub loans, the outstanding balance when the student leaves school is the loan amount plus accrued interest. Therefore, Direct Sub loans are cheaper than Unsub loans. Another factor that affects your loan cost is loan fees.

Loan fees, also called origination fees, are a type of costs of borrowing. Loan fees are subtracted before money is given out to students. For example, if a student borrows $5,000 in Direct Unsub loan, the loan fee will be $52.85 ($5000 x 0.01057) and the student will receive only $4,947.15 ($5000 – $52.85). However, the student must pay interest on the entire $5,000. Therefore, the loan fee will accumulate interest, even though the student does not get to use that money. Assuming a standard repayment term of 10 years, the loan fee of $52.85 may accumulate $73 of interest, adding over $125 to the student’s cost of borrowing. Federal student loan origination fees are not a trivial burden on students. In AY 2023-24 these fees totaled $1.7 billion, not including any interest.

Repayment Options

The billing, record keeping, and customer services for all federal student loans are handled by a “loan servicer.” There are several private companies contracted by the federal government to act as loan servicers. You can find out who your loan servicer is on the Federal Student Aid website (www.studentaid.gov).

The types of repayment plans for federal student loans are approved by Congress. Currently there are four main types: standard, graduated, extended, and income-driven repayment (IDR) plans. If you do not make a choice, the default is the 10-year standard plan. This plan requires a fixed monthly payment amount and the entire loan balance plus interest will be paid off by the end of 10 years. Remember that each loan you take out is treated individually. You can choose which loan to pay off first instead of the default. Take the example in Figure 2.9. The monthly payment of a standard 10-year plan on the $52,540 outstanding balance will be around $637. The default is to allow the loan servicer to allocate this amount across the four loans. Instead of the default, you can choose to apply the entire payment toward the loan with the highest interest rate first. By doing so, you can shorten the time needed to pay off all the loans and lower the overall interest costs. In this particular example, you can reduce the time by 3 months and the total amount paid from $76,453 to $74,433, a saving of over $2,000. If you are financially able, you can also make additional payments to pay off your loans faster. The key is to communicate with the loan servicer and be very clear about how you want your payments to be applied.

The graduated repayment plan starts with a lower monthly payment and increases every two years, usually for a term of 10 years to pay off the entire balance. This option will increase your overall interest costs but may be a good option for careers that have low initial pay but high potential for substantial increases. There is a risk that your future income does not increase and you will not be able to make the higher payments. Using the example from Figure 2.9, the initial monthly payment can be lowered to less than $500 but the later monthly payments can be greater than $1,200.

The extended repayment plan has fixed monthly payment amounts and allows for a longer loan term, 12 to 30 years instead of 10 years. The longer term results in smaller monthly payments but higher overall interest paid. Applying an extended repayment plan of 20 years to the Figure 2.9 example will lower the monthly payment to $439 (instead of $637) but increase the total amount paid to $105,393 (instead of $76,453), significantly higher.

There are several income-driven repayment (IDR) plans and their availability is currently under debate in Congress. In essence, these plans set the monthly payment amount as a percentage of your discretionary income. The risk is that the payment amount may be lower than the accrued interest for the month. If that is the case, the outstanding balance will continue to grow even though you are making monthly payments. The original design of these plans allows the loan balance to be forgiven after the borrower has made 10, 20, or 25 years of payments. These forgiveness options may no longer be available. If the loan forgiveness options are revoked and the monthly payments are lower than the monthly accrued interest, these loans will never be paid off.

When choosing how much student loans to borrow, take into account the repayment options and how future loan payments will impact your life-style. Borrowing money to invest in your future is a good use of the loan. Do not let fear of debt limit your career opportunity. At the same time, be prudent about how much you borrow. The tools you will learn in the next chapter (Chapter 3) will help you budget and optimize your spending.

Personal Financial Plan Exercise 2

Conduct an informational interview

- Research a career field you are interested in.

- Identify someone working in the field.

- Develop a short introduction about yourself (20-30 seconds).

- Develop 5 to 10 interview questions. (You can use the sample questions from this chapter as references.)

- Request and conduct an informational interview (15-30 minutes).

- Follow up with a thank you note.

- Review results from the interview and your research.

- Evaluate your findings against your personal values, financial goals, and family needs.

- Write a brief reflection on whether you want to pursue a career in this field and your information interview experience.

Integrated Case 2

Choosing a Major and a Career Path

Blake Jackson will be a first generation college student. Her parents did not have the opportunity to continue education past high school. They encourage Blake to pursue higher education but they lack experience to give her specific guidance. Blade maintains a relatively high GPA and did well on the SAT in her junior year of high school. Some of her friends spent the summer before senior year visiting colleges and some decided against college and switched to the vocational program. Blake is undecided but leaning towards going to college. She met with her high school counselor who encouraged her to do a personal inventory.

Personal values:

- Acceptance

- Achievement

- Autonomy

- Creativity

- Dependability

- Fun

- Justice

- Safety

Interests:

- Computer gaming

- Guitar

- Drawing

- Cars

- Woodworking

Positive Experiences:

- Mentoring a grade school robotics team

- Working at an oil change place

- Building a 3D printer

- Playing in a high school band

- Creating a platform game for a computer class

Education options:

- Go to a vocational school for automotive repair

- Go to a community college

- Go to a 4-year university

Career options:

- Mechanics

- Musicians

- Software developers

Activities:

- Relate Blake’s values, interests, and experiences to each career option.

- Recommend actions Blake can take to learn more about each career.

- Recommend an education option for Blake. Explain your decision.

Chapter Two Summary

This chapter introduces resources and strategies for career planning, financial aid, and student loan management. It emphasizes the interconnectedness of self-understanding, career research, and financial prudence in achieving long-term well-being.

I. Understanding the Career Decision Process

Informed career choice requires understanding your own personal values, interests, skills, and requirements of potential careers. Tools like the “Personal Values Card Sort” help identify 5-10 core personal values. Examining what you find enjoyment in hobbies, school subjects, and past jobs will reveal your interests and current skills.

II. Researching Career Opportunities

After self-assessment, the next step is researching career fields. Key Resources include the Bureau of Labor Statistics (BLS) Occupational Outlook Handbook,career office and counselors in your school, job search sites, and industry groups. Factors to consider include:

- Entry level education requirements

- Licenses, certifications, registrations requirements

- Work experience requirements

- Continuing education requirements

- Work environment and work hours

- Job outlook

- Salary range

To gain more real world insights, get a part-time job or internship in the career fields you are interested in. Use your network to connect with professionals in the field. Conduct informational interviews.

III. Financing Your Education

A. Costs of higher education and its impact

- Costs of higher education vary greatly. Take into account scholarships and grants when comparing costs.

- More education generally leads to higher earnings and lower unemployment rates, especially during economic downturns.

- Life-long learning, training, and reskilling are as important as choosing a particular career due to changing technology.

- Beware of for-profit colleges which have a long history of manipulative behavior and yield higher debts and poorer job placement outcomes.

B. Types of Financial Aid

- Need-Based Grants: Do not need repayment.

- Merit-Based Scholarships: Do not need repayment and are based on achievements.

- Student Loans: Must be repaid with interest.

- Work-Study: Paid directly to the student. Job availability is not guaranteed.

C. Federal Student Loans:

Federal loans offer lower interest rates and more flexible repayment plans than private loans.

Types of Federal Student Loans

- Direct Subsidized (Sub) Loan: Need-based, no interest accrues in school/grace period.

- Direct Unsubsidized (Unsub) Loan: Interest accrues from disbursement.

- Direct PLUS Loan: For parents; interest accrues from disbursement.

- Grad PLUS Loan: For graduate students; interest accrues from disbursement.

Repayment Options for Federal Student Loans

- Standard Repayment Plan: fixed monthly payments over a 10-year term.

- Graduated Repayment Plan: Lower initial payments that increase every two years.

- Extended Repayment Plan: Fixed payments over 12-30 years, smaller monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: Payments are a percentage of discretionary income. A potential downside is that if payment does not cover interest, loan balance will increase.

End of Chapter Questions

- Beyond financial impact, what other vital roles does employment play in an individual’s well-being?

- Explain the “Know Thyself” component of career planning. List the four main aspects it includes.

- What key factors beyond salary should individuals consider when researching career information?

- Name the primary online resource recommended by the chapter for gathering detailed information on different vocations. List five types of information it provides.

- What are the best ways to gain valuable hands-on experiences and real-world insights into a specific industry beyond just reading job descriptions?

- Define an informational interview. What is its primary purpose, and what is it not?

- List five types of open-ended questions you might ask during an informational interview to gather insights about a career field.

- Describe the crucial steps to prepare for and conduct an informational interview.

- How does higher education generally impact an individual’s earnings and employment opportunities?

- Explain the concept of lifelong learning in the context of career planning, especially in reference to the impact of technological advancements on the labor market.

- What are the significant differences in estimated total costs for attending various types of higher education institutions (e.g., 2-year public, 4-year public in-state/out-of-state, 4-year nonprofit private university)?

- Why is it important to evaluate college costs based on your individual financial aid package rather than just the published amounts?

- Name the four common types of financial aid discussed in the chapter and briefly explain whether each needs to be repaid.

- Compare and contrast the two main types of federal student loans: Direct Subsidized (Sub) Loan and Direct Unsubsidized (Unsub) Loan, specifically regarding interest accrual while in school.

- What are loan fees (origination fees) for federal student loans, and how do they impact the actual amount of money a student receives versus the amount they owe interest on?

- Explain the difference between “accrued interest” and “capitalized interest” for student loans, and how does capitalization impact the total cost of borrowing? Provide an example of how interest capitalization works.

- Describe the “Standard Repayment Plan” for federal student loans. What is the default monthly payment allocation, and how can a borrower potentially save money on overall interest by communicating with their loan servicer?

- Briefly explain the “Graduated Repayment Plan” and the “Extended Repayment Plan.” How do they differ from the standard plan, and what are the potential pros and cons of each?

- What is the main risk associated with “Income-Driven Repayment (IDR) Plans” for federal student loans, especially if loan forgiveness options are subject to change or revoked?

Appendix 2.1

| Common Personal Values | Descriptions |

| ACCEPTANCE | to be accepted as I am |

| ACCURACY | to be accurate in my opinions and beliefs |

| ACHIEVEMENT | to have important accomplishments |

| ADVENTURE | to have new and exciting experiences |

| ATTRACTIVENESS | to be physically attractive |

| AUTHORITY | to be in charge of and responsible for others |

| AUTONOMY | to be self-determined and independent |

| BEAUTY | to appreciate beauty around me |

| CARING | to take care of others |

| CHALLENGE | to take on difficult tasks and problems |

| CHANGE | to have a life full of change and variety |

| COMFORT | to have a pleasant and comfortable life |

| COMMITMENT | to make enduring, meaningful commitments |

| COMPASSION | to feel and act on concern for others |

| CONTRIBUTION | to make a lasting contribution in the world |

| COOPERATION | to work collaboratively with others |

| COURTESY | to be considerate and polite toward others |

| CREATIVITY | to have new and original ideas |

| DEPENDABILITY | to be reliable and trustworthy |

| DUTY | to carry out my duties and obligations |

| ECOLOGY | to live in harmony with the environment |

| EXCITEMENT | to have a life full of thrills and stimulation |

| FAITHFULNESS | to be loyal and true in relationships |

| FAME | to be known and recognized |

| FAMILY | to have a happy, loving family |

| FITNESS | to be physically fit and strong |

| FLEXIBILITY | to adjust to new circumstances easily |

| FORGIVENESS | to be forgiving of others |

| FRIENDSHIP | to have close, supportive friends |

| FUN | to play and have fun |

| GENEROSITY | to give what I have to others |

| GENUINENESS | to act in a manner that is true to who I am |

| GOD’S WILL | to seek and obey the will of God |

| GROWTH | to keep changing and growing |

| HEALTH | to be physically well and healthy |

| HELPFULNESS | to be helpful to others |

| HONESTY | to be honest and truthful |

| HOPE | to maintain a positive and optimistic outlook |

| HUMILITY | to be modest and unassuming |

| HUMOR | to see the humorous side of myself and the world |

| INDEPENDENCE | to be free from dependence on others |

| INDUSTRY | to work hard and well at my life tasks |

| INNER PEACE | to experience personal peace |

| INTIMACY | to share my innermost experiences with others |

| JUSTICE | to promote fair and equal treatment for all |

| KNOWLEDGE | to learn and contribute valuable knowledge |

| LEISURE | to take time to relax and enjoy |

| LOVED | to be loved by those close to me |

| LOVING | to give love to others |

| MASTERY | to be competent in my everyday activities |

| MINDFULNESS | to live conscious and mindful of the present moment |

| MODERATION | to avoid excesses and find a middle ground |

| MONOGAMY | to have one close, loving relationship |

| NON-CONFORMITY | to question and challenge authority and norms |

| NURTURANCE | to take care of and nurture others |

| OPENNESS | to be open to new experiences, ideas, and options |

| ORDER | to have a life that is well-ordered and organized |

| PASSION | to have deep feelings about ideas, activities, or people |

| PLEASURE | to feel good |

| POPULARITY | to be well-liked by many people |

| POWER | to have control over others |

| PURPOSE | to have meaning and direction in my life |

| RATIONALITY | to be guided by reason and logic |

| REALISM | to see and act realistically and practically |

| RESPONSIBILITY | to make and carry out responsible decisions |

| RISK | to take risks and chances |

| ROMANCE | to have intense, exciting love in my life |

| SAFETY | to be safe and secure |

| SELF-ACCEPTANCE | to accept myself as I am |

| SELF-CONTROL | to be disciplined in my own actions |

| SELF-ESTEEM | to feel good about myself |

| SELF-KNOWLEDGE | to have a deep and honest understanding of myself |

| SERVICE | to be of service to others |

| SEXUALITY | to have an active and satisfying sex life |

| SIMPLICITY | to live life simply, with minimal needs |

| SOLITUDE | to have time and space where I can be apart from others |

| SPIRITUALITY | to grow and mature spiritually |

| STABILITY | to have a life that stays fairly consistent |

| TOLERANCE | to accept and respect those who differ from me |

| TRADITION | to follow respected patterns of the past |

| VIRTUE | to live a morally pure and excellent life |

| WEALTH | to have plenty of money |

| WORLD PEACE | to work to promote peace in the world |

Appendix 2.2

Link to printable personal values cards: personal-values-card-sort

- Hartung (2011) ↵

- Parsons (1909) ↵

- Gati and Kulcsar (2021) ↵

- Miller et al. (2001) ↵

- Appendix 2.1 provides a brief explanation for each value. Appendix 2.2 contains printable cards with these values that you can use as an exercise. ↵

- Myers (1976) introduced the Myers-Briggs indicators. Hook et al. (2020) proposed the Enneagram model. Friedman and Rosenman (1956) identified the type A, type B, type C, and type D personalities ↵

- Costa et al (2002) ↵

- Deming, Ong, and Summers (2025) ↵

- Shiro and Reeves (2021) ↵