8 Purchasing, Financing, and Insuring a Car

Chapter Eight Learning Objectives

- Identify resources for researching car information.

- Understand the total costs of owning and operating a car.

- Identify the pros and cons of a new car versus a used car.

- Identify factors affecting the cost of automobile insurance.

- Evaluate appropriate automobile insurance coverage.

- Evaluate different options to pay for a car.

- Calculate estimated car payments.

- Evaluate leasing versus buying.

- Develop a smart car shopping strategy.

Buying a car is often the first major purchase in one’s life. The car shopping process may be fun and exciting for some, or it may be intimidating for others. Deciding on a car is no easy task. There are so many makes and models. The need to choose a financing option adds to the complexity. In addition to the price of a car, you should look at the total cost of ownership, which includes operating, depreciation, and repair costs. Auto insurance can add a significant amount to your budget. And do not forget opportunity cost. When you miss work or school frequently due to an unreliable car, you could end up losing your job or failing a class. In which case the opportunity cost is very high. When there are a multitude of choices, it can feel overwhelming. In fact, most respondents in a 2014 survey said that buying a car was more stressful than going on a first date. You can apply tools from this book to make the car buying process manageable.

How Much Car Can You Afford?

First, use your budget to help you determine how much car you can afford. As a rule of thumb, keep your car payment to be less than 10 percent of your take-home pay. For instance, if your monthly take-home pay is $4000, your car payment should be less than $400. Keep car payment, insurance, gas, and regular maintenance to be less than 20 percent of take-home pay. Then there is down payment. A short cut to estimate how much car you can get given how much you have saved up for down payment is to divide your savings by the down payment percent. A typical down payment on a car loan is 20 percent.

Approximate car cash price you can afford = Down payment savings / Down payment percent

If you have saved up $5,000, that means you can get a $25,000 car with a $20,000 loan, assuming the monthly payment and other car expenses are within the 10 percent and 20 percent guideline. Then rank the various alternatives based on their feasibility and alignment with your personal values and lifestyle. In the following sections we will explore the costs of owning and operating a car, auto insurance, and financing options.

Total Cost of Ownership

Before going to a car dealer, you will benefit from doing some homework first. Your personal values, family situation, and lifestyle will guide your priorities. A family with 3 kids under the age of 10 will need plenty of passenger and cargo space. If you have a long commute or your work involves a lot of driving, fuel efficiency will be important. The internet is a useful resource for researching car information. There are dedicated websites that specialize in car reviews and provide estimates on average operating and repair costs. Examples include Edmunds.com and kbb.com. Operating costs include gas, depreciation, and routine maintenance such as oil change, brakes, and tires. The key is to be informed so you will be prepared. For instance, a single tire can cost from around $100 to $3-$400 or more. Can you afford to replace a tire on your chosen car easily if you are unlucky and hit a pothole?

The advertised prices from car dealers usually do not include all the fees and taxes. Some of these fees and taxes are state mandated such as title and registration fee, sales tax, and inspection. Some dealer fees, charges, and add-ons are optional or negotiable. An example of optional add-ons is the cost of etching the vehicle identification number (VIN) to the windshield. VIN etching is advertised as a deterrent to car thieves. You can decline this service at the dealer and do it yourself or at lower cost somewhere else. Examples of negotiable dealer fees include “market adjustment fees” and “advertising fees”. These fees and taxes can add 8 to 10 percent to the advertised price. To avoid unpleasant surprises, get an “out-the-door” cash price of the cars that interest you in writing via email. That means getting the dealer to send you the total cash price of the car including all taxes and fees. Delay discussing financing and trade-in options at this stage of your shopping process. Having the “out-the-door” price in writing before you go to the showroom will help you compare offers from different dealers on an apples-to-apples basis. It also makes it easier to catch extra charges and add-ons that you do not want. Ask if you qualify for any available offers such as rebates, discounts, or special prices. Look closely to see if there are restrictions on these offers. Examples of discounts include “new grad” offers for recent college graduates or military discounts for active duty members and veterans. Some offers apply only to specific car models. Do not assume that any rebates have already been included in the price you are offered. You want answers to all your questions in writing. That way, you can evaluate your options at home, a less stressful environment than at the dealer. You can also check the final deal against what you have been quoted when everything is in writing. When you compare your options, include the operating costs in addition to the price. The following example demonstrates the importance of looking at the total cost.

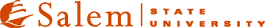

Figure 8.1 shows the operating costs for two comparable new vehicles that have similar cash prices but vastly different operating costs for their first year. The Jeep Compass has a higher maintenance cost than the Honda HR-V. The biggest difference is in the depreciation. The Compass depreciated by $8,001 in the first year, compared to only $3,271 for the HR-V.

New versus Used Cars

Cars are a depreciating asset, which means it loses value over time due to wear and tear. The steep depreciation in the first two years is often cited as a disadvantage of buying a new car. There are pros and cons for both new and used cars. The pros of buying a new car include the manufacturer’s warranty, the latest safety features and technology, and let us face it…shiny and new. It is easier to find the exact features you want and you can even customize a new car to your own specification. New cars tend to be more reliable. Oftentimes, manufacturers offer special low interest rates on new cars as promotions. Even conventional auto loans tend to have lower rates on new cars than used cars. The disadvantages of buying a new car include a higher price and steep depreciation in the first few years. Depreciation is the greatest with special custom features such as premium paint colors or audio upgrades.

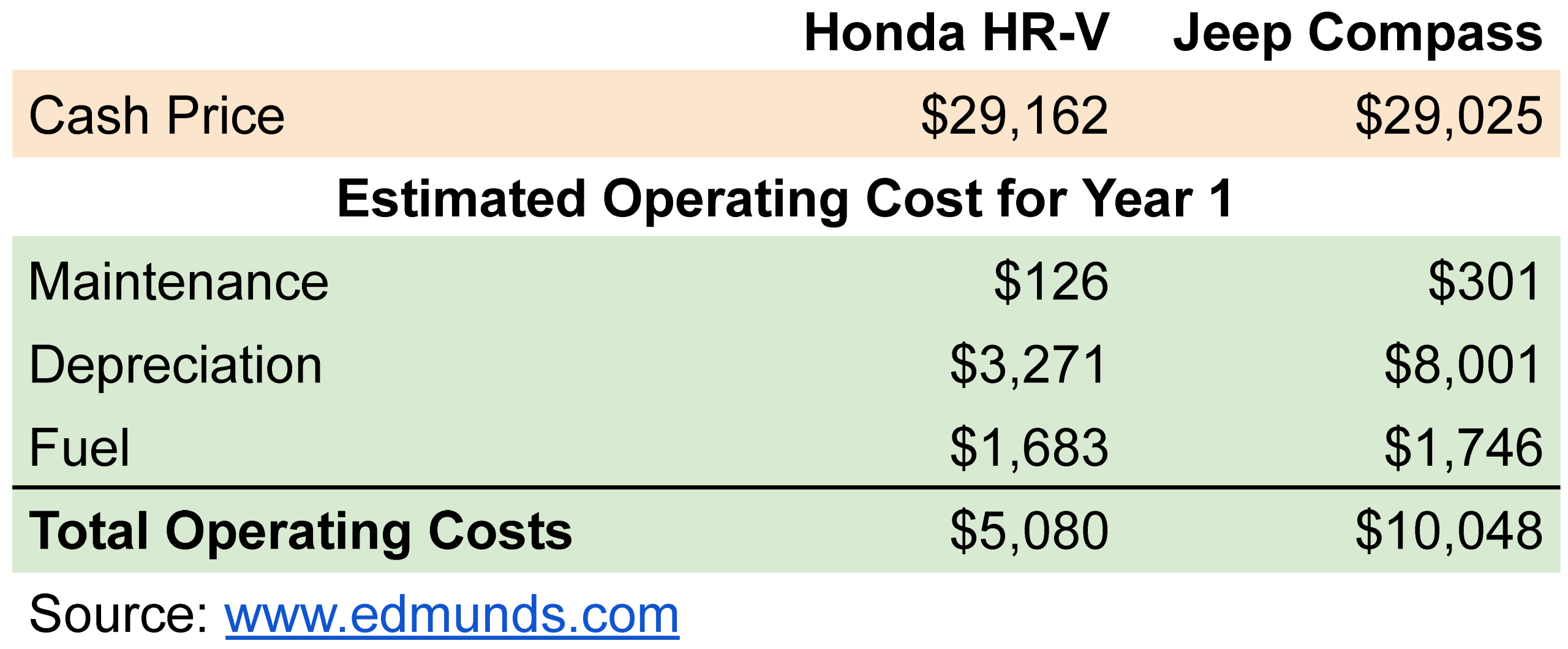

The biggest advantage of a used car is its price. It also has slower depreciation. The cons of buying a used car include lack of manufacturer’s warranty, higher maintenance and repair expenses, potential problematic car history, and higher interest rates. There are also rental costs and inconvenience when your car is being repaired. Used cars, especially ones with a lot of miles or problematic repair history, may be unreliable. You do not want to get into trouble at work or school because your car breaks down frequently. It may take longer to find a used car with all the features you want. If you are considering a used car, you should research the car’s history, find out costs for major repairs, and have a reliable mechanic to inspect the car. You can find out a car’s history using its 17-digit Vehicle Identification Number (VIN) at websites such as VehicleHistory.gov or Carfax.com. Car history information includes ownership changes, past accidents, flood damage, and whether a car has been declared salvage. A salvage vehicle is a car so extensively damaged that the cost of repair was greater than the value of the car. Such cars can be rebuilt but the values are significantly lower. In addition to Edmunds and KBB, Consumer Reports and NADA Guides are good resources for finding out used car values and major repair costs. Consider having a mechanic you trust perform a pre-purchase inspection. It may cost a few hundred dollars for the inspection but it can prevent you from buying a car with mechanical problems or in need of major maintenance soon. If the seller does not allow a third-party inspection, it is a red flag and you are better off looking for a different car. Some used cars, called certified pre-owned, come with limited manufacturer’s warranty and have fewer mileage than typical used cars. Many are less than 5 or 6 years old and have fewer than 60,000 miles. Certified pre-owned cars are more expensive than regular used cars but cheaper than new cars. Figure 8.2 compares the cash price, operating, and repair costs of four vehicles. In this example, the lower depreciation of the used cars are offset by higher maintenance costs. It is interesting to note that the car with the lowest cash price has the second highest operating and repair costs. This example demonstrates the importance of taking into account both price and operating and repair costs when evaluating a car. The relative prices of new versus used cars fluctuate with supply and demand. During the COVID pandemic, supply shortage caused used car prices to soar. In 2025, President Trump imposed a 25 percent tariff on imported cars and car parts, leading to higher prices for new cars. Before you go car shopping, get to know the current car market conditions.

New Car versus Used Car

Pros of buying a new car

|

Pros of buying a used car

|

Cons of buying a new car

|

Cons of buying a used car

|

Consumer Protection of Auto Purchase

Most states have “lemon laws” to protect buyers of new cars. A “lemon” is a car with a substantial defect that the manufacturer cannot fix after three or four attempts. The buyer is eligible for a refund or replacement under the lemon law. You need to document the repair attempts and the defect to establish the car as a lemon. Keep all repair receipts and if possible, take photos and videos of the defect. A few states extend the lemon laws to used cars. Most states have laws that require “implied warranties of merchantability” to protect buyers of used cars. Dealers have to guarantee that the used car will run – at least for a little while.

The manufacturer’s warranty covers basic parts against defects, including the powertrain in the engine, transmission, drive train, and corrosion. The specific time horizon, mileage, and parts covered vary by manufacturers and car models. The coverage is longer and includes more parts for a new car than a certified pre-owned car. If a part under warranty needs repair or replacement, the manufacturer covers the cost.

Car dealers almost always offer extended warranty, also called service contracts, to buyers. This extended warranty is through the dealer, not the manufacturer. A recent Consumer Reports survey found that 55 percent of owners who purchased an extended warranty did not use it at all. On average, those who did use it spent hundreds more for the price of the contract than they saved in repair costs. Unless your unique situation makes the extended warranty worthwhile, the average consumer does not appear to benefit from buying one.

Auto Insurance

Once you have narrowed down your choices to a few different car models, the next step is to get an estimate on their insurance costs. Some of the car review sites include insurance and financing costs in their estimates, which will likely differ significantly for your actual costs on these two items. The primary purpose of insurance is to protect your net worth against events beyond your control. Many states have financial responsibility laws which require drivers to purchase a minimum amount of liability insurance. Another name for liability insurance is casualty insurance. It covers payments to others when you are responsible for their injuries and damages to their properties. You may be held legally responsible, or considered at fault, even if you think you are not the sole cause of the accident. Negligence on your part is often sufficient ground. The specifics of financial responsibility laws vary by state. If you purchase a car with an auto loan or lease, the lender will require property insurance to cover damages to the car that is pledged as collateral.

Types of Insurance Coverage and How to Read an Insurance Policy

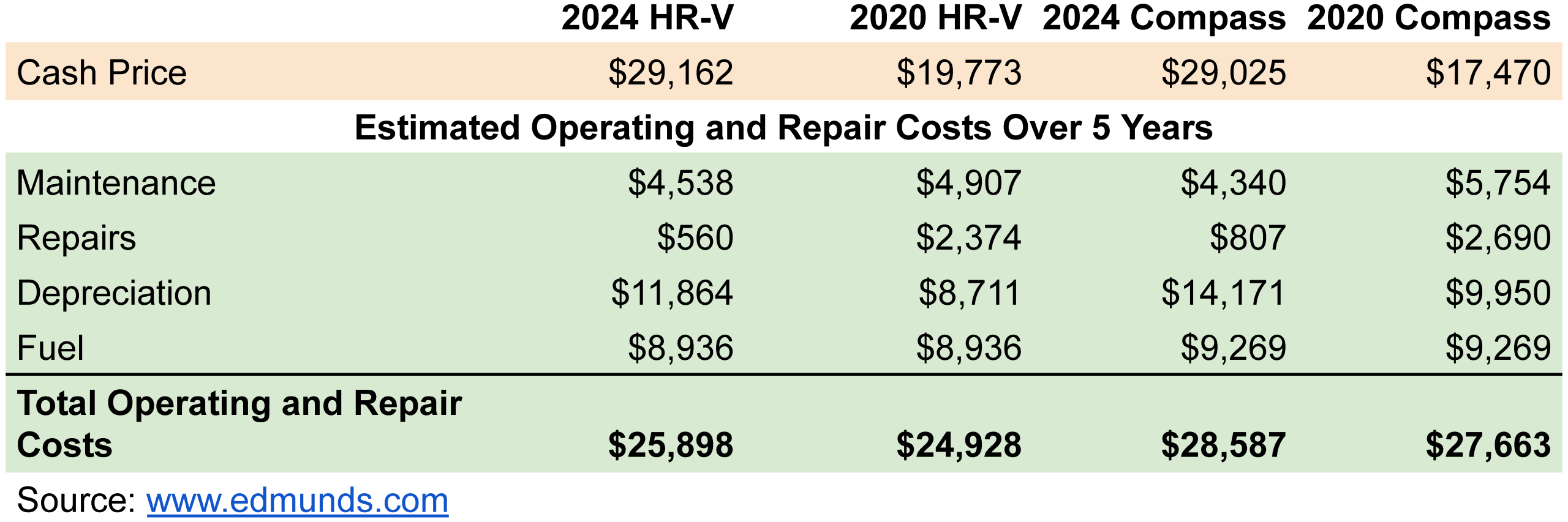

An auto insurance policy is a legal contract specifying how much the insurance company will pay under what conditions. The first page of the policy, called the declaration page, summarizes the coverages, limits, deductibles, and premiums. Coverages describe the type of damage and injuries the insurance company agrees to pay. Coverage limits are the maximum amount the insurance company will pay. Deductible is the amount you owe before any insurance payment. Premium is the price you pay for the insurance policy.

There are four main categories of coverage. The first covers injuries to others when you are responsible for the accident. Injuries include legal and medical expenses, lost wages, and other expenses incurred as a direct result of the accident. The coverage limit specifies the maximum amount the insurance will pay per person injured and a maximum total per accident. Figure 8.3 shows the declaration page of a sample policy.

In Figure 8.3 the per person limit is $300,000 and the per accident limit is $500,000. The second category covers damage to other people’s properties, including their cars. The property damage limit in Figure 8.3 is $100,000. Sometimes these liability insurance coverage limits are written as XXX/XXX/XXX where the first number describes the per person injury limit, the second describes the per accident limit and the third describes the property damage limit. In the sample policy, these limits will be expressed as 300/500/100. The following two examples illustrate how liability insurance works.

Sam takes pride as a skilled driver. Unfortunately, a text notification distracted them and they did not stop in time when the car in front of them braked suddenly. The insurance company determined that Sam was at fault. Sam had purchased liability insurance coverage with limits of 15/30/5. Luckily no one was hurt but the damage to the other car required $8,000 in repairs. Sam’s insurance paid $5,000 according to the policy and Sam had to pay the additional $3,000 out of pocket to the other driver.

Example: Chris’s Nightmare

Chris was on a road trip with three friends when their car was struck by a drunk driver. Chris required surgery and two of the friends needed a brief hospital stay. Chris’s car, which was worth $18,000, was totaled. The drunk driver carried liability insurance with limits of 15/30/5. The hospital bill was $100,000 for Chris and $10,000 each for the two friends. The insurance company paid $15,000 to Chris because that was the per person limit. Even though the hospital bill for the other two friends was below the $15,000 per person limit, they would not receive full payment of $10,000 each because of the per accident limit. The insurance company paid $7,500 to each friend. Chris received $5,000 for the car. Total payout from the insurance company was $30,000 for injuries ($15,000 + $7,500 + $7,500) and $5,000 for property. Chris and their friends now faced the dilemma of whether to sue the drunk driver for damages not covered by insurance. For the two friends, the uninsured damage amount was only $2,500 each. For Chris, the total uninsured amount was $98,000 ($100,000 – $15,000 + $18,000 – $5,000).

The third category covers injuries to you and passengers in your car. Uninsured motorist coverage pays the costs of bodily injury to you and your passengers when an accident is caused by another driver who is not insured or if the other driver is not identified (hit-and-run). Underinsured motorist coverage pays for remaining medical expenses when the driver causing the accident has insufficient coverage to pay the full amount. Imagine you are in an accident with someone who has a liability limit of $50,000, but your medical bills are $80,000. The at-fault driver’s insurance will pay $50,000, and your underinsured motorist coverage will pay the remaining $30,000 or up to the limits of your own policy. If you live in a no-fault state, you will need to purchase no-fault insurance, also called Personal Injury Protection (PIP) insurance. In a no-fault insurance state, your own insurance company will pay for your expenses due to injuries sustained in the accident, no matter who is at fault. Note that insurance companies still determine who is at fault after an accident and the driver can still be held liable for property damages and bodily injuries they cause even in a no-fault state. You can purchase “add-on” or “choice” PIP insurance to cover the costs of your own injuries when you are at fault in an accident in some states that are not no-fault states.

The minimum auto insurance coverage under financial responsibility laws varies greatly from state to state. For instance, California requires only liability insurance with the minimum limits set to $15,000 per person, $30,000 per accident, and $5,000 for property damage (15/30/5). Massachusetts is a no-fault state and it requires liability, PIP, and uninsured motorist insurance. The minimum limits for liability insurance is 25/50/30, for PIP is $8,000, and for uninsured motorist coverage is $25,000 per person, $50,000 per accident. New Hampshire, a neighbor to Massachusetts, does not require auto insurance but you must show proof that you are able to pay for the damages if you are at fault in an accident.

The fourth category covers damages to your car. Collision coverage insures against costs of damage to your car resulting from an accident in which you are at fault. Comprehensive coverage insures you against damage to your car that results from floods, theft, fire, hail, explosions, riots, and various other events. If you have a loan or lease on your car, the lender will require collision and comprehensive coverage. If your loan term is long relative to the age of the car, you may want to consider getting GAP insurance. GAP insurance covers the difference between the loan value or remaining lease obligations and what your collision and comprehensive insurance would pay out in case the car is totaled or stolen. Remember that you are responsible for the loan or lease even if your car is gone. For instance, if your loan balance is $12,000 and the insurance values your car at $10,000, you are on the hook for $2,000 to the bank.

There are other items you can add to your policy. A common additional coverage is to pay for rentals when your car is not usable due to an accident when you are at fault. The rental bill could be hundreds of dollars or more while your car is in the shop. Even if you are not at fault, without rental coverage you will need to wait to get reimbursed from the other driver’s insurance. If having use of a car is indispensable you may want to consider adding this to your policy. Most policies have a daily and total claim amount. The daily amount is how much your insurance company will pay per day for the rental car. Anything over that amount will come out of your pocket. The total per claim amount is the maximum you can be reimbursed for each accident. These might be a dollar or a time limit. Another popular option is to insure against towing costs. Towing can be expensive. These additional items add to your premium. They also help you avoid unexpected large expenses.

What To Do If You Are In An Auto Accident

If you are in an auto accident, contact the police immediately. Ask for a copy of the police report. Request information from the other driver(s), including their names, phone numbers, addresses, and their insurance information. If there are witnesses, obtain their contact information. Take pictures of any evidence. Write down details of the accident right away. You will forget important facts if you wait till you have time. Save receipts for all immediate expenses, such as medical bills and towing fees. File a claim with your insurance company as soon as you get home. Contact the other driver’s insurance company if they are at fault. Write down and follow all instructions from both insurance companies. Include the police report, details of the accident, and photographs with your claim. Arrange to meet with the claims adjuster. A claims adjuster investigates insurance claims to determine the extent of damages and repairs the insurance company will cover. Your insurance company may have preferred garages for auto repairs. You can choose your own auto shop but be aware that the insurance company may not approve the full repair costs even if they are below the limit.

Research your own state’s financial responsibility law.

- Determine whether auto insurance is mandatory in your state.

- Determine whether your state is a no-fault state.

- If so, identify the minimum insurance coverage requirement.

- List other items that are not required by law in your state that you would add to your own policy.

Factors Affecting Your Auto Insurance Premiums

The coverages and limits are only some of the factors that affect your insurance premium. Personal factors play an important role. Insurance companies look at your age, driving record, how much you drive, where you live and work, and even your credit score. Premiums for young drivers under age 25 are usually very high. Speeding tickets and other traffic violations will increase your premiums significantly and a DUI (Driving Under the Influence) offense can more than double it. Consumers with poor credit scores may pay twice as much as consumers with excellent credit scores. Students can get a discount for good grades. Insurance companies often offer discounts for purchasing multiple insurance policies, such as more than one car or combining homeowner or renter insurance. Notice in Figure 8.3 that the biggest discounts are Good Driver discount and Multi-vehicle discount. Other common discounts include safe driver discounts or for belonging to a group, such as alumni of a university. Some companies offer a discount if you agree to install a monitoring app on your phone, which allows insurance companies to have access to your driving habits. When evaluating insurance options, be sure to investigate all available discounts and whether the intrusion to your privacy is worth it.

The year, make, and model of the car will obviously have a significant impact on the premium. Insurers evaluate a car’s average repair costs, accident rates, and theft rates. While the repair costs are usually related to the value of a car, the other two factors may vary greatly. For example, a four-door car is usually cheaper to insure than a two-door car. You may be surprised to find that the insurance premium for a cheaper car may be higher than a more expensive car! Another factor that can affect your insurance premium is the amount of deductible. The higher the deductible, the lower your premium. A higher deductible means you have higher out of pocket costs.

Your budget, net worth, and emergency funds can help you decide on the amount of auto insurance coverage you need. In addition to three to six months of living expenses, your emergency fund should be sufficient to cover the deductible amount. If the insurance payout (i.e. the limit amount) is less than the actual costs, the injured party can potentially sue you for the remaining amount. Your bank accounts, home, car, wages, and even retirement accounts may be at risk, depending on your state’s specific laws. Consider purchasing sufficient insurance coverage so you would not lose all your money and your home in case of an accident. On the other hand, purchasing too much insurance may signal that you have high net worth and you may become a target for lawsuits. A commonly recommended amount for liability insurance is a 100/300/100 policy, which means $100,000 per person, $300,000 per accident, and $100,000 for property damage. This level of coverage is appropriate if you own a home or have a few hundred thousand dollars in net worth. If you do not have any assets, the minimum required coverages may be right for you.

Shopping for Auto Insurance

After you have decided on the amount of coverage you need, the next step is to shop for a policy. Insurance companies are called underwriters. They underwrite the policies, collect premiums, and make assessments and payments in case of an accident. Insurance companies range from full service to barebone discount ones. Full service insurance companies have a diverse selection of policies, many optional items, and have physical office locations. Examples include State Farm, Allstate, and Liberty Mutual. They may sell their policies through exclusive agents or independent agents. Exclusive agents handle only one insurance company’s policies. Independent agents carry policies from multiple insurance companies. Premiums of policies from full service companies tend to be higher. When you have questions or experience an accident and need help with making a claim, the agent of a full service insurance company can guide you through the process. You can visit the agent in person to resolve any issues. Discount insurance companies typically do not have physical locations and conduct all businesses online or via mobile apps. They offer few policy selections and sell their policies directly to consumers instead of through an agent. Customers of discount insurance companies submit claims online or via mobile apps. If you have questions or need help, you can contact them online. Premiums, especially for policies with minimum required limits, tend to be much cheaper at these companies. Some insurance companies operate primarily online, have a range of policy selections and limited in-person services. They mostly sell their policies directly but also make them available through independent agents. Examples include GEICO and Progressive. Premiums at these companies tend to be cheaper than full service. If you or a member of your family is/was in the military, the USAA insurance is another good option. Beware of advertisements for “no deposit” auto insurance. Such policies do not exist. Legitimate insurance companies will require paid premiums before providing coverage. Many companies offer monthly payment options, making it easier for you to budget. This convenient feature may cost more. You need to decide if the higher price (or forgoing the single payment discount) is worth it.

Price is only one of many factors to consider when choosing an insurance company. Other important factors include the types of policies offered, financial stability, claim payment history, past consumer complaints, and whether you need in-person service. Each state government has a department headed by its insurance commissioner that regulates and issues licenses to insurance companies and insurance agents. This department also examines the financial health of insurance companies. In addition to state oversight, there are independent rating agencies that rate the financial strength of insurance companies. The most well known ones are Moody’s, Standard & Poor’s, A.M. Best, and Fitch. Each rating agency has its own scale that is not equivalent even when the ratings appear similar. The highest rating is usually labeled AAA, Aaa, or A++. Avoid insurance companies with ratings less than A, indicating lack of financial strength. Another useful resource is the National Association of Insurance Commissioners (NAIC, www.naic.org). It maintains a database containing the number of complaints, licensing reports, and financial overview reports. You can also file a complaint at the NAIC website if your insurance company is taking an excessive long time to process your claim or declines a legitimate claim. The J.D. Power Auto Claims Satisfaction Study provides more detailed information about customer satisfaction, not just the number of past complaints.

Obtain quotes from multiple companies before deciding on an auto insurance policy. Ask about available discounts. You may be surprised by the various types of discounts insurance companies offer. If you already have a policy, you may be able to negotiate a lower premium by presenting a quote from a competing company. Always include the cost of insurance when you are evaluating which car to buy.

Exercise 8.2 Auto Insurance Companies

In this exercise, you will research information on insurance companies. Identify two insurance companies, one that has a local office near you and one that operates mostly online.

Activities:

- Look up the financial rating from Fitch on your companies.

- Look up the financial rating from Moody’s on your companies.

- Look up the complaint history on NAIC for your companies.

Financing Your Car Purchase

The final piece of the car buying puzzle is how to pay for it. The three options are cash, auto loan, and car lease. Cash is the simplest but very few people have sufficient cash on hand to pay for a reliable car. If you plan to take out an auto loan, get a copy of your credit report before approaching a lender. Review it to make sure there is no error. If your credit score is less than prime, consider adopting some of the suggestions in Chapter 6 to improve your credit score. Credit unions and banks usually have lower interest rates than dealer-arranged financing, especially on used cars. You do not need to borrow from your existing bank. Obtain quotes from different credit unions and banks. When lenders check your credit for pre-approval, it is considered a credit inquiry and if all the inquiries occur within 30 days, it is considered a single inquiry and will not impact your credit score. When comparing the loan offers, pay attention to APR, length of the loan, prepayment option, and other terms. Get a pre-approval from a lender before going to the dealer. Having a loan pre-approval allows you to separate negotiating financing from negotiating on the price of the car. Manufacturers sometime offer low interest rates on new cars as promotions or incentives. This is a special case when the dealer-arranged financing may be a better option. Leasing is generally more expensive than buying a car. There may be unique circumstances where leasing makes sense. The key to comparing financing options is to look at the total payment over the entire loan term, not just the monthly payment. We will explore auto loan and lease in details in this section.

The two most important factors affecting the interest rate on an auto loan are the length of the loan and your personal financial status including your income, debt level, and credit score. Recall from Chapter 6 that lenders often look for a debt payment-to-income ratio (DTI) of less than 35 percent when housing costs are included. When housing costs are excluded, lenders look for a DTI of less than 20 percent. Compute your DTI with the estimated monthly payment on the desired vehicles. Check that your DTI remains below lenders’ requirements. The specific car model can affect the amount lenders are willing to finance, called the loan-to-value (LTV) ratio. Lenders usually allow a higher LTV ratio on new cars than on used cars. The LTV ratio determines the amount of down payment you must come up with. A typical LTV ratio is 80 percent or lower. This means that lenders are willing to lend up to 80 percent of the car’s value. If you purchase a $30,000 car, you can borrow $24,000, implying you need a $6,000 down payment. Manufacturers sometimes offer promotions or incentives in financing terms for new cars. Such promotions may include lower interest rates and/or higher LTV ratios. You may have heard advertisements promoting zero down payment, which means the manufacturer is offering a 100 percent LTV ratio. In addition to down payment, you will need to pay fees and taxes up front.

As explained in Chapter 5, longer term loans tend to have higher interest rates. There are other disadvantages to a long-term car loan. First, you end up paying more in total interest payments because the loan is longer. Second, there is a greater danger of being trapped in an “upside down” situation where your loan balance is higher than what the car is worth. This is called negative equity. Remember that cars are depreciating assets. Unless you pay down the loan faster than the car’s depreciation, you can end up in such a situation. A rule of thumb is to keep car loans to less than 5 years (60 months) for new cars and less than 4 years (48 months) for used cars. Let us look at an example of two car loans with different terms.

Chris was looking at a beautiful used truck. The price was $25,000. Chris had a credit score of 700, which they had worked hard to achieve. The dealer quoted them an APR of 9 percent for a 48-month loan. With a $5,000 down payment the monthly payment came to $497.70. Chris told the dealer that the payment was $100 more than they had budgeted. Instead of negotiating on the price of the truck or finding a cheaper car, the dealer offered Chris a 72-month loan at an APR of 10 percent. The monthly payment was reduced to $370.52, well within Chris’s budget!

Between work, school, and the occasional road trips and home visits, Chris drove over 20,000 miles per year. The high mileage put a lot of wear and tear on the truck. Chris also had a minor car accident. After 3 years, the truck had over 170,000 miles and was starting to have mechanical troubles. Chris was considering getting another car. They looked up the trade-in value of the truck and found that it was worth $10,000. Chris had hoped that the trade-in value of the truck would cover the down payment for the next car. Unfortunately for Chris, with the 72-month loan, the remaining balance after 3 years was $11,483, more than the value of the truck. This means Chris was upside down on the car loan. If Chris were to trade in the truck, they would have to pay $1,483 to the lender to make up the difference. Chris would not be able to get another car at this time.

Chris shared their predicament with Sam, who reviewed the original loan offers with them. Sam showed Chris that with the 48-month loan, their total payments would be $23,889.64 ($497.70 x 48). Since the loan was $20,000, that meant the total interest payments would have been $3,889.64. With the 72-month loan, the total payments were $26,677.21 ($370.52 x 72) and the total interest payments were $6,677.21. The interest payments on the 72-month loan almost doubled that on the 48-month loan. Chris realized they were focusing on the monthly payment amount and not the total payment amount. They also did not take into account that a used truck with over 100,000 miles would not be reliable for another 6 years (72 months) without major repairs. It was another painful financial lesson for Chris but they would be better prepared the next time.

In addition to interest rate and loan terms, there are other factors to watch out for when considering a car loan. Avoid loans that have prepayment penalties. If your car loan has a prepayment penalty, it will cost you money if you trade in the car before the loan is fully paid off. You will also be penalized if you want to make extra payments toward the loan or refinance the loan at a lower interest rate. Some financing companies require credit insurance and GAP insurance as part of the loan agreement. Credit insurance pays the lender if you fail to make payments on the loan. These add-ons are common with financing companies working through dealers. GAP insurance can be much, much more expensive (hundreds of dollars more) through a dealer-arranged lender than your existing insurance company. Dealers often work with 4 or 5 different financing companies. You can ask the dealer to negotiate better financing terms on your behalf, including a lower APR and removing add-ons you do not want. The APR you negotiate with the dealer usually includes an amount that compensates the dealer for handling the financing. If you already have a pre-approved financing offer, be sure to compare the APR, loan term, and amount financed to what the dealer offers. You might decide to stick with the financing from your chosen bank if the difference is small. If you decide to go with the dealer-arranged loan, make sure that the terms are final and fully approved before you sign the contract and leave the dealership with the car. If the dealer says they are still working on the approval, the deal is not final. Wait to sign the contract, and keep your current car, until the financing has been fully approved.

Buy-Here, Pay-Here Car Dealers (BHPH)

“Buy-Here, Pay-Here” (BHPH) dealers target consumers with poor credit history. They often advertise “No Credit, No Problem.” These dealers offer financing themselves instead of through an independent lender. Their inventory includes mostly older, high mileage used cars. They advertise weekly or bi-weekly payment amount instead of cash price, making comparison shopping difficult. BHPH financing is significantly more expensive than traditional car loans. In addition to the add-ons to auto loans described in the last section, some BHPH dealers even require a tracking device to be installed on the vehicle, similar to a car title loan company. Recall that car title loans are considered predatory lending in some states.

Customers of BHPH dealers sometimes get trapped in a car nightmare cycle. Due to their age and high mileage, these cars frequently die before they are fully paid off. The BHPH dealer may offer to add the balance of the loan to the next car the customer purchases. If the customer does not have the money to pay off the loan, they may not have a choice to shop elsewhere. This often means the customer is forced to buy an even older car from the same dealer to keep the payments affordable, increasing the chances of repeating the cycle over and over.

If you have poor credit, do not assume you must go with a BHPH dealer. Some financial institutions may be willing to consider your loan application, especially if you have solid income and sufficient down payment. Try paying down some debts, such as credit cards, before applying for a preapproval. Use the tools described in Chapter 6 to improve your credit score. Getting a small car from a reputable car dealer is a better alternative than a loaded old SUV from a BHPH dealer. You may be surprised how much passenger and cargo space a 4-door hatchback compact car has. If you have had a poor credit history but have worked hard in changing your financial habits, you may consider getting a cosigner for a conventional car loan. Asking someone to cosign a loan is a huge favor. If you fail to make payments, you will affect both the co-signer’s and your credit ratings. There are also non-profit organizations focusing on providing affordable vehicles to low-income households. Examples include Vehicles For Change and Working Cars for Working Families. Explore all your options and consider seeking advice from one of the reputable non-profit credit counseling agencies described in Chapter 6.

Exercise 8.3: Sam’s Car Shopping Decision

Sam had learned that new cars depreciate quickly in the first year. At the same time, Sam wanted a reliable car. When they went car shopping, they had planned to buy a Certified Pre-Own Car (CPO) that was 2 to 3 years old with 20-30k miles. Sam got pre-approval from their credit union for a 60-month auto loan up to $30,000 at 7 percent for a new car and 10 percent for a used car. After reading a number of reviews and comparing total operating costs, Sam decided on a hybrid hatchback.

After contacting the dealer via their website, Sam obtained a written “out-the-door” quote of $29,000 for a new model and $24,000 for a 2-year old Certified Pre-Own (CPO) with 28,000 miles on it. The new car came with a 5-year manufacturer’s warranty whereas the CPO came with only a 3-year manufacturer’s warranty. The price difference of $5,000 was less than Sam expected. Sam found out that since COVID, used car prices had increased significantly.

Sam was offered a special promotional APR of 2 percent for a 60-month loan on a new car from the manufacturer. The dealer did not have any special offer for used cars and they quoted an APR of 12 percent. Sam had saved $4,000 to use as down payment. This meant that Sam would take out $25,000 in loan for the new car and $20,000 in loan for the used car. Armed with all this information Sam sat down to evaluate their options.

Activities:

- Compute the monthly payment on the CPO car. (Hint: Review how to compute monthly payment from Chapter 5.)

- Compute the total payments and total interests on the CPO car.

- Compute the monthly payment on the new car at the credit union’s APR of 7 percent.

- Compute the total payments and total interests on the new car at APR of 7 percent.

- Which car would you recommend Sam purchase based on the credit union’s interest rates?

- Explain your recommendation.

- Compute the monthly payment on the new car at the promotional APR of 2 percent.

- Compute the total payments and total interests on the new car at APR of 2 percent.

- Explain whether the lower APR changes your recommendation.

- What other additional information would you want before making a final decision?

Lease versus Buy

When you lease a car, you do not own the car at the end of the lease. Your payments are for the use of the car, like a long-term rental. That means you are paying for the car’s expected depreciation during the lease period, plus a rent charge, taxes, and fees. Even though you do not own the car, you are responsible for all repair and maintenance during the lease. The specifics of the terms and conditions are listed in the lease agreement. These include the monthly costs, the length of the lease, restrictions, additional fees, and other important items. At the end of the lease, you have the option to purchase the car at a predetermined price (called the residual value) per the lease agreement. The leasing company determines the residual value by subtracting the expected depreciation from the original price. A common restriction is a predetermined mileage limit, often set between 10,000 to 15,000 miles per year but can vary. If you exceed this limit, you will have to pay an excess mileage fee, which typically ranges from 10 to 30 cents per mile. This fee can add up very quickly. In addition, you will have to pay an excess wear-and-tear fee if the car’s condition is worse than what is considered “normal” per the lease company. This often means performing all recommended scheduled maintenance according to the manufacturer. If you do not perform these services at the dealer, be sure to keep all receipts as documentation. The car exterior needs to be free of dents, scratches, or rust and the interior stain free. If you are not careful, these excess fees can amount to thousands of dollars at the end of the lease. If you want to terminate the lease early, you will have to pay an early termination penalty. The size of the penalty depends on the number of remaining payments on the lease, depreciation of the vehicle, and excess mileage and wear and tear. If the value of the vehicle has depreciated below the residual value, you may be responsible for the difference if you end the lease early. You may also be charged administrative fees to process the early termination. The earlier into the lease, the higher the penalty. Early termination penalties can be tens of thousands of dollars.

An often cited advantage of leasing is lower monthly payments compared to buying a car with a loan. Lease payments are lower because you do not own the car. The residual value in the lease agreement has a great impact on the monthly payment amount. Generally you do not need a down payment on a lease. You need to pay the first month’s lease payment and any registration fees and taxes when you sign the lease. If the dealer suggests a down payment to reduce the monthly payment, that may be a red flag. This is because unlike a loan, any money you put down is treated as prepaid lease payments, not equity. The disadvantages of leasing include the lack of flexibility, no equity in the car, and high costs when you fail to meet any of the lease terms. A lease is less flexible because of the significant early termination penalty. People end their leases early usually due to unforeseen circumstances such as job loss, income changes, or life changes. Leasing may be an appropriate option if you want a new car every few years, not planning to own a car outright, and always drive under the mileage limit. The following example illustrates leasing versus buying a car.

Example: Pat’s Leasing Adventure

Pat was excited to go car shopping. As a newly minted nurse practitioner with more than $7,000 per month in take-home pay, Pat’s salary would allow them to own a new car for the first time. They fell in love with a beautiful brand new SUV. The dealer quoted the cash price to be $45,000 and the manufacturer was offering a special incentive of 5 percent down. Pat had excellent credit and qualified for a 60-month loan at 6 percent APR. With the special incentive, the down payment was only $2,250. Pat had sufficient savings to make the down payment and other upfront costs. The monthly payment on the $42,750 loan turned out to be $826.48, much higher than Pat expected. Sensing Pat’s sticker shock and reluctance, the dealer suggested Pat consider leasing. The dealer quoted Pat a zero percent down 3-year lease for $683.99 per month on the same vehicle, more than $140 “cheaper” than the loan payment. Pat was ready to sign on the dotted line and drove the new car home. Pat brought their roommate Sam with them as their car shopping wingman. Sam suggested Pat asked the dealer to put in writing the loan contract and the lease agreement and took them home to review. Pat took Sam’s advice.

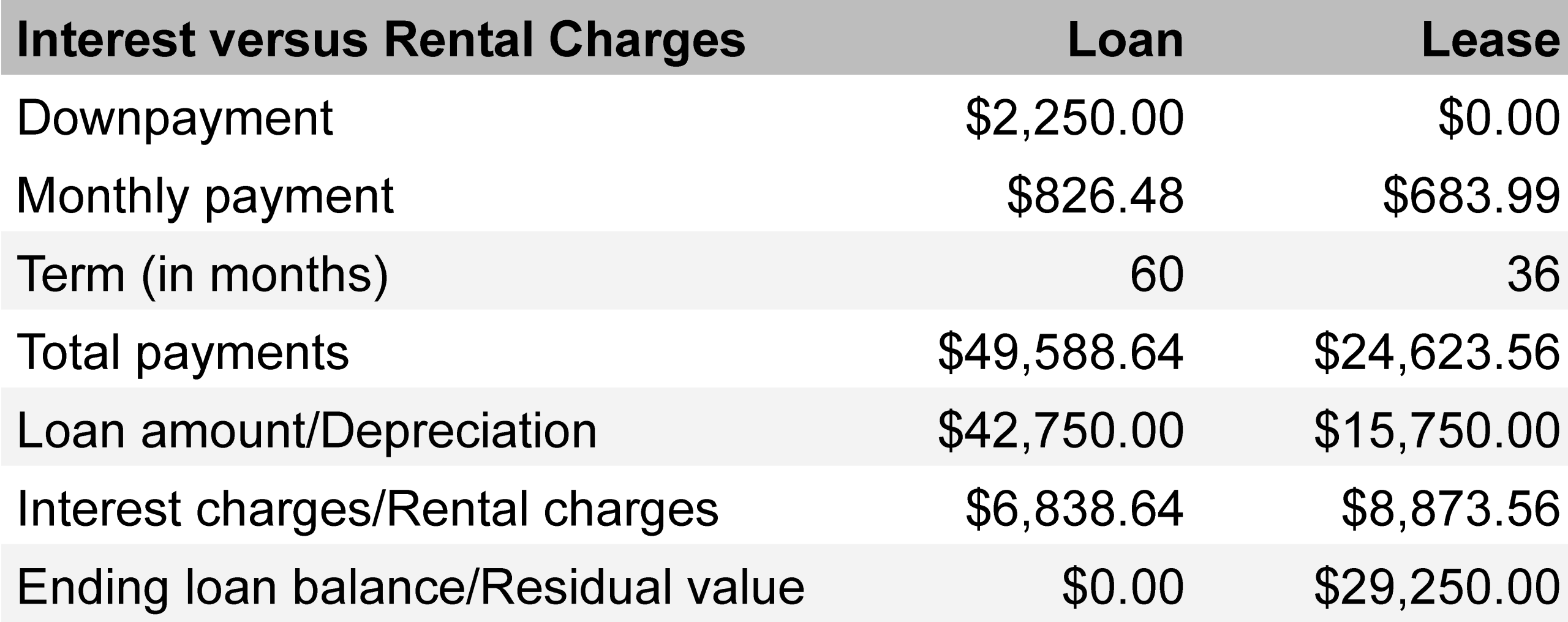

Once home, Sam helped Pat look over both documents. The car loan was through the manufacturer’s affiliated bank and did not have prepayment penalty or any add-ons. The $826.48 payments over 60 months would total $49,588.64. This meant the total interest on the $42,750 loan was $6,838.64 ($49,588.64 – $42,750).

The lease agreement contained a lot of information Pat was not familiar with. Pat wondered how the dealer was able to reduce the monthly payment by such a large amount with leasing. Sam explained that when Pat leased the SUV, they did not own it. The lease payments covered rental charges and depreciation. If Pat wanted to keep the car at the end of the lease, they would need to pay the residual value of $29,250. This implied the leasing company expected the car to depreciate by $15,750 ($45,000 – $29,250). Since the lease payments over 36 months would total $24,623.56, this meant rental charges of $8,873.56 ($24,623.56 – $15,750). The rental charges on the lease were actually higher than the interest charges on the loan (Figure 8.4).

Sam pointed out the excess mileage and excess wear and tear fees on the lease agreement. The lease allowed 10,000 miles per year with a 30 cent per mile excess mileage fee. Pat lived 45 miles from the hospital. Just the work commute would put over 9,000 miles per year on the car. Pat estimated they drove close to 15,000 miles per year. That could result in $4,500 of excess mileage fees at the end of the lease. The excess wear and tear fee depended on the condition of the SUV at the end of the lease and could range from $1,000 to $5,000. Pat realized that with the potential additional fees, the lease was not as cheap as it first appeared. A little disappointed, Pat was glad they took the time to review the options at home before signing a document they did not fully understand. Pat wanted to keep the car payment to be less than $700 per month, 10 percent of their take-home pay. That meant looking at models with fewer options. Sam suggested that Pat emailed dealers to get the quotes in writing before going to the lot next time.

Trading in Your Old Car

If you plan to trade in your old car, look up its value before going car shopping. Edmunds, KBB, and NADA Guides are good resources for finding out trade-in values. Wait to discuss the possibility of a trade-in until after you have negotiated the best possible price for your next car with the dealer. You want to be sure the dealer does not adjust the sales price of the car to make up for a generous trade-in offer. If you have a loan on your old car, find out how much you still owe. Your loan balance is available in your monthly statement. You can also look it up on the bank’s website. If your trade-in value is greater than the loan balance, you can use your equity in the car as part of your down payment on the next car. If you owe more than the car is worth, you have two options. You can pay off the difference between the trade-in value and the loan balance. In other words, you need to put more cash down. Alternatively, you can increase the loan on the next car to cover the negative equity. This will increase your monthly payment. If you are upside down on your current car, you may want to wait until you have paid down the existing loan more before shopping for another car.

A Car Shopping Game Plan

Most people find negotiating at the dealer’s showroom a very stressful experience. You can reduce that stress by having a solid game plan. You have learned all the important issues relating to car purchase in this chapter. Now is the time to put them together into practice. First and foremost, know your car budget and stick to it. Avoid accepting a longer loan term or leasing to lower your monthly payments. Do most of your car shopping research at home. Following is a suggested to-do checklist before visiting a dealer in person.

- Review your budget to determine how much car you can afford.

- Get a copy of your credit report.

- Get quotes and shop for the best auto loan deals from credit unions and banks.

- Get an auto loan pre-approval.

- Get quotes and shop for the best auto insurance policy.

- Research the trade-in value of your existing car.

- Get an “out-the-door” price for the desired cars in writing from different dealers via email. Check fees, taxes, and add-on’s. If you are shopping for used cars, confirm that a third-party inspection is allowed.

- Ask the dealers about incentives, promotions, rebates, discounts, and special prices and have them in writing.

- If you want any add-ons, get their prices in writing.

- Know your total cost, not just the monthly payment.

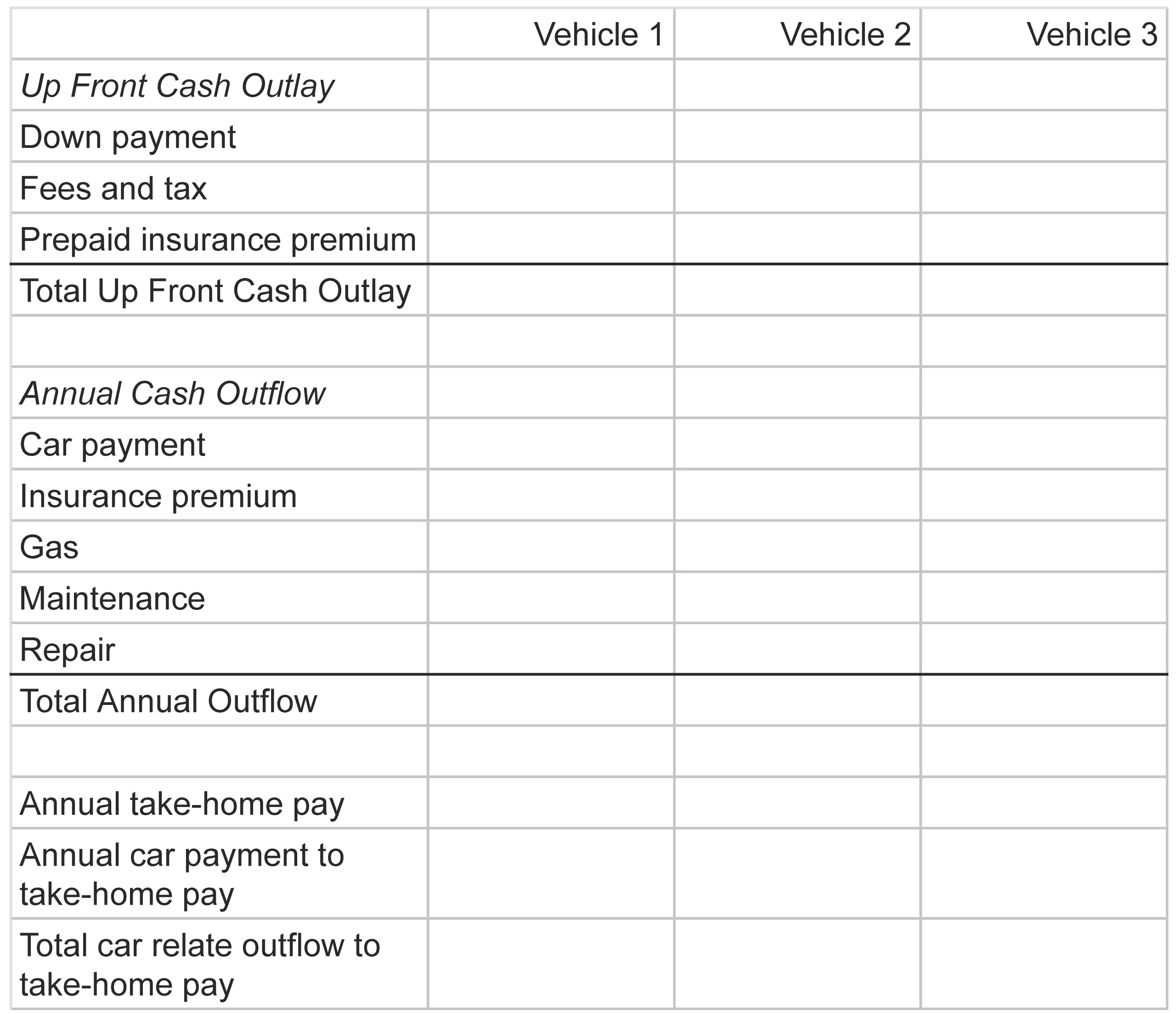

- Check the estimated car payment, insurance, fuel, maintenance and repair costs against your budget. Confirm that you have sufficient savings to cover all the upfront costs, including prepaid insurance premium. Figure 8.5 shows a sample template for comparing the feasibility of different vehicles.

When you visit a dealer, bring your loan pre-approval, the dealer’s written quotation, estimated trade-in value of your existing car. If you are shopping for a used car, arrange for a third-party inspection and bring the car’s history. Confirm with the dealer that the “out-the-door” price and all the terms in the written quotation are still valid. Test drive the car and if you are satisfied, negotiate on the trade-in. If it is a used car, get it inspected by your own mechanic.

Review the terms before you sign for the purchase and if applicable, financing. Do not be rushed. Ask the dealer to slow down, especially if they are moving quickly and only showing you the agreement on a screen, instead of in print that you can read at your own pace. Tell them you want to see the terms clearly before you agree, especially all the fees and charges in the deal. That way, you know the dealer did not include charges for any extra items you do not want. Carefully compare what you are seeing at the time of signing to what the dealer sent you beforehand. Decline any add-ons that you have decided you do not want.

If you are financing through the dealer, do not leave the dealership without a copy of the completed loan contract or lease agreement signed by both parties. Make sure you understand whether the deal is final before you leave. Occasionally customers are called back to the dealership because the financing was not final or did not go through even though they already took the car home. Do not panic if that happens. Carefully review any changes or new documents you are asked to sign. If you do not like the new terms, tell the dealer you want to cancel and ask for your down payment and trade-in back. Get confirmation from the dealer in writing that the loan application and contract have been canceled. If the loan was being arranged by a financing company, call that financing company to confirm. Keep copies of your paperwork. If you agree to a new deal, be sure you have a copy of all the documents. Such potential back and forth is why arranging your own financing directly with a credit union or bank is preferred. The dealer may initially quote you a financing offer slightly cheaper than your pre-approved loan but later it may turn out your application is declined. With a pre-approval, you can decline the dealer’s later offer and stay with your chosen financial institution.

This chapter provides you with the tools and knowledge to help you reduce the stress of car shopping and avoid expensive financial mistakes. Do not be pressured by sales tactics. You can be confident that you can always find a car that meets your needs.

Personal Financial Plan Assignment 8

Total Cost of Car Ownership

Choose a car you are interested in. Be specific about the make, model, and options. Research the cost of ownership for a new car and a 2-year old used car of the same make and model.

Activities

- Choose a website to research the total cost of ownership.

- Compare the list price of a new car and a 2-year old used car of the same make and model.

- Assume $1000 down payment, an APR of 6 percent and 5 year financing. Compute the monthly payment for a new car and a 2-year old used car of the same make and model.

- Compare the total cost of ownership: insurance, maintenance, repairs, financial, depreciation and gas (fuel) for a new car and a 2-year old used car of the same make and model.

- Assuming you can afford the monthly payments, explain whether you would purchase the new car or the used car.

Integrated Case 8

Choosing and Financing a Car

Blake Jackson closed her laptop, a huge grin on her face. She did it! She officially accepted the job offer, ready to put her knowledge and newly minted degree to work. She did not plan to make any major changes in her lifestyle right away except for her car. It had over 180,000 miles and last year the mechanic told her it would likely need major repairs to pass the next inspection. Besides, she needed reliable transportation with her new job.

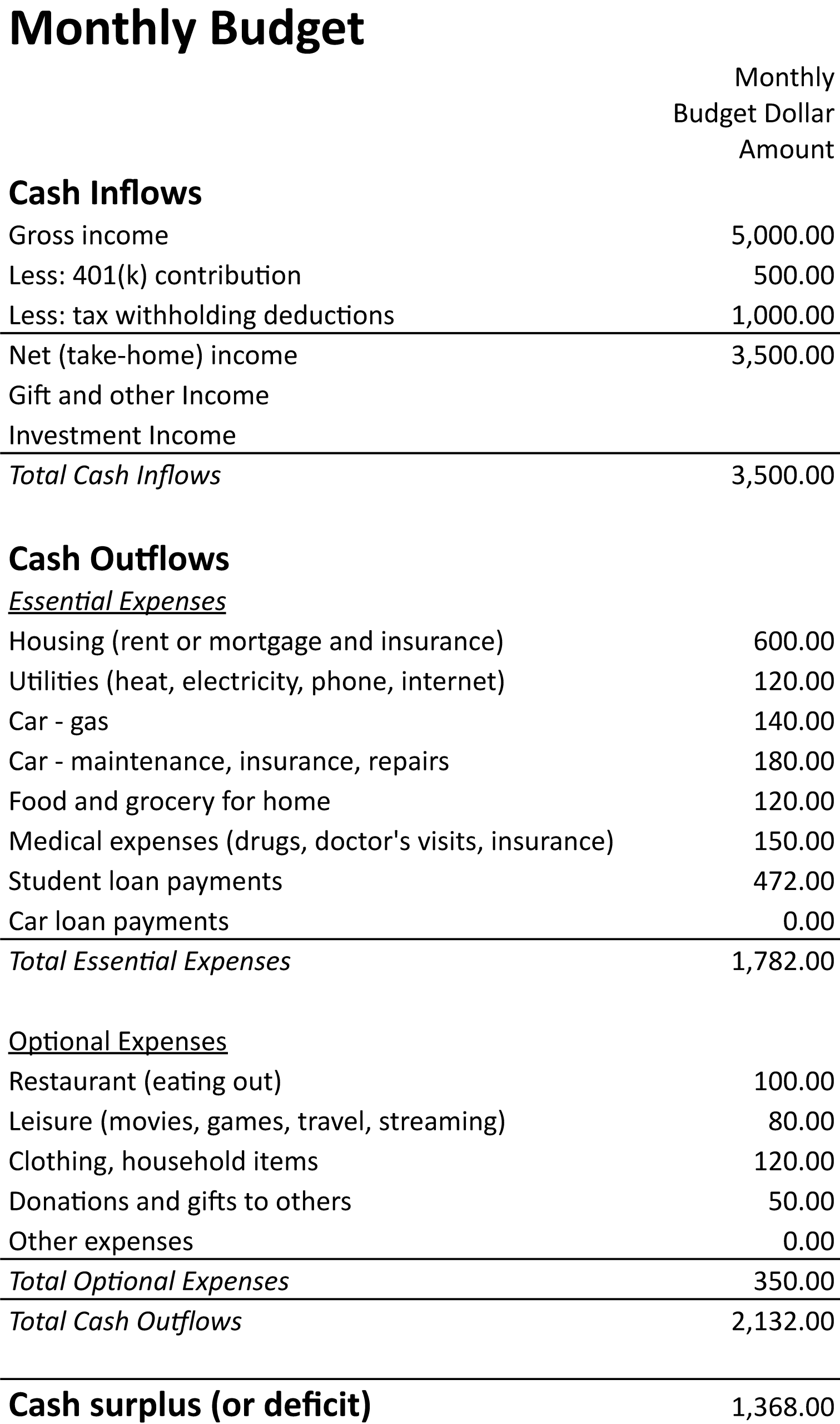

Her gross income would be $60,000 per year ($5,000 per month) before tax. She wanted to take advantage of her company’s matching program and planned to contribute 10 percent of her gross income to the 401(k) plan. Her tax withholding amounted to approximately 20 percent of gross income. She would also need to begin paying $472 per month on her student loans. Blake had not forgotten her dream to own a house one day and would like to begin saving for the down payment. Figure 8.6 shows Blake’s current monthly budget.

Blake wanted to be prepared before visiting a dealership. She planned to do most of her research online. Opening up a new spreadsheet, she set to work.

Activities

- Identify resources Blake can use to do research on her next car.

- Identify the most important types of ownership costs.

- Review Blake’s budget which was based on her old car before major repair costs. How much would you recommend Blake to budget for her next car’s total cost of ownership per month?

- Would you recommend Blake to get a used car or a new car? Explain your recommendation.

- Would you recommend Blake to lease or finance the car purchase? Explain your recommendation.

- Blake decided to finance the car purchase. Describe steps Blake should take before visiting the dealerships.

Chapter Eight Summary

This chapter provides tools and knowledge to make the car buying process manageable and help avoid expensive financial mistakes.

Understanding Affordability

- Begin by using your budget to determine how much car you can afford.

- A general rule of thumb is to keep your car payment less than 10 percent of your take-home pay.

- Additionally, the total of your car payment, insurance, gas, and regular maintenance should be less than 20 percent of your take-home pay.

- The approximate cash price you can afford can be estimated by dividing your down payment savings by the typical down payment percentage such as 20 percent.

- Consider how the car loan will affect your debt-to-income ratio.

Total Cost of Ownership

- Beyond the advertised price, always consider the total cost of ownership, which includes financing, operating, depreciation, and repair costs, as well as insurance. Opportunity costs, such as losing work or school due to an unreliable car, can also be very high.

- Operating costs encompass gas, depreciation, and routine maintenance such as oil changes, brakes, tires.

- Always ask for an “out-the-door” cash price in writing via email or in print, as advertised prices often exclude state-mandated fees and negotiable dealer fees. These can add 8 to 10 percent to the price.

- Delay discussing financing and trade-in options until you have the final “out-the-door” price for comparison.

New vs. Used Cars

- Cars are a depreciating asset, losing value over time, with the steepest depreciation occurring in the first two years for new cars.

- Pros of buying a new car include manufacturer’s warranty, the latest safety features and technology, customization options, and potential for special low-interest financing. New cars also tend to be more reliable.

- Cons of buying a new car are a higher initial price and rapid depreciation.

- Pros of buying a used car include a lower price and slower depreciation.

- Cons of buying a used car can be a lack of manufacturer’s warranty, higher maintenance and repair expenses, potential problematic car history, and higher interest rates. It may also take longer to find a used car with desired features.

- When considering a used car, research its history using its VIN at VehicleHistory.gov or Carfax.com. Find out major repair costs, and have a reliable mechanic perform a pre-purchase inspection. Refusal for inspection is a red flag.

Consumer Protection and Warranties

- Many states have “lemon laws” to protect new car buyers from substantial, unfixable defects. Some states extend this to used cars.

- Most states require “implied warranties of merchantability” for used cars, guaranteeing they will run for at least a short period.

- Manufacturer’s warranties cover basic parts and vary by time, mileage, and parts covered.

- Extended warranties (service contracts) are offered by dealers, not manufacturers. A Consumer Reports survey found 55% of owners who bought one did not use it, and those who did often spent more on the contract than they saved in repairs.

Auto Insurance

- The primary purpose of auto insurance is to protect your net worth. Most states have financial responsibility laws requiring minimum liability insurance.

- Types of Coverage:

- Liability (Casualty) Insurance: Covers payments to others for injuries and property damage you are responsible for.

- Uninsured/Underinsured Motorist Coverage: Pays for bodily injury to you and your passengers if the at-fault driver is uninsured, unidentified (hit-and-run), or has insufficient coverage.

- No-fault Insurance (Personal Injury Protection – PIP): Required in no-fault states, your own insurer pays for your injuries regardless of fault. You can still be held liable for property damages and injuries you cause.

- Collision Coverage: Covers damage to your car from an accident where you are at fault.

- Comprehensive Coverage: Insures against damage to your car from non-collision events (e.g., floods, theft, fire, hail).

- If you have a loan or lease, lenders usually require collision and comprehensive coverage.

- GAP Insurance: Covers the difference between your car’s value and your loan/lease balance if the car is totaled or stolen.

- Factors Affecting Premiums: Age, driving record, mileage, location, credit score, student discounts, multi-policy discounts, vehicle year/make/model (including repair/accident/theft rates), and deductible amount (higher deductible typically means lower premium).

- Shopping for Insurance: Obtain quotes from multiple companies. Consider financial stability, claim payment history, consumer complaints, and whether you need in-person service from a full-service insurer or prefer online discount providers.

- If you are involved in an Accident: Contact police immediately, get a police report, collect information from other drivers/witnesses, take photos, write down details, save receipts, and file a claim with your insurer promptly.

Financing Your Car Purchase

- Payment options include cash, auto loan, or car lease.

- Auto Loans:

- Get a copy of your credit report and your credit scores. Improve your score if needed, as it significantly impacts your interest rate.

- Obtain a loan pre-approval from banks or credit unions before going to the dealer; they often offer better rates than dealer-arranged financing.

- Key factors affecting interest rates are the length of the loan and your financial status (income, debt, credit score).

- Lenders consider Debt-to-Income (DTI) and Loan-to-Value (LTV) ratios.

- Avoid long-term loans as they result in more total interest and increase the risk of being “upside down”. A rule of thumb is less than 5 years for new cars and less than 3 years for used cars.

- Watch out for prepayment penalties and expensive add-ons like credit insurance or GAP insurance through dealers.

- “Buy-Here, Pay-Here” (BHPH) Dealers: These target consumers with poor credit, offer their own financing, and are significantly more expensive than traditional loans. They often advertise weekly/bi-weekly payments, making comparison difficult, and may require tracking devices. Customers can get trapped in a cycle where old, unreliable cars die before they’re paid off, leading to more expensive loans for even older cars.

- Leasing vs. Buying:

- Leasing means you pay for the car’s expected depreciation and a rent charge, plus taxes and fees, but you do not own the car.

- Advantages of leasing can include lower monthly payments (as you only pay for depreciation) and the ability to drive a new car every few years.

- Disadvantages of leasing include no equity in the car, lack of flexibility due to significant early termination penalties, and potentially high costs for exceeding predetermined mileage limits or for excess wear-and-tear. You are still responsible for maintenance, damages, and insurance.

Smart Car Shopping Strategy

- Do your homework at home to reduce stress at the dealership.

- Review your budget, get your credit report, shop for and get auto loan pre-approval, get insurance quotes, research trade-in value, and get “out-the-door” prices in writing from multiple dealers.

- Know your total cost, not just the monthly payment.

- When visiting the dealer, bring your pre-approval and written quotes. Test drive the car, and if buying a used car, arrange a third-party inspection.

- Review all terms carefully before signing, especially fees and charges. Decline unwanted add-ons.

- If financing through the dealer, ensure the deal is final and fully approved before leaving with the car.

- Don’t be pressured by sales tactics. You can always find a car that meets your needs.

- Watch out for salespersons asking “How much can you afford per month?”, offers to hold a vehicle for a small deposit, attempts to upsell features/service contracts, and efforts to lengthen the loan term to lower monthly payments.

End of Chapter Questions

- What is the general rule of thumb for your car payment relative to your take-home pay?

- What does the “total cost of ownership” of a car include, beyond the advertised price?

- Why is it important to ask for an “out-the-door” cash price in writing from car dealers?

- List the advantages and disadvantages of buying a new car.

- List the advantages and disadvantages of buying a used car.

- What steps should you take when considering a used car before purchasing it?

- Why are extended warranties (also called service contracts) generally not recommended for the average consumer?

- What does liability (casualty) insurance cover in an auto accident?

- What is “no-fault” insurance (Personal Injury Protection – PIP)?

- Explain the difference between collision coverage and comprehensive coverage.

- What is GAP insurance?

- Name three personal factors that can significantly affect your auto insurance premiums.

- Why is it advisable to obtain a loan pre-approval from banks or credit unions before visiting a car dealership?

- What is a major financial risk associated with taking out a long-term car loan such as 72 months?

- What are “Buy-Here, Pay-Here” (BHPH) car dealers, and why are they generally considered a poor financing option?

- List the advantages and disadvantages of leasing a car.

- What is a recommended strategy to reduce stress when car shopping at a dealership?

- What are some “red flags” to watch out for from salespeople at a car dealership?