6 Credit Scores, Credit Report, and Consumer Credits

Chapter Six Learning Objectives

- Understand the different types of consumer credits.

- Identify good and bad reasons for using consumer credit.

- Identify important factors to consider before taking out a loan.

- Determine the true cost of credit.

- Obtain and evaluate your credit report.

- Develop a plan to achieve a good credit score.

- Recognize identity theft tactics and apply preventive practices.

- Understand personal bankruptcy.

The term “credit” refers to the ability of a customer to obtain goods or services before paying for them, based on the trust that payment will be made in the future. This chapter will explore the fundamental aspects of consumer credit, discuss good reasons for its use, the factors to consider before borrowing, and the importance of responsible credit management. It includes a section on how to obtain a free copy of your own credit report, read its content, correct errors if necessary, and strategies to improve your credit scores.

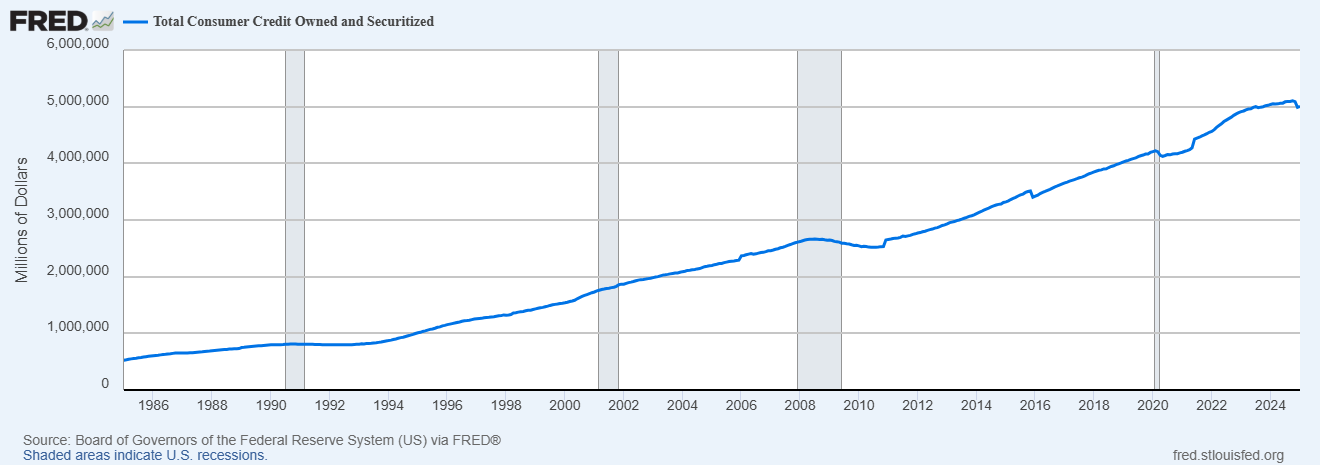

Consumer credit encompasses various forms of borrowing used by individuals for personal or household purposes, from purchasing essential items to investing in their future. Durkin et al (2015) noted that the merits and pitfalls of using consumer credits has long been a topic of debate. Some people view the use of credit as an attempt to live beyond one’s means, itself a moral failing and a potential cause of financial troubles if debts pile up. These concerns have some valid points. American households rely more and more on consumer credits overtime. Figure 6.1 shows the amount of total consumer credits in the U.S. from 1985 to 2024, which exhibits a continuous upward trend.

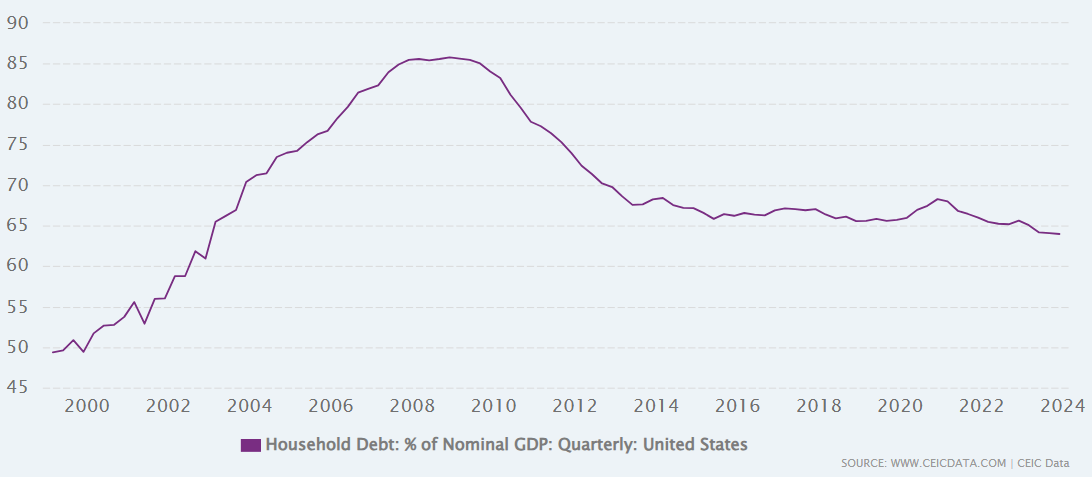

To put the size of consumer credits in perspective, it may be helpful to look at it as a percentage of the country’s overall income, defined as the nominal gross domestic product (GDP). Figure 6.2 shows that household debt as a percentage of nominal GDP remained relatively stable at around 65 percent since 2013, after peaking at 85 percent surrounding the 2008 financial crisis. One possible reason is that consumers use credits as part of their emergency plan during economic hard times and revert to normal financing patterns when the crisis is over. Another possible explanation is that consumers maintain a relatively stable level of debt even when the economy contracts. Hence when GDP decreases during a recession and debt level stays the same, the ratio will increase.

We learn in chapter one that some money beliefs are more likely to lead to excessive spending and debt accumulation. Individuals who exhibit money worship or money status personalities should be more careful when using consumer credits. The tools discussed in chapter three, such as using a budget, the 72-hour and 7-day rules, sticking to a list when shopping, setting spending alerts, and the envelope method, can help overcome these challenges. Using a waiting rule of 3 to 7 days is especially helpful if impulse buying is a culprit. While waiting, consider the following questions.

- Does the item solve a real problem in your life?

- Will you still be using this item a year from now?

- Is this a quality item that will last a long time?

- Where will this item go in your home?

- Can you borrow or rent this item instead?

- Will you buy this item if you need to pay cash for it?

Exercise 6.1: Spender, know thyself!

Reflect on your spending habits. It is useful to review the personal cash flow statement you prepared for the Personal Financial Plan Exercise 3 in Chapter 3.

- Identify one to two areas where you can reduce spending.

- Select one of the methods discussed in this section to use. Explain why you think this method will work for you.

Example: Maya and Isis Learned to Live Within Their Budget

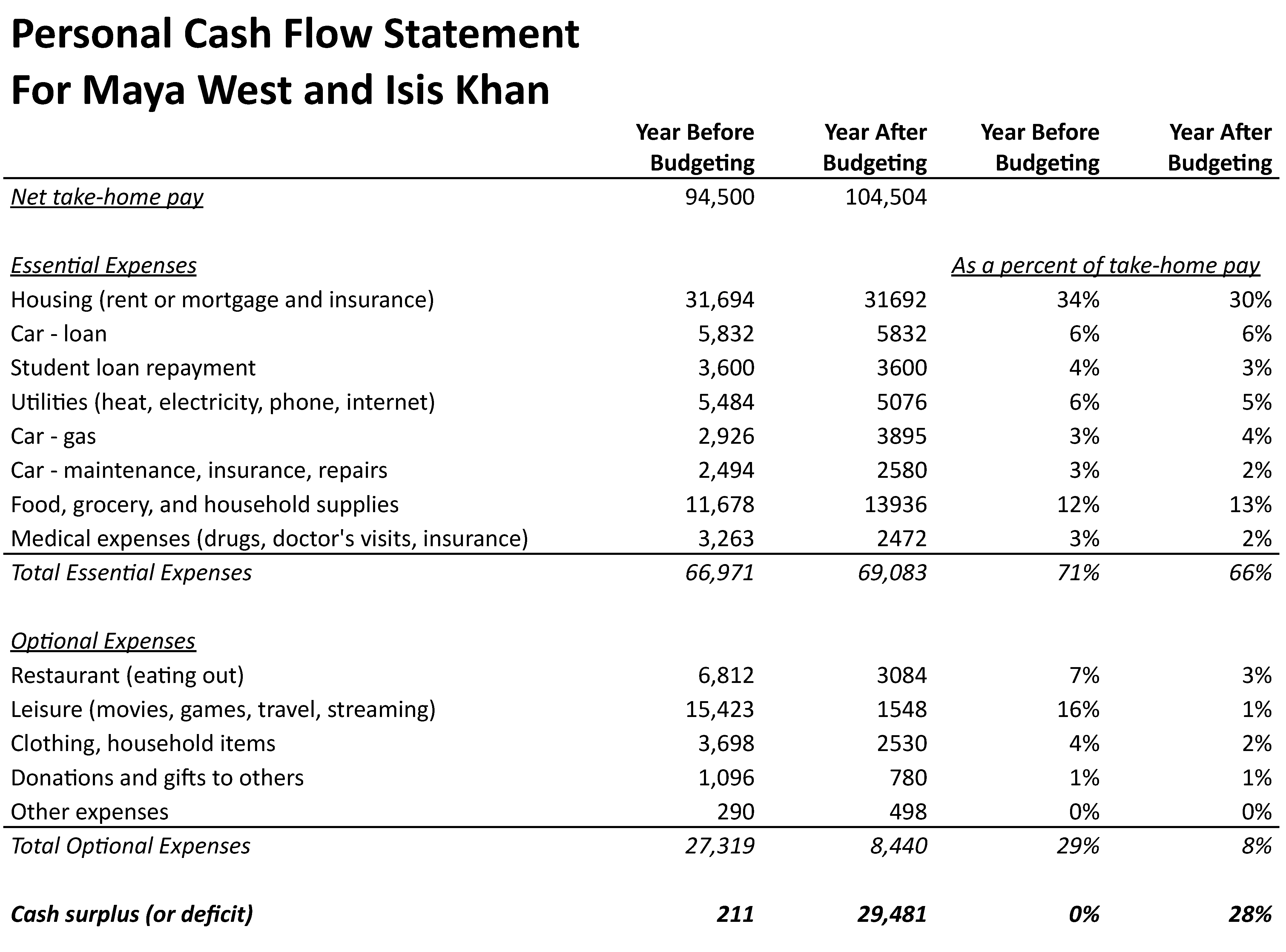

After creating their personal cash flow statement Maya and Isis realized they were spending almost 30 percent of their take-home pay on optional expenses, especially on leisure items and eating out. They expected to get a 5 percent raise next year and did not want to continue to live paycheck to paycheck. To reach their financial goals, they created a budget which significantly reduced optional expenses.

Maya and Isis found that sticking to a budget was much harder than creating one. Some changes were easier for them than others. They used a list when going grocery shopping and were delighted with the results. Not only were they able to reduce impulse purchases, they seldom forgot to buy items they actually needed, so no more mid-week runs to the store. For clothes and household items, Maya and Isis shopped mostly online. They put items in the shopping cart or a wish list and came back after 3 to 7 days and only hit “buy” after reviewing the items carefully. They found they had much fewer buyer regrets with this system.

They decided to only eat out with friends and limited that to once per week as much as possible. Planning meals ahead of time was a big challenge for them. Their old habit was to text each other on their way home and if it was a busy day and neither wanted to cook, they would have take-outs for dinner. Maya and Isis decided to add some fun into meal prep. They shared the changes they were trying to make with their friends and some of them expressed interest in doing the same. They took turns hosting meal prep “parties” each week. The community and support they received from each other helped them stick to the new habit. They discovered they were eating healthier and spending less at the same time. They did not think they could do it without their friends.

The biggest optional spending category for Maya and Isis was leisure activities like travel and streaming services for games, music, and shows. They reviewed their streaming services and realized they watched one or two shows at most from each. They cancelled all but one service and rotated to another service when they grew tired of the catalog. Instead of streaming games, they limited new game purchases to $150 per year. This one change reduced their streaming expense by 90 percent. This change was a little challenging because they could not watch whatever show they wanted on demand but they felt the sacrifice was worth it. It took time to cancel the services but once done it was not difficult to stay within the limits they set for themselves.

While reviewing their financial health, Maya and Isis realized they also needed to improve their physical health. They had expensive gym memberships but did not use the gym as often as they liked or should. They cancelled the gym memberships and invested in free weights and a bike stand. Having the equipment at home made it easier to work out. They also joined a hiking club, which gave them incentive to keep in shape in the winter. Instead of expensive resort vacations, they went on backpacking trips. Maya and Isis were avid hikers in their youth and really enjoyed reconnecting with nature. This change was not difficult for them.

After one year, Maya and Isis updated their cash flow statement and were proud of the results (Figure 6.3). They were able to save almost 28 percent of their take-home pay and made an excellent start towards reaching their financial goals.

Having too much debt is obviously a problem. But if you do not use any credit, you will not have a credit history, which will negatively impact your life. A 2015 Consumer Financial Protection Bureau report found that 26 million Americans are “credit invisible.” This means that one in every ten adults does not have any credit history. An additional 9.9 million people do not have sufficient history and 9.6 million lack any recent credit history to get a credit score. All together, there are 45 million consumers who are credit invisible or unscorable, making up 20 percent of the U.S. adult population. This problem varies by income and demographics. In low-income neighborhoods, almost 30 percent are credit invisible and 15 percent are unscorable. Approximately 28 percent of Black and Hispanic consumers are credit invisible or unscorable compared to 16 percent of White consumers. Learning how to use consumer credit appropriately is essential to building a good credit history.

Consumer credits can be used to purchase goods and services that produce long-term returns. For instance, purchasing a reliable car can reduce absenteeism, improving job performance. Obtaining a college degree provides better employment opportunities and higher income over the long run. Instead of saving up enough cash to pay for these items in full, consumers can borrow part of the costs. The opportunity cost of waiting to save up enough cash can be high. An unreliable car can lead to someone losing a job and income, creating a negative cycle that is difficult to get out of. While excessive debt and late payments will negatively impact your credit history, never using credit also has its downsides. Your credit history affects many areas of your life. In addition to your ability to borrow money, insurance companies use information from your credit report to determine your insurance premium and coverage. Often your credit report is part of a background check for employment and rental application. Therefore, the crux of the issue is mastering how to use consumer credits responsibly and strategically to improve your financial well-being.

Exercise 6.2: Why use consumer credits?

Based on what you have learned so far about personal finance and your personal and family experiences, classify the loans in Figure 6.4 as a good reason or a bad reason for taking out a personal loan. Explain your decisions.

Good and bad reasons for using consumer credit

Good reasons for using consumer credit include:

- Investing in your future: This could involve taking out a car loan to commute to a job or obtaining a student loan to pursue education for career advancement.

- Building a good credit score: Responsible use of credit and timely payments are crucial for establishing and improving one’s credit score. A good credit score can make it easier to obtain loans in the future at more favorable interest rates.

- Convenience: Using credit cards can be more convenient than carrying large amounts of cash. They also offer additional benefits such as fraud protection and rewards programs.

- As part of your emergency planning: Having access to credit can provide a financial safety net for unexpected expenses. This can help you avoid costly alternatives such as payday loans or title loans.

Bad reasons for using consumer credit include:

- Not considering the effects of repayment on your future budget: Borrowing without a clear plan for repayment can lead to financial strain. It is important to consider your income, expenses, and other debts before taking on additional debt.

- Excessive spending: Studies have shown that individuals tend to spend more when using credit cards or buy-now-pay-later (BNPL) compared to cash. This can lead to accumulating debt that is difficult to repay.

- Accumulating debt unintentionally: Without careful monitoring, open-end credit like credit cards can lead to a gradual and unnoticed increase in debt. It is important to track your spending and make sure you are not using credit to finance a lifestyle you cannot afford.

Types of Consumer Credits

A borrower’s default risk, the chances that the loan will not be repaid, is the primary determinant of interest rate and availability of consumer credits. In addition, different types of consumer credits have unique characteristics that also affect their interest rates and availability. One important characteristic is secured versus unsecured. The term secured means that a loan is backed by an asset, such as a car or a house. If the borrower fails to repay the loan, the lender can repossess the asset and sell it to offset the loan. An unsecured loan is based solely on the borrower’s promise to pay. The risk to the lender is lower with a secured loan because of the value of the underlying asset. Interest rate on a secured loan is lower than the interest rate on an unsecured loan for borrowers with the same default risk.

Another important characteristic is open-end versus closed-end. With closed-end loans, the entire loan amount is given out and the repayment schedule specified when the contract is signed. With open-end credit, the consumer can take out money repeatedly, up to a certain pre-approved amount. For revolving open-end credit, there is no fixed end date for full repayment. Since closed-end loans have fewer unknowns they typically have lower interest rates than open-end loans. Student loan is an example of unsecured, closed-end credit. Each semester students take out a new student loan and each loan has its own interest rate and repayment schedule. Auto loans secured by a car and mortgages secured by a house are examples of secured, closed-end credit. A home equity line of credit (HELOC) secured by a house is an example of secured, open-end credit. Credit cards are a common example of unsecured, open-end credit. When you make purchases with a credit card, the bank is loaning you the money to pay the merchant. At the end of each month, you pay off the balance. You can use the same card for purchases the following month. You do not open a new credit card each month. Therefore the credit on the card is considered revolving.

Consumer credits can be classified in several ways

- Unsecured Credit: This type of credit is based solely on the borrower’s promise to pay.

- Secured Credit: This type of credit is backed by an asset, such as a car or a house, which can be repossessed by the lender if the borrower fails to repay the loan.

- Closed-end Credit: The full loan amount is given out when the contract is signed and must be paid back by specific dates. Student loan is an example of unsecured, closed-end credit whereas auto loan (secured by the car) is an example of secured, closed-end credit.

- Open-end Credit: This is a loan where the borrower can draw on funds repeatedly, up to a certain pre-approved amount, and there is no fixed end date for full repayment. Open-end credit is also called revolving credit because borrowers can repeatedly take out more credit on the same loan. Credit cards are a common example of unsecured, open-end, revolving credit. A home equity line of credit (HELOC) secured by the house is an example of secured, open-end credit.

Factors to Consider When Taking Out a Loan

Before taking on any form of consumer credit, it is important to carefully consider all the key factors. First and foremost is whether you can afford the loan. When considering the total monthly payments, be sure to include any hidden fees and potential changes in interest rates. Budgeting is essential to help you determine if you can meet all your existing essential expenses and the payments on the new loan. You should also think about what you might need to give up to afford the loan. A second factor to consider is fixed versus variable interest rates. Open-end loans almost always have variable interest rates. Closed-end loans may have fixed or variable rates. As the name implies, fixed interest rates remain the same for the life of the loan, while variable interest rates can fluctuate with the benchmark interest rate, usually the Prime Rate. Most variable rate loans have a lifetime cap or interest rate ceiling, which is the maximum level the interest rate can increase to. Use the life-time cap interest rate as the worst case scenario in your budget when evaluating whether you can afford the loan. It may not happen but it is better to be prepared. Be extra wary if the initial rate is much lower than a comparable fixed rate loan. This is sometimes called a “teaser rate” and is used to tempt borrowers into taking out a larger loan than they can truly afford. During the 2008 financial crisis, many homeowners found they could not make their mortgage payments when the interest rates on their variable rate mortgages increased significantly, leading to loan defaults and home foreclosures.

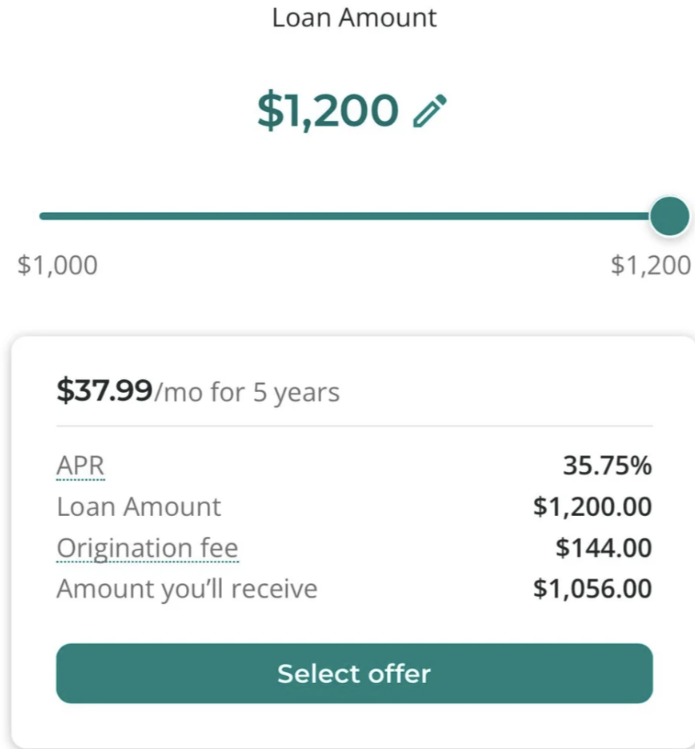

Other important factors include origination fee, prepayment fee, late payment fee, and credit insurance premium. These are potential extra charges that add to the cost of borrowing. Some lenders charge an origination fee, which may have other names. Essentially it is a fee levied when you take out a loan and is often added to the loan balance instead of an out of pocket cost to the borrower. This fee can sometimes increase the cost of borrowing a lot, especially for short-term loans. Late payment fee or penalty is applied if you miss a payment on the loan. Missing loan payments can damage your credit history and may sometimes increase the interest rate on a variable rate loan. Some lenders charge a prepayment fee or penalty if you pay off the loan early. Loans with prepayment fees reduce your flexibility. For instance an auto loan with a prepayment fee will increase the cost of trading in the car before the loan is fully paid off. Occasionally lenders may require credit insurance as part of the loan requirement. The insurance company will pay the lender for a specified period of time in case you are unable to make the loan payment due to certain events. The type of events covered – death, illness, or unemployment – depends on the specific policy. The insurance company charges a premium, which may be a single lump sum added to the loan balance when you take out the loan or a monthly amount based on the outstanding balance of the loan. Credit insurance can increase the cost of borrowing significantly. If you have a good credit history, shop for lenders that do not require insurance. Many of these additional costs are not included in the calculation of the APR and you must read the loan agreement carefully to find them.

Factors to consider when taking out a loan

- Origination fee: Some lenders charge an origination fee to cover the cost of processing the loan. This fee is often a percentage of the loan amount and adds to the total cost of borrowing.

- Prepayment fee (penalty): Some lenders charge a prepayment penalty if you pay off your loan early.

- Late payment fee (penalty): If you miss a payment on your loan, you may be charged a late payment fee. This fee can add to the total cost of borrowing and can also damage your credit history.

- Fixed versus variable interest rates: Fixed interest rates remain the same for the life of the loan, while variable interest rates can fluctuate based on financial market conditions. Evaluate the worst case scenario using the lifetime cap rate.

- Credit insurance: Credit insurance protects the lender from your inability to repay the loan if you lose your job or become unable to work. The insurance premium increases the cost of the loan.

- Can you afford the loan? This is the most critical question. Consider your total monthly payments, including any hidden fees and extra costs such as credit insurance premium, and whether you can meet all your essential expenses and afford the total loan payments. Budgeting is essential to determine loan affordability. You should also think about what you might need to give up to make the monthly loan payment.

Exercise 6.3: Identify key factors in a loan.

Review the personal loan offer from an online lender in Figure 6.5. Identify the following items.

- How much will you receive today if you take out this loan?

- Explain the difference between the “loan amount” and the amount you will receive.

- How much is your monthly payment?

- How many payments will you need to make to repay this loan?

- How much will your total payments add up to?

- (Optional) Using the TVM tool from Chapter 5, what is the annual rate on this loan? Compare your result from the disclosed APR.

What Do Lenders Look For When Extending Credit?

A lender’s primary concern when considering whether to approve a loan is the borrower’s ability to repay the loan. They used the term creditworthiness to describe this ability. Traditionally lenders use the five Cs of credit to evaluate borrowers. The five Cs are character, capacity, capital, collateral, and conditions. Character refers to a person’s moral, ethical, and emotional qualities. People with good character are honest and fair. They display self-discipline, make good decisions, and have a strong sense of responsibility. Capacity measures someone’s ability to make the loan payments. Capital is based on the current equity and debt burden of the borrower. Lenders are wary of excessive debt. Collateral is the value of the asset used to secure a loan and is relevant when evaluating a secured loan. Conditions include national, international, and industry factors that may affect the lender’s ability to lend and/or the borrower’s ability to repay the loan. For instance, a borrower employed in an industry that is currently laying off employees may not be able to get a loan. Uncertainty about the economy may reduce a lender’s willingness to extend long-term loans. Conditions are generally factors beyond the borrower’s control.

Some of these factors can be evaluated objectively. The debt payment-to-income ratio (DTI) is used to estimate capacity. The DTI compares your monthly debt payments to your gross monthly income. There are two common measures for debt payment. The first includes housing costs, such as rent or mortgage payment. Lenders often look for a DTI of less than 35 percent when housing costs are included. When housing costs are excluded, lenders look for a DTI of less than 20 percent. Chapter 3 explains how to compute DTI using data from the personal cash flow statement. Capital can be evaluated using the debt-to-equity ratio, defined as total liabilities divided by net worth. If you own a house with a mortgage or a car with an auto loan, the debt-to-equity ratio will likely be high. For instance, if you put 10 percent down on a house, the debt-to-equity ratio for the house is 9. Chapter 3 presents several cases where the values of net worth are negative. Banks put more emphasis on DTI than debt-to-equity ratio when evaluating personal loans, especially for secured loans. For secured loans, lenders can sell the collateral in case the borrower fails to pay the loan, providing an alternative source of repayment. The value of the collateral, such as a car or a house, can be assessed by an independent party.

Character is more difficult to quantify. In the old days, banks may require character reference letters from respected members of the community. Today many lenders use your credit report and your credit scores as a proxy for your character. The next section is devoted to credit reports and credit scores.

The Five C’s of Credit

- Character – Refers to a person’s moral, ethical, and emotional qualities.

- Capacity – Can a person’s income cover additional debt payments?

- Capital – How much is a person’s debt and net worth?

- Collateral – Will the loan be secured using valuable assets?

- Conditions – Are there industrial, economic, or political circumstances that may affect a person’s ability to repay a loan and/or the lender’s willingness to lend?

Credit Reports and Credit Scores

Credit reports and credit scores are two very different things. A credit report is a historic document of your past credit activities. A credit score is a number computed by a mathematical model based on information in your credit report and other sources. Lenders use the credit score to predict how likely you will make future payments as promised.

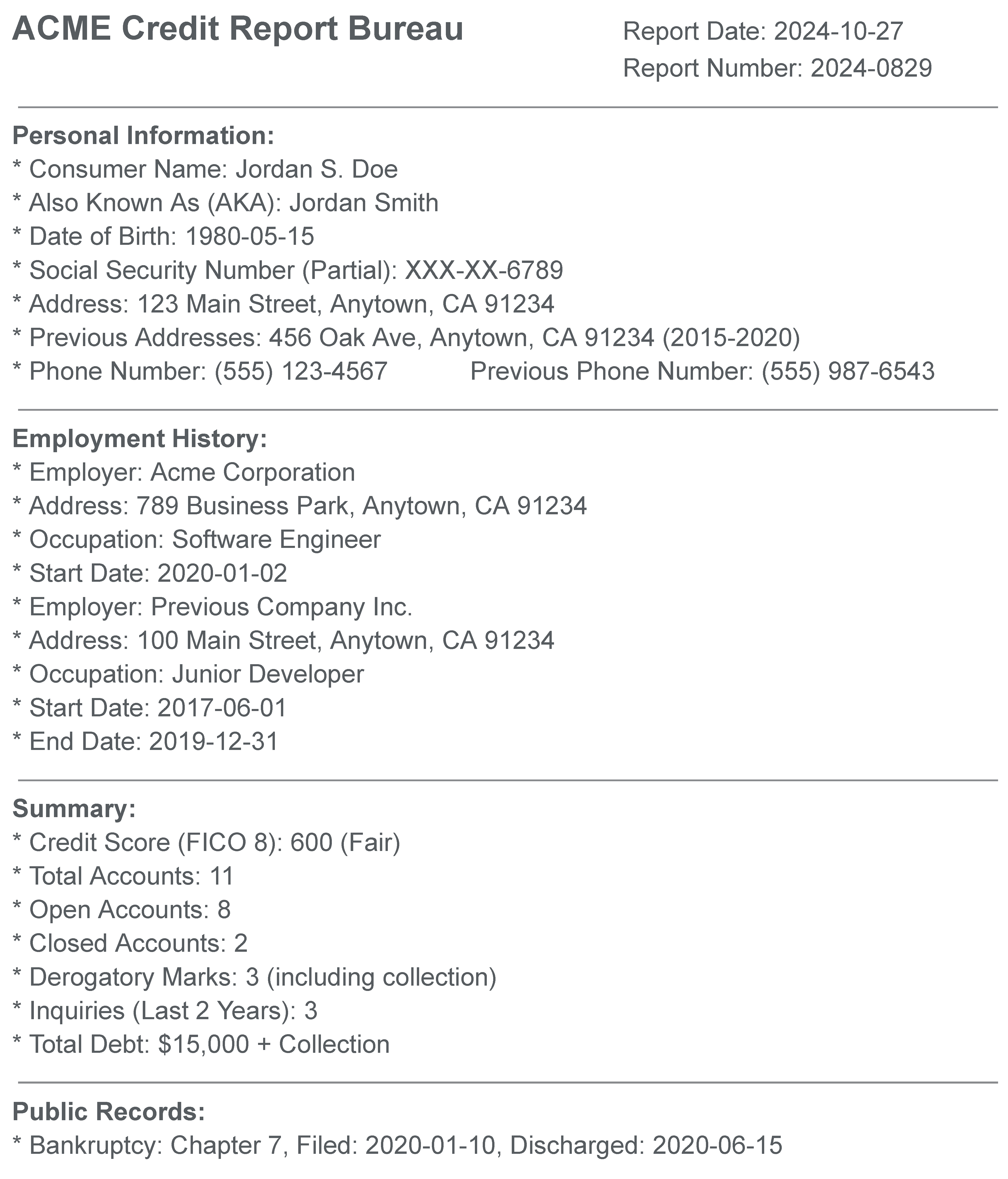

The three main credit reporting bureaus that compile credit reports are Equifax, Experian, and TransUnion. Appendix 6 contains sample reports from each of these bureaus. The formats of the credit reports differ for each bureau but all contain the same main sections: personal information, public records, credit accounts, collections, inquiries, and personal statements. You should download your credit reports regularly (at least once per year) and review it for accuracy. The Fair Credit Report Act (FCRA) of 1970 required the three main credit bureaus to ensure that the information they collect is accurate, to provide a free copy of the credit report to consumers every year, and to allow consumers a chance to fix any mistakes. As of 2023, consumers can download a free report every week online at www.annualcreditreport.com. You have to provide your name, date of birth, social security number, and address to obtain the report. These are very important and sensitive personal information. Be sure to go to the correct website by typing in the address. Do not use a search engine to look for free credit reports as there are many scammers and fake sites. Store your credit reports securely because it contains sensitive information that can be used to steal your identity, a topic we will discuss in a later section. You can also request a paper copy of your credit report once per year in accordance with the Fair Credit Report Act, which limits the company to charge no more than $14.50 for a paper credit report.

How to Read a Credit Report

We will use a generic sample report to explain the key items to look for in a credit report. It is important to request the credit bureaus to correct any errors so your credit reports are accurate. Each report contains the date the report was generated because information changes over time. Figure 6.6 shows the personal information section and public record section on a sample credit report. The personal information section includes name(s), date of birth, social security number, current and previous addresses, current and previous phone numbers, and employment history. The public record section may include events such as bankruptcies, civil judgements resulting from lawsuits, and tax liens by the federal, state, or local governments. Many consumers do not have any item in the public record section.

Figure 6.6

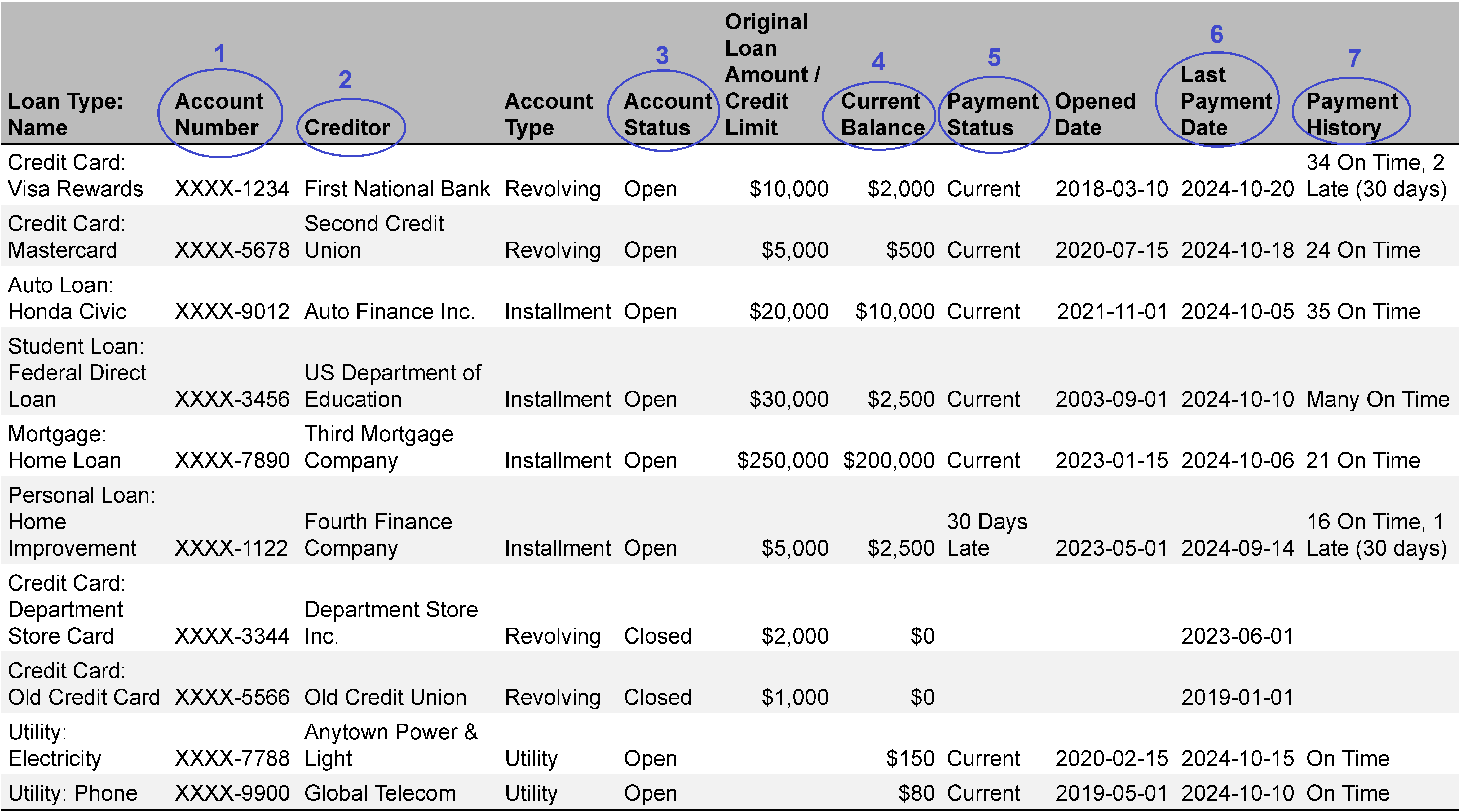

The longest section in a credit report is on the credit accounts. Some bureau separates this section into accounts in good standing versus accounts with late payments, sometimes referred to as adverse accounts or accounts with potentially negative items. There are three main account types: installment credit, open credit, and revolving credit. Installment credit accounts are closed-end credit accounts. They usually have a fixed monthly payment and interest is charged on the amount borrowed or the remaining balance. Examples of installment credit include auto loans, mortgages, and student loans. Revolving credit accounts are open-end credit accounts which charge interest and fees based on the remaining balance each month. These accounts have a maximum loan amount and a minimum monthly payment amount. Examples include home equity line of credit (HELOC) and credit cards. Open (non-installment) credit accounts require the balance to be paid in full every period, usually monthly or quarterly. Examples include electricity, water, and phone accounts. These utility accounts are considered credit accounts because consumers receive the service before paying for them. Since full payment is expected on these accounts, they are usually reported to credit bureaus only when payments are late.

The layout of the credit reports from the credit bureaus differ but they all contain the same essential information, which is included in the sample report (Figure 6.7). Items you should look for in the accounts section of the report include (1) account number, (2) name of the creditor, (3) account status, (4) current balance, (5) payment status, (6) last payment date, and (7) payment history. You should match the account numbers on the credit report to what you have in your own record to verify that the loans and accounts belong to you. Sometimes the name of the creditor or institution may appear unfamiliar for a number of reasons. One is that loans are often sold from one bank to another. When a loan is sold, the bank must notify the borrower. However, consumers usually remember the name of the bank they borrow from but not necessarily the latest bank their loan has been sold to. Another reason is that a merchant’s credit card is actually issued by a bank, not the merchant. The name of the merchant is what most people see on the card. The name of the issuing bank is in small print at the back or sometimes just a tiny logo. On the credit report, it is the name of the issuing bank that is listed, not the merchant. It is useful and important to know the name of the institutions to whom you owe money. If you see an account that you did not open, contact the creditor and the creditor bureau right away. You may be a victim of identity theft, a topic we will discuss later in this chapter.

An account that is still in use will have its status listed as open or active. Notice that loans you have paid off or accounts you have canceled recently are still on the report. The status of these accounts should be listed as closed and the current balance should be $0. The last payment date and current balance are often used by banks to verify your identity. Current balances are especially important because they represent your liabilities. Accounts with payment status listed as current or paid as agreed means you have made the necessary payments. Since most consumer credits have monthly payments, late payments are indicated as 30 days late, 60 days late, 90 days late, etc. In this sample report, payment history information is summarized. Late payments are items of great concern to future lenders and can lower your credit scores.

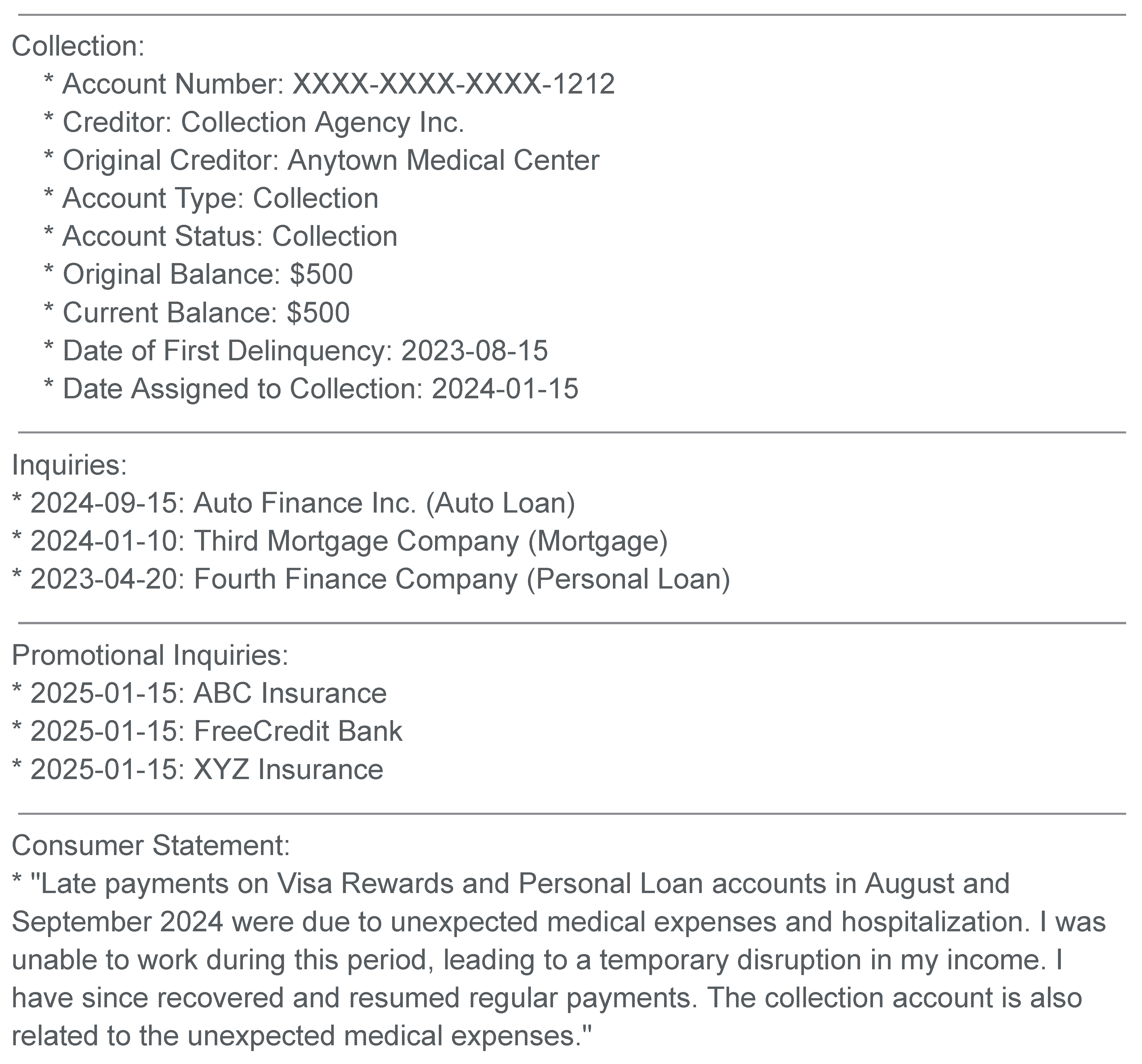

Other important information on a credit report include any collection actions, inquiries, and personal statements (Figure 6.8). The collection section lists loans that have been sent to collection agencies after the borrower fails to make payments. Any history of collection action is viewed negatively by future lenders. There are two types of inquiries. Promotional inquiries, also known as soft inquiries or soft credit pulls or soft credit checks, are often not initiated by the consumer and have no impact on the credit history or credit scores. If you receive advertisements (aka junk mails) from credit card or insurance companies with “pre-approved” written on the envelopes or in the emails, these are likely results from promotional inquiries. Regular inquiries, sometimes referred to as hard inquiries or hard credit pulls or hard credit checks, are approved by you and requested on your behalf. These inquiries are usually part of a loan, credit card, or rental application. Hard inquiries can negatively affect your credit scores because they signal to other lenders that you may be taking on more debt in the near future. These potential future debts and debt payments are not currently on your credit report. Personal or consumer statements are optional. If you have any late payment or collection actions, you can submit a statement to the credit bureau to explain the circumstances. These personal statements help future lenders understand your situation when evaluating your loan application.

Figure 6.8

If you find any errors in your credit report, be sure to submit a correction request to the reporting bureau. All three reporting bureaus have a dispute-handling system on their website. Explain clearly which item you are disputing and be sure to include relevant supporting documents such as a paid bill for an incorrectly reported missing or late payment, or a police report in case of stolen credit card or identity theft. Credit reporting bureaus must forward your dispute, including all information you submitted, to the company that originally gave the information to them. If the company corrects your information because of your dispute, it must correct the same item with every credit reporting bureau it has provided that information.

What Are Credit Scores?

You can get a credit score for free from many credit card companies, banks, lenders, and nonprofit credit and housing counselors. There is no government regulation requiring companies to provide credit scores for free. However, if you are rejected for a loan or credit card based on your creditworthiness, the lender is required to provide you with the numerical credit score it used in the decision and the key factors that affected your score. Many companies advertise “free credit scores.” They could be part of the credit reporting companies such as Experian and Equifax, or lenders or websites that make money from advertising. Beware of companies that ask you to provide payment information before showing you the numbers. These companies are selling you services, usually with a monthly fee. They are charging you for services that you may not want.

The two main companies that compute credit scores are FICO and VantageScore. Unlike credit reports, credit scores are not governed by any government regulations. FICO is the first credit scoring company founded in 1956 by two engineers. VantageScore is a joint venture created in 2006 between the three major credit bureaus: Equifax, Experian, and TransUnion. Each credit scoring company uses their proprietary algorithms to compute credit scores using information from credit reports and other sources. Your credit score is also affected by who is requesting it and the purpose of the inquiry. Each company assigns different weights to different credit behaviors and has different models for different applications. They may have one model for credit card companies, one for mortgages, and other ones for insurance companies, background check, etc. The credit score number you see from your credit card company may differ from the number given to the lender evaluating your auto loan application even though both numbers are from FICO. At the same time, the auto lender will receive different numbers from FICO versus VantageScore on the same loan applicant. Since the primary use of credit scores is to predict future credit behaviors, these algorithms rely heavily on machine learning and some incorporate AI to improve their predictive power. Combined with the proprietary nature of these algorithms, it is impossible to determine precisely how credit scores are computed. Nevertheless, it is useful to know which factors play critical roles in affecting your credit scores.

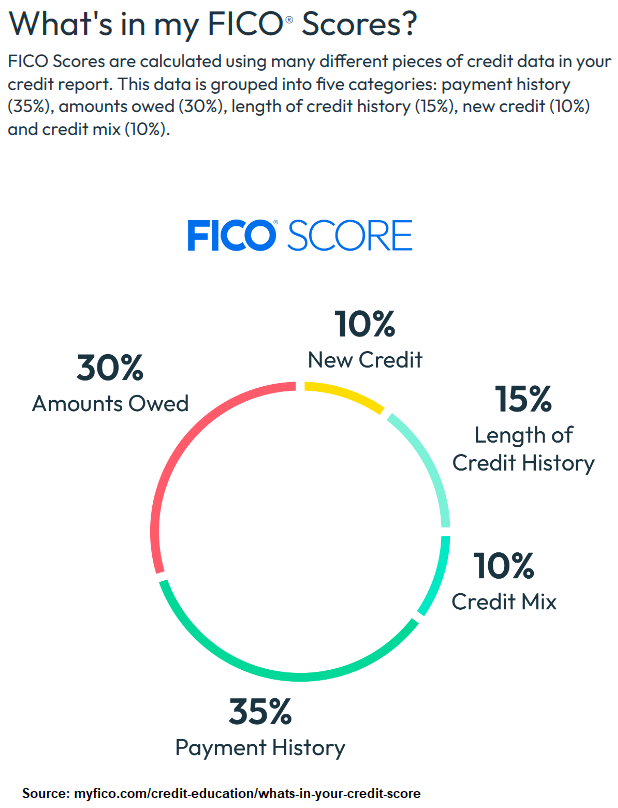

The most important factor is your payment history. According to VantageScore, 90 percent of people with a “prime” VantageScore pay all their debts on time and the company considers this an extremely influential factor in their scoring model. For FICO, 35 percent of the data items used in their model is related to payment history, including bankruptcies and collection actions (Figure 6.9). Other important factors include type and age of the credit accounts and percentage of credit use. Age is how long you have opened an account. Longer relationships have a positive impact on your credit score. Having different types of credit (credit mix) such as credit card, student loans, auto loans, also improves your credit score. VantageScore considers these factors highly influential and 15 percent of the data items used by FICO is related to length of credit history and 10 percent is related to credit mix. Percentage of credit use is particularly relevant for revolving credit such as credit card and home equity line of credit (HELOC). To avoid negatively affecting your credit score, keep the balances on revolving credit to be less than 30 percent of the credit limit. VantageScore considers total debt balances to be a moderately influential factor. FICO also uses debt balances and percentage of credit use in their model, with this type of data representing 30 percent. Opening many new credit accounts can also negatively affect your credit scores in both companies’ models. Expect to see your credit scores decrease temporarily after opening a new credit card or taking out a new loan. The scores will return to normal after a few months provided you make on time payments.

Key Factors Affecting Your Credit Scores

- Payment history, including bankruptcies and collection actions

- Age of accounts

- Types of accounts (credit mix)

- Percentage of credit use

- Total debt balances

- Recent credit activities

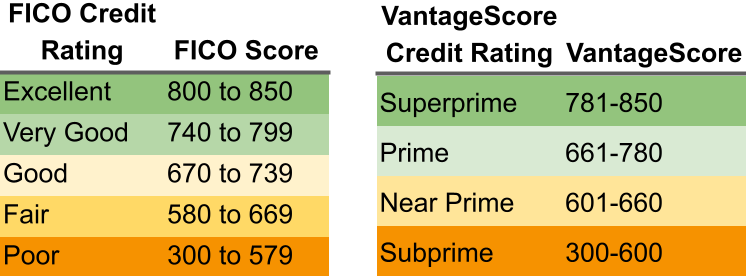

What Is a Good Credit Score?

Credit scores from both FICO and VantageScore range from 300 to 850. Since the two companies use different models to derive their numbers, the scores are not directly comparable. There is no official standard for interpreting these scores. In general, a credit score below 600 is considered bad and a score over 800 will usually qualify you for the best interest rates. Gravier (2025) reported that the national average FICO Score was 717 in 2023. Figure 6.10 shows the common ratings for FICO and VantageScore numbers. Consumers with “very good” or “excellent” ratings from FICO and “prime” or “superprime” ratings from VantageScore can generally get approval for loans and credit cards at reasonable interest rates. Remember that credit score is only one of the elements a lender considers when evaluating loan applications. Debt-to-income (DTI) ratio and other factors also play a role in the lender’s decision.

Ways to Establish Credit and Improve Your Credit Scores

It takes time to build a credit history. Start early and go slowly. Those who are fortunate to have someone willing to be a cosigner can make a beginning with a cosign credit card or a cosign loan. Cosigning is a valuable gift. The cosign credit accounts appear on the credit reports of both people and any non-payment or late payment affect both. There are other options besides cosigning.

In general, merchant cards such as gas station cards or store cards have easier approval standards. These cards are sometimes referred to as proprietary cards because you can only use them at the specific merchant. Gas station cards can be a good first credit card because gas is an essential expense and its limited use reduces the temptation to overspend. Some credit cards are specially designed for college students. These cards require little to no credit history. They have lower credit limits and many have no annual fees. Another type of credit cards that require little to no credit history and are not limited to college students are secured credit cards. You deposit money with the secured credit card companies as collateral. Watch out for hidden fees and restrictions on secured credit cards. Note that debit cards linked to your checking account do not count towards your credit history. If you attend college, federal student loans, especially those that offer interest deferment are a great option to establish credit. Even if interest is not deferred, federal student loans typically have much lower interest rates than credit cards. Credit cards, debit cards, student loans, and personal loans are important topics and will be the focus in a later chapter. Another way to establish credit is to have non-installment (open) credit accounts such as phone bills, utility bills, or streaming service in your name. Usually only late payments of open credit accounts are reported to the credit bureaus.

Once you establish a credit history, you can work on getting and maintaining a good credit score. As noted in an earlier section, the most important thing is to pay your loans and bills on time consistently. Set up reminders on your calendar so you do not forget. If you opt for electronic billing, pay the bills as soon as you receive them. Do not dismiss the reminders or the emails! If you miss any payment, pay up as soon as you can and call the company and explain why the payment was late. If this is a first incident, you can request them to report your account “paid as agreed” to the credit reporting bureaus. When you use credit cards, do not exceed 30 percent of your total credit limit. Paying off the balance in full each month will get you the best credit scores and avoid interest costs. Do not avoid the bills. Even if you cannot pay the entire balance, pay as much as you. It is also time to review your spending and budget if you find yourself in the same situation month after month. Only apply for credit that you need. If you apply for a lot of credit over a short period of time, the credit scoring models will lower your scores because it appears that you may be dealing with financial setbacks. Check your credit reports on a regular basis and submit corrections if you identify any errors.

Example: Jordan’s First Credit Cards

After needing their parents to cosign a car loan, Jordan decided it was time to apply what they learned in their personal finance class to overcome their fear of debt. Since they already prepared a statement of net worth, a statement of cash flow, and a budget, Jordan had all the information necessary to evaluate their debt capacity. With an annual gross income of $65,000, car payment of $445 per month and rent of $1,200 per month, Jordan’s DTI was about 30 percent. Since lenders generally prefer a DTI of 30 percent or lower, Jordan was in a good shape to get approval for a credit card.

DTI = (1200 + 445) / (65000/12) = 0.30 = 30 percent

From their budget, Jordan knew that they spent about $80 on gas and $400 on groceries each month. Instead of putting these expenses on debit cards, Jordan decided to apply for a gas card from their go-to gas station and a credit card with no annual fee to pay for groceries. Jordan set up purchase alerts on the credit card and paid off the balance each week. Jordan made consistent payments on the car loan, the gas card, and the credit card, and reached a credit score over 700 within one year.

Ways to establish credit history

- Start with merchant cards such as gas station cards.

- Take out interest deferred federal student loans.

- Obtain student credit cards or secured credit cards.

- Establish open accounts such as phone bills or streaming services in your name.

- Have someone cosign a credit card, a lease, or a loan.

Ways to improve credit scores

- Pay your bills on time.

- Pay off credit card balances each month.

- Have a diverse set of credit accounts.

- Limit credit use to be less than 30 percent of the credit limit.

- Obtain copies of your credit report and verify the information.

Exercise 6.4: Know your credit scores

- Obtain your credit scores from a reliable website such as a credit card company, a bank, or Experian.

- Is your credit score higher or lower than you expected?

- How do you feel about your credit score?

- Identify 3 actions you can take to improve your credit score if needed.

Know Your Rights and Consumer Protection

Consumers suffer when unscrupulous businesses take advantage of them. Financial products such as loans and investments are especially vulnerable to abuses because it is easy to obfuscate information, making financial products difficult to understand. You cannot pick up a loan and examine its quality. Instead, loan contracts and investment agreements are written in long legalese and finance jargons. In addition to individual losses and sufferings, these bad business practices have led to national and global financial disasters. Over time Congress has passed laws to combat some of the worst abuses to protect consumers. You already learned about the Fair Credit Reporting Act (FCRA) of 1970 earlier in this chapter. The first law directly related to consumer credits is the Truth in Lending Act (TILA) passed in 1968 in response to widespread predatory loan practices. Prior to the TILA lenders would use different terminology and payment structures to manipulate uninformed borrowers. Under the TILA, lenders must disclose the Annual Percentage Rate (APR), which includes interest and fees in its calculation. Chapter 5 explains how APR is determined. Lenders must also disclose the dollar amount of finance charges such as interest, fees, and points, as well as payment schedule including the number of payments, payment amounts, due dates, total amount borrowed, and total amount of payments. Other important information to be disclosed include late fees, prepayment penalties, and service charges. With the disclosure requirement of the TILA and the time value of money tools discussed in Chapter 5, you now have the information and methods necessary to compare loans covered under the TILA.

Often financial innovations create new products that are not governed by existing laws, necessitating the government to play catch up. In 1976, the Consumer Leasing Act was passed to amend the TILA, requiring similar disclosure requirements for consumer leases, which became popular in the 1960s after the passage of the TILA which covers only loans. As credit card use became more popular and cases of fraud and abuse by criminals and merchants increased, congress passed the Fair Credit Billing Act (FCBA) in 1974, which provides consumers a process to dispute billing errors such as incorrect amount, undelivered goods or services, and unauthorized charges. The FCBA also prohibits creditors from taking action that could negatively affect a consumer’s credit rating during the investigation and limits consumers’ liability for unauthorized charges to $50. If you notice errors in your credit card bill, notify the credit card company in writing and include any information that will support your case and pay the portion of the bill not in dispute. If a sincere effort to resolve a problem with an item purchased has been made, but the store is not cooperative, you can ask your credit card company to stop payment. The FCBA aims to protect consumers from criminals and bad merchants. In 2009, congress passed the Credit Card Accountability Responsibility and Disclosure act (CARD) to protect consumers from unfair and deceptive practices by credit card issuing companies. Under the CARD act, credit card issuers must disclose the interest rate, annual fees, late fees and other terms in a clear and understandable manner. They must provide a 45-day written notice before increasing interest rates or making significant changes to the terms. Credit card statements now must show the total cost of making minimum payments and the number of months it would take to pay off the balance if only minimum payments are made. College students used to be the target of “free credit card” offers and many students accumulated thousands of dollars in credit card debt without fully understanding the terms or consequences. A Sallie Mae survey in 2008 found that 84 percent of college students had at least one credit card and 19 percent of seniors graduated with more than $7,000 in credit card debt. The CARD act prohibits credit card issuers from opening an account for anyone under 21 unless the applicant demonstrates an independent ability to make payments or has a cosigner. It also restricts how credit card companies can market to young adults, preventing them from using gifts or other incentives. A Sallie Mae 2013 survey reported that 62 percent of college students pay their entire credit card balance every month and 33 percent make at least the minimum payment. By requiring credit card companies to provide important information in a clear and easy to understand manner, young adults are able to make better financial decisions. Without government regulations, credit card companies bury this information behind legalese and lengthy small prints.

The Fair Debt Collection Practices Act (FDCPA) of 1977 prohibits debt collectors from engaging in unfair, deceptive, or abusive practices. This includes misrepresenting the amount owed, lying that they are attorneys or government representatives, making false threats about arrests by the police, or threatening to do things to you that are illegal. Debt collectors can call your family, friends, or employers to find out how to contact you, including your address and phone number, but they cannot say they are trying to collect on a debt. If you tell the collectors you cannot receive their calls at work, they must stop. Debt collectors are also not allowed to harass, oppress, or abuse you or anyone else they contact. This includes excessive repetitive phone calls, use of obscene or profane language, and threats of violence or harm. If you think a debt collector has violated FDCPA, you can sue them for damages.

Another important financial consumer protection law is the Equal Credit Opportunity Act (ECOA) of 1974 which prohibits discrimination based on race or color, religion, national origin, sex, sexual orientation, gender identity, marital status, age, current or past income from public assistance programs, and past actions exercised in good faith. The ECOA requires creditors to notify applicants within 30 days of a credit application of their decision and if credit is denied, they must explain the reasons. The reasons must be specific, such as “your income is too low,” or “you have not been working long enough,” or “your credit score is below our requirement.” Vague statements like, “you did not meet our standards,” are insufficient. If it is due to creditworthiness, creditors must tell you which credit bureau’s report they use and the numerical credit score they use and the key factors that affected your score. Most of the time credit discrimination is hidden or even unintentional, making it hard to detect. These challenges are exacerbated by new technology. For example, redlining, a practice of crossing out entire minority neighborhoods from mortgages, is illegal. However, there is no law banning zip code as an input data in a credit scoring model. Kabler (2004) found that credit scores were lower for residents of high-minority zip codes after controlling for income, education, and marital status. The ECOA provides consumers specific rights when credit is explicitly denied but it does not police how and where credit companies promote specific products. A lender can promote a higher interest rate loan in high-minority neighborhoods or use online ads targeting minorities without specifying demographic characteristics. When working with a lender, watch out for warning signs. Beware if the lender offers a loan with a higher interest rate than you apply for, or encourages you to apply for a type of loan that has less favorable terms such as higher interest rate or points or fees. It is a red flag if you are treated differently in person than on the phone or online, or are refused credit even though you qualify for it based on advertised requirements, or are discouraged from applying for credit.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank) made exercising your rights a lot easier. Before the Dodd-Frank Act, consumers have to file their complaints with the proper federal agency that regulates the specific financial product. There are quite a few federal agencies and a credit company may sell several financial products, each regulated by a different agency. Navigating the federal and state regulatory landscape can be confusing and frustrating for consumers. The Dodd-Frank Act established the Consumer Financial Protection Bureau (CFPB), which now acts as a clearing house for all consumer complaints on financial services. The CFPB can also set rules to prevent deceptive practices such as requiring plain language in disclosures and statements and limit unreasonable penalty fees. Protecting consumers from financial malpractice is an important function the federal government is uniquely qualified to do. Through the end of 2024, the CFPB has saved consumers over $21 billion and helped over 205 million consumers from financial malpractices.

Consumer Rights and the Consumer Financial Protection Bureau (CFPB)

Some important consumer rights include:

- Clear and complete disclosure of all finance charges and payment schedule on loans and credit products regulated by the Federal Trade Commission (FTC).

- Protection against predatory lending practices, especially for young adults under 21.

- Timely dispute resolution process with creditors, merchants, and credit bureaus.

- Access to credit reports and control over who can obtain credit reports.

- Protection against unfair, deceptive, or abusive debt collection practices.

- Protection against credit discrimination based on race or color, religion, national origin, sex, sexual orientation, gender identity, marital status, age, current or past income from public assistance programs, and past actions exercised in good faith.

The Consumer Financial Protection Bureau (CFPB) was created to provide a single point of accountability for enforcing federal consumer financial laws and protecting consumers. The CFPB’s responsibilities include:

- Rooting out unfair, deceptive, or abusive acts or practices by writing rules, supervising companies, and enforcing the law.

- Enforcing laws that outlaw discrimination in consumer finance.

- Taking consumer complaints.

- Enhancing financial education.

- Researching the consumer experience of using financial products.

- Monitoring financial markets for new risks to consumers.

Identity Theft

You worked diligently to build up your finances and manage your credit carefully. All that hard work could evaporate if you fall victim to identity theft. AARP reported that in 2024 American adults lost $47 billion to identity theft and scams, continuing an upward trend. Some thieves steal money from the victims’ existing bank accounts or credit cards. Other thieves abuse the stolen personal information to open new credit cards and new bank accounts or file for bogus unemployment claims, causing damages to the victims’ credit history and credit scores. Not all losses are financial. Fifteen percent of the respondents in a Federal Trade Commission (FTC) report said that their personal information was misused in non-financial ways, including giving the victims’ identity to law enforcement authorities when stopped by the police or charged with a crime. Time is lost as well. Imagine having to contact the police, banks, credit card companies, credit bureaus, and friends and families. A FTC report found that consumers spend between 30 to 60 hours on average resolving problems. These inconveniences can become disasters if these shenanigans are discovered too late. Quite often victims do not know that their identities have been stolen until they apply for a job or unemployment or a loan and are turned down. In addition to loss of time and money, victims of identity theft also suffer from emotional distress, a sense of being violated and insecurity. By understanding the tactics employed by identity thieves and taking proactive steps to protect yourself, you can reduce the risk of becoming victims of this pervasive crime.

Common Identity Theft Tactics

Large scale identity thefts happen when criminals hack into databases of companies and institutions (called data breaches) as a result of inadequate security measures, software vulnerabilities, or employee negligence. In 2017, Equifax, one of the three credit reporting bureaus, suffered a data breach that exposed the personal information of 147 million people. If the FTC determines that the companies or institutions are at fault, consumers are usually given free credit monitoring for a set period of time as compensation. Credit monitoring provides email or text alerts when there are changes to your credit reports, such as new credit accounts opened in your name, hard inquiries, changes to your personal information, or changes to your credit scores. Credit monitoring does not cover non-financial abuses.

In addition to hacking into databases, the tactics employed by identity thieves are diverse and constantly evolving, exploiting vulnerabilities in both human behavior and technological systems.

Pretexting or Spoofing: A cornerstone of identity theft, pretexting or spoofing involves impersonating a business, institution, or government agency to scam consumers. They use deceptive communications with believable stories to trick victims into giving them money or divulging sensitive information such as credit card and bank account numbers, Social Security number, driver’s license, or birthdate. Pretexting has many other names, depending on the media used by the attackers: via email (phishing), text message (smishing), phone call (vishing), or even in person. Some phishing emails and smishing texts trick users to click on links that direct them to bogus websites that look like the real thing. Figure 6.11 shows a smishing text message lying about unpaid tolls. They collect login or credit card information on these fake websites and use that information to access your real bank or credit card accounts or use the stolen card numbers to make purchases. Some email- or text-attacks trick users to download images or files that contain malicious software (malware). Once installed, malware can steal sensitive data, monitor user activity, and even take control of the device. Keyloggers, a type of malware, record keystrokes, potentially capturing login credentials and other sensitive information.

Criminals often employ manipulation tactics (social engineering), preying on emotions like fear or urgency, or may leverage current events or trends to appear credible. For instance, a criminal may impersonate a law enforcement officer requesting bail money for a loved one. Another common scam is fake fundraisers for disasters or sensational news events. Some tactics are designed to bypass security measures such as multi-factor authentication (MFA), which requires a security code in addition to user id and password. Figure 6.12 shows a fake text message from a bank. If the victim replies with any of the options provided, the criminals will attempt to access the victim’s account, triggering a security code to be sent out. The criminals will then call the victim pretending to be a bank employee helping them resolve the issue and ask the victim to give them the security code, thus gaining access to the victim’s account. Do not give out MFA security code to anyone. Legitimate banks and credit card companies will never ask for a MFA security code over the phone.

Skimming and Shimming: Skimming devices (called shimmer) are installed on point-of-sale card readers or ATMs to capture credit or debit card information. Criminals often take advantage of unmanned stations such as gas pumps, self-checkout counters, or ATMs to install these devices. A low-tech version of skimming involves criminals posing as employees at a business to steal your credit card information. The stolen information can then be used to create counterfeit cards or make unauthorized purchases.

Dumpster Diving and Mail Theft: Rummaging through trash or stealing mail to obtain documents containing personal information does not require any technology. Criminals look for bank statements, credit card offers, medical bills, or other sensitive documents.

Protecting Against Identity Theft

Protecting against identity theft requires a multi-layered approach. Here are some steps you can take to safeguard your sensitive information:

-

- Safeguard your Social Security Number (SSN): Your SSN is a prime target for identity thieves. Keep items containing your SSN, such as your Social Security card, out of your purse or wallet. Never have your SSN printed on your checks. Shred any documents that contain your SSN before discarding them.

- Be wary of unsolicited communication: Be suspicious of any phone calls, text messages, or emails that ask for your personal information. Legitimate companies will never ask for your SSN, security code, or other sensitive information over the phone or via email or text.

- Be cautious with emails and texts: Pay attention to the sender’s email address. Never click on a link in an email from an unknown sender. If you are unsure whether an email or text is legitimate, contact the company directly. Avoid clicking on links. Go to the website directly to login.

- Secure online shopping: Only shop online on secure websites. Look for “https://” in the website address.

- Set up transaction alerts: Many banks and credit card companies offer transaction alerts. These alerts will notify you when a transaction is made on your account. This can help you quickly identify any fraudulent activity.

- Monitor your accounts: Carefully review your bank and credit card statements each month. Look for any unauthorized charges or activity. If you see anything suspicious, contact your bank or credit card company immediately.

- Place a credit freeze: A credit or security freeze prevents new credit accounts from being opened in your name without your permission. This can be a powerful tool for preventing identity theft. You must request a credit freeze with each credit reporting bureau separately, Equifax, TransUnion, and Experian. If you place a credit freeze, you must lift it before applying for a loan or credit card. There is no charge for placing or lifting a credit freeze. Watch out for “premium” services, which often have terms like “credit lock” or “credit monitoring,” that require subscription fees. You can do the same things yourself without paying any fee.

- Follow password security best practices: Use strong passwords or passphrases that are at least 16 characters long and include letters, numbers, and symbols. Do not use names, birthdays, addresses, or other personal information as part of your passwords. Use a unique password for each account. Enable multi-factor authentication (MFA). Never give security code from MFA to anyone. Regularly update your passwords, especially after a data breach.

- Have dedicated email addresses: Have an email address for fun, promotional, or junk emails. Use your personal email address for friends, family, and important business relationships. Consider having an email address for financial accounts only.

- Beware of public Wi-Fi networks without protections: Many public networks are poorly secured and hackers can exploit them to intercept your data. Use a Virtual Private Network (VPN) that protects your data when using public networks. Bring your own phone charger and avoid public USB power ports, which can download data from your phone.

- Update phone and computer system consistently: Install system updates on your computer and phone regularly. Do not turn off the default virus protection software such as Microsoft Defender for Windows and XProtect for Mac. This will help protect your computer from viruses and malware that can steal your personal information. Get a new phone when the manufacturer no longer provides system updates.

- Document your accounts: Keep a record of all your financial accounts, including bank accounts, credit cards, and investment accounts. This will help you quickly identify any unauthorized accounts when reviewing your credit report.

- Use online statement delivery: Download and keep a copy of the recent statements in a secure drive as backup. If you use paper delivery, invest in a shredder and shred any documents that contain your name, address, phone number, and financial information.

- Protect your mail while on vacation: Have your mail held at the post office when you are on vacation. This will prevent mail from piling up in your mailbox and becoming a target for thieves.

By taking these steps, you can help protect yourself from identity theft and keep your personal information safe. Sometimes criminals may still succeed despite your best efforts. If you become a victim of identity theft, file a police report right away. Keep a copy of the police report. Contact the creditors and banks for any accounts that have been tampered with or opened fraudulently. Follow up the initial contact in writing and include a brief summary of what was discussed and a copy of the policy report. Contact all three credit reporting bureaus and instruct the bureaus to flag your file with a fraud alert, including a statement that creditors should contact you for permission before they open any new accounts in your name. Report the identity theft incident to the Federal Trade Commission (FTC) at https://identitytheft.gov. By being proactive as soon as possible, you can minimize the damages.

Exercise 6.5: Place and lift a credit freeze

Choose one of the three credit reporting bureau. Go to its website directly, e.g. https://www.experian.com or https://www.transunion.com/ or https://www.equifax.com/. On its website, search for the term “credit freeze.” DO NOT use search engines.

- Read the instructions on how to place a credit freeze carefully.

- Place a credit freeze. (Optional)

- Remember that you must lift the credit freeze if you want to apply for a new credit card or a loan or a rental application.

What to do if you are over your head in debt?

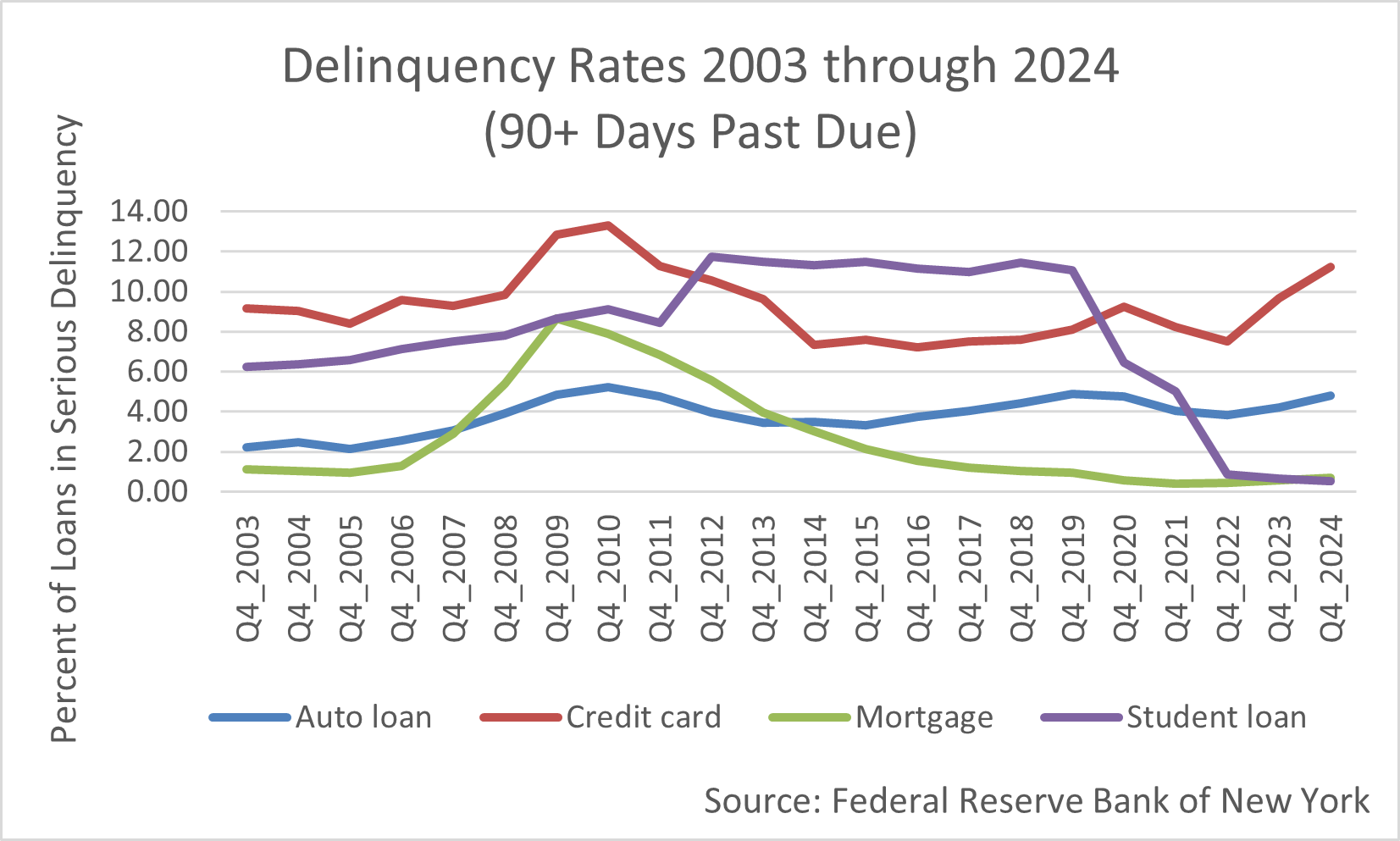

The Federal Reserve Bank defines serious delinquency as payments that are 90 or more days past due. Figure 6.13 shows the percentage of serious delinquency in various types of loans from 2003 through 2024. Notice the high delinquency rate on mortgages during the 2008 financial crisis. Predatory mortgage lending practice was one of the causes of the crisis and led to the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Student loan repayments were paused during the 2020 COVID pandemic, resulting in a significant drop in delinquency rate. Credit cards and student loans are unsecured debts and they have a higher delinquency rate than secured debts such as auto loans and mortgages. During recessions when the unemployment rate is high, more people fall behind in their debt repayment.

If you find yourself overwhelmed by debt, immediate action is crucial. Ignoring the problem will not change the situation. Start by creating a detailed list of all your debts, including the amount owed, interest rates, and minimum payments. Contact your creditors to discuss possible repayment plans to avoid becoming delinquent or having the debt sent out to collection. Consider seeking advice from a reputable non-profit credit counseling agency, which can help you create a budget, consolidate debt, or explore debt management plans. These agencies, such as the National Foundation for Credit Counseling (NFCC) or Financial Counseling Association of America (FCAA), typically do not advertise or reach out to consumers. They emphasize financial education and budgeting and may charge a small administrative fee for supervising debt repayment plans. Be wary of for-profit debt settlement companies that promise quick fixes that come with high fees and can negatively impact your credit score. Stay away from any credit repair or debt consolidation services that require payment in advance.

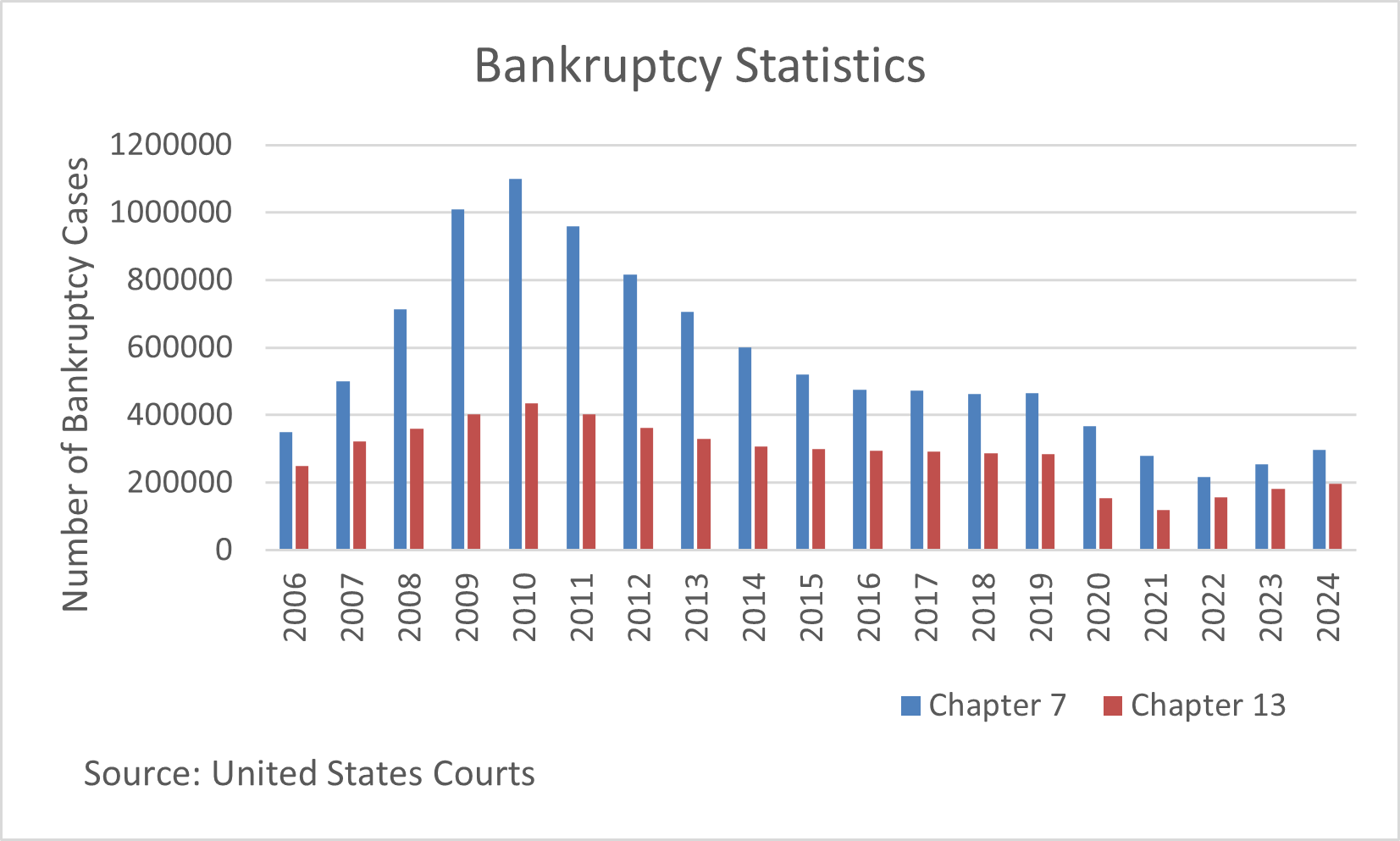

In extreme cases, bankruptcy may be an option, but it should be considered a last resort due to its long-term negative effects on your financial future. The bankruptcy process can be long and expensive. The number of bankruptcies peaked in 2009, 2010, and 2011 with over 1 million people filing for bankruptcies each year, a result of the 2008 financial crisis (Figure 6.14). The top reasons people gave for filing for bankruptcy are loss of jobs and medical bills. There are multiple types of bankruptcies, with Chapter 7 and Chapter 13 being the most common for individuals. The names refer to the respective chapter of the United States Bankruptcy Code. Not all debts are eliminated in bankruptcy. Some debts are considered not dischargeable, such as past due taxes, student loans, legal judgements, child support. You may not lose everything after bankruptcy. Some assets are exempt. For instance, you may be able to keep a car, up to a certain value, so you can get to work. Federal law sets the framework for bankruptcy and state law plays a significant role in specifying the details such as the qualification standards for different types of bankruptcy, the types of debts that are dischargeable, and the types of assets that are exempt. These specifics can vary greatly from state to state. You should consult an attorney if you are considering filing for bankruptcy. Some law firms provide pro bono assistance, meaning free or reduced-cost legal help. You can contact your local or state bar association for referrals.

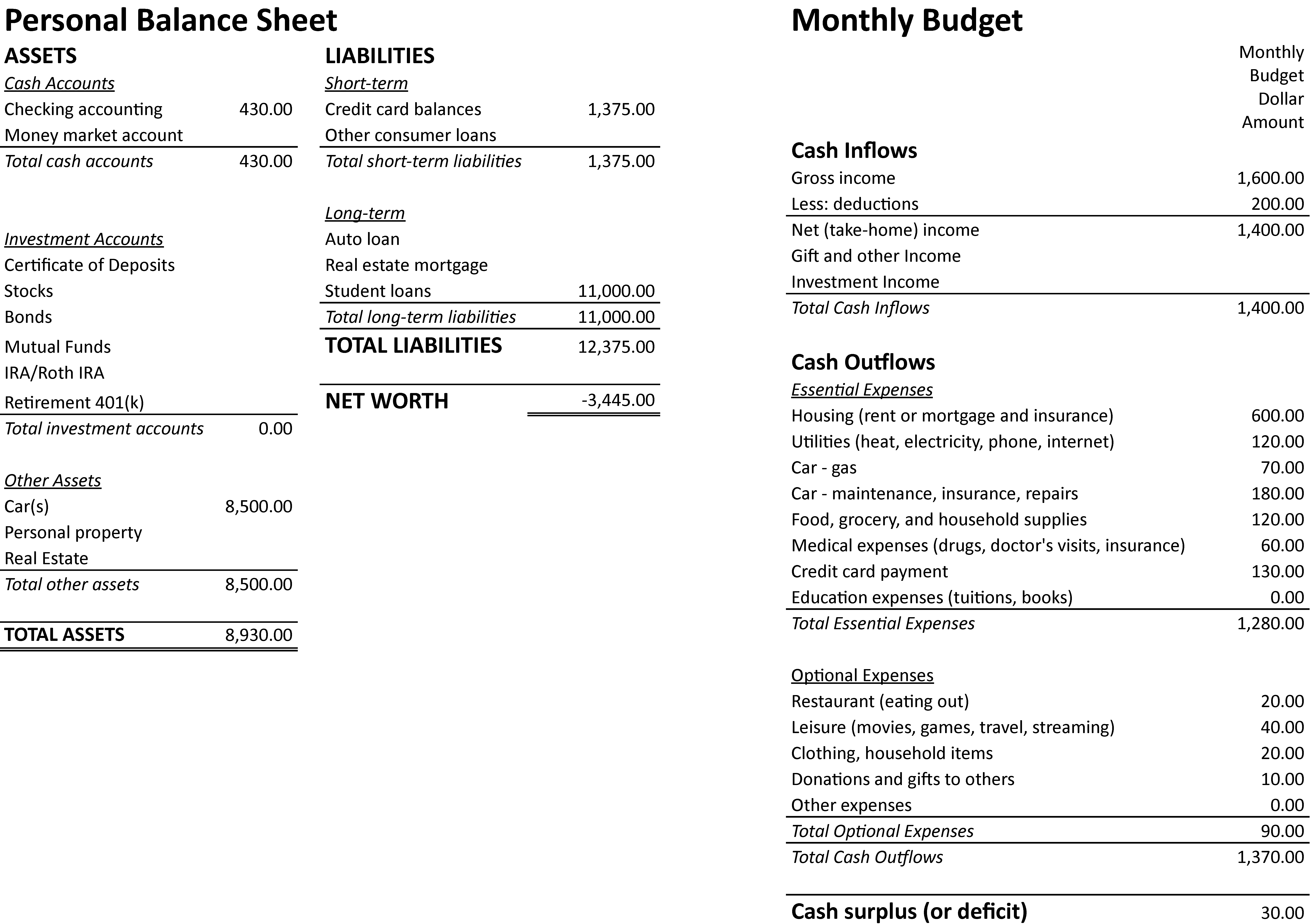

Both Chapter 7 and Chapter 13 bankruptcies require a list of all properties and debts (personal statement of financial positions), and income and monthly living expenses (personal statement of cash flow). Income is a key factor for determining which type of bankruptcy someone is eligible for. To qualify for Chapter 7 bankruptcy, the income must be less than the state median or passes a means test. Chapter 13 bankruptcy requires a regular income and ability to create a repayment plan. In general, Chapter 7 is more suitable for individuals with limited assets and income and want a quick discharge of unsecured debts such as credit cards and medical bills. Under Chapter 7 bankruptcy, assets that are not exempt are sold to pay off dischargeable debts and no further payment is required. Chapter 13 bankruptcy is more complex and better suited for individuals who want to keep their assets and have sufficient regular income to make payments on a debt repayment plan. Individuals must complete credit counseling and develop a repayment plan for 3 to 5 years. Unsecured debts are often discharged after the repayment period. An important provision of Chapter 13 bankruptcy is that it stops foreclosure proceedings on secured loans. Past due mortgage payments can be incorporated in the repayment plan, giving homeowners an opportunity to catch up on missed payments and keep their homes. Chapter 7 bankruptcies stay on credit reports for 10 years whereas Chapter 13 bankruptcies stay on for 7 years. Credit scores will likely decrease to around 500 following a bankruptcy.

Bankruptcies are complicated and stressful. By learning about personal financial planning and applying the tools you have learned, you will reduce the chances of encountering this fate. An ounce of prevention is worth a pound of cure. Should you find yourself in the unfortunate situation of needing to file for bankruptcy, be sure to consult an attorney.

Types of Bankruptcies

| Chapter 7 Bankruptcy | Chapter 13 Bankruptcy | |

| Income eligibility standard | Below state median or passes a means test. | Sufficient regular income to support a repayment plan. |

| Assets | Non-exempt assets are sold off. | Assets are generally not sold off. |

| Unsecured debts | Dischargeable debts are eliminated after non-exempt assets are sold off. | Dischargeable debts are eliminated after the repayment plan is complete. |

| Secured debts | Limited flexibility on secured debt. Lenders may foreclose homes or repossess cars if payments are not made on time. | Foreclosures are paused. May include past due payments in the repayment plan. Opportunity to renegotiate new payment terms. |

| Credit report | Stay on credit report for 10 years. | Stay on credit report for 7 years. |

| Credit score | Decrease to around 500. | Decrease to around 500. |

Personal Financial Plan Exercise 6

Evaluate Your Credit Worthiness

- Evaluate your credit report.

- Obtain a copy of your credit report from https://www.annualcreditreport.com/. Federal law allows each person one free copy of credit report every 12 months.

- Identify any errors that you need to correct.

- Identify ways you can improve your credit score.

- What steps can you take in your life to reduce your exposure to identity theft?

Integrated Case 6

Blake Jackson is half way through her first semester at State University. She enjoyed her classes and made some great new friends, especially her teammates. Things had been going very well until yesterday when her 5-year old computer died completely and suddenly. She is on the University eSport team so she needs a computer with reasonable power. The cheapest model she found that met all her needs cost around $1800. The store was running a pre-holiday financing special, offering 10 percent off the purchase price and a 6 percent APR for 24 months, for customers opening a new store credit card.

Blake decided to take the special offer and completed the credit card application. To her surprise, her application was declined. She knew that just a few months ago her credit score was in the mid-600’s and she had no problem obtaining her student loan. Since then, she had paid off more on her credit card balance and continued to make regular monthly payments. As a full-time student, she did not have to make payments on her student loans until she graduated. Blake was concerned and wondered why her application was not approved. Could she be a victim of identity theft or was the new payment on the computer too high given her income?

Blake reviewed her current financial situation.

Activities

- Describe steps Blake should take after the store declined her credit card application.

- If Blake found evidence of identity theft, what should she do?

- Explain whether her debt payment to income ratio is a likely reason for her credit card application to be declined.

Chapter Six Summary

Consumer credit refers to borrowing by individuals for personal or household needs.

Good Reasons for Using Consumer Credit:

- Investing in your future: This includes essential purchases like a reliable car for work or student loans for education, which can lead to long-term returns and better employment opportunities.

- Building a good credit score: Timely payments and responsible credit use are needed for establishing and improving credit scores, which in turn can lead to more favorable loan terms in the future.

- Convenience: Credit cards offer convenience, fraud protection, and rewards programs, reducing the need to carry large amounts of cash.

- Emergency planning: Access to credit can serve as a financial safety net for unexpected expenses, helping avoid high-cost alternatives like payday loans.

Bad Reasons for Using Consumer Credit:

- Not considering repayment effects: Borrowing without a clear repayment plan can lead to financial strain.

- Excessive spending: Studies show that individuals tend to spend more with credit cards or Buy Now, Pay Later (BNPL) services than with cash.

- Unintentional debt accumulation: Open-end credit like credit cards can lead to a gradual and unnoticed increase in debt without careful monitoring.

Curbing Excessive and Impulse Spending:

Effective strategies to curb excessive and impulse spending include:

- Using a budget.

- Sticking to a shopping list.

- Setting spending alerts.

- Using the envelope method.

- Applying a “waiting rule” of 3 to 7 days for purchases, considering questions like: “Does the item solve a real problem in your life?” and “Will you buy this item if you need to pay cash for it?”

Types of Consumer Credits

Consumer credits are classified based on their characteristics:

- Secured Credit: Backed by an asset (e.g., car, house). Lower risk for lenders, thus typically lower interest rates. Example: Auto loans, mortgages.

- Unsecured Credit: Based solely on the borrower’s promise to pay. Higher risk for lenders, often higher interest rates. Example: Student loans, credit cards.

- Closed-end Credit: The full loan amount is disbursed at the start, with a specified repayment schedule. Examples: Student loans (unsecured), auto loans (secured).

- Open-end Credit (Revolving Credit): Allows repeated borrowing up to a pre-approved limit, with no fixed end date for full repayment. Examples: Credit cards (unsecured), Home Equity Line of Credit (HELOC) (secured).

Factors to Consider When Taking Out a Loan

Before borrowing, evaluate these factors:

- Affordability: Can you afford the monthly payments, including hidden fees and potential interest rate changes? How do these payments affect your budget?

- Variable Interest Rates: Fluctuate with benchmark rates. Be wary of “teaser rates” and consider the lifetime cap as a worst-case scenario.

- Origination Fee: A fee levied when taking out a loan, often added to the loan balance.

- Prepayment Penalty: Charged if the loan is paid off early, reducing flexibility.

- Late Payment Fee (Penalty): Applied for missed payments, increasing loan balance.

- Credit Insurance Premium: Protects the lender if you cannot repay due to specific events. It significantly increases borrowing costs.

Creditworthiness and the Five Cs of Credit

Lenders assess creditworthiness using the five Cs of credit to determine loan approval:

- Character: Refers to a person’s moral, ethical, and emotional qualities. The credit report and credit scores are often used as a proxy.

- Capacity: The borrower’s ability to make loan payments, often measured by the Debt Payment-to-Income ratio (DTI). Lenders generally look for a DTI less than 35 percent (including housing costs) or 20 percent (excluding housing costs).

- Capital: The borrower’s existing equity and debt burden.

- Collateral: The value of the asset securing a loan, relevant for secured loans.

- Conditions: External factors (national, international, industry) that may affect the borrower’s ability to make payments or lender’s willingness to extend loans.

Credit Reports and Credit Scores

Credit reports and scores are two different things though they are related.

- Credit Report: A historical document detailing your past credit activities, compiled by credit reporting bureaus (Equifax, Experian, TransUnion). It includes personal information, public record, credit accounts, collections, soft and hard credit inquiries, and personal statements. Consumers can obtain a free copy weekly from www.annualcreditreport.com.

- Credit Score: A numerical prediction of your likelihood to make future payments, computed by mathematical models based on credit report information and other sources. Scores range from 300 to 850.

Key Factors Affecting Credit Scores:

- Payment history (most important): On-time payments are crucial. Bankruptcies and collection actions significantly lower scores.

- Age of accounts: Longer credit relationships generally have a positive impact.

- Types of accounts (credit mix): Having diverse credit (e.g., credit card, student loans, auto loans) can improve your score.

- Percentage of credit use: For revolving credit, keep balances below 30 percent of the credit limit.

- Total debt balances.

- Recent credit activities: Opening many new accounts can temporarily decrease scores.

What is a Good Credit Score?

While no official standard exists, generally:

- Below 600 is considered bad.

- Over 800 can qualify for the best interest rates.

- The national average FICO Score in 2023 was 717.