4 Personal Taxes and Financial Planning

Chapter Four Learning Objectives

- Understand the roles of taxes in a society.

- Identify major types of taxes.

- Calculate taxable income and the amount owed for federal income tax.

- Identify resources for tax preparation and tax strategies.

- Incorporate tax strategies in your financial plan.

- Tariff and personal finance.

Benjamin Franklin once said “…in this world nothing can be said to be certain, except death and taxes.” Whether or not you love working on taxes (in which case you have a bright future as a Certified Public Accountant), or loathe and avoid taxes like the plague, we all have to deal with it. A recent study by Benzarti and Wallossek (2024) found that the majority, 77 percent, of taxpayers they surveyed considered tax filing to be tedious though it only took approximately 4 hours on average to complete. On a scale of 0 to 100, with 0 being very complex and 100 being not complex at all, study participants rated the U.S. tax system to be around 31 to 33, in other words, relatively complex. If you do not consider tax a fun topic, you are not alone. The truth is that tax filing is more a tedious task than a complicated one and you do not need to be intimidated. There are many tools, from free and paid tax software, trained volunteers, to professional tax preparers to help you. The goal of this chapter is to provide you with a basic understanding of the U.S. individual tax system so you can prepare your own taxes or be an informed consumer of tax preparation services. Knowledge of some basic tax laws will improve your personal financial plan.

Why are There Taxes?

Taxes are the primary source of revenue for any government, from the U.S. Federal Government to small local towns, and from capitalist to communist countries. Taxation provides a way for a large number of individuals to pool their money to pay for certain services and goods. People are willing to pool their money because these goods and services are important for the well-being of everyone. These items are best provided by the government due to the free-rider problem, where it is difficult or impossible to prevent individuals from benefiting, even if they have not paid for it. There is no incentive for private firms to provide these goods and services because they cannot force individuals to pay. Economists call these public goods. Public goods are a cornerstone of any functional society, as they are commodities or services that are available to all members of the public, and their use by one individual does not diminish their availability to others. President Lincoln recognized the importance of public goods and services and the government’s role in providing them when he said “The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves – in their separate, and individual capacities” (Basler 1953). Classic examples of public goods include national defense, policing, firefighting, street lighting, public libraries, and public parks. In today’s information economy, many basic research endeavors such as mapping the human genome (DNAs) are funded by the government. The cost and scale of these projects are beyond any individual or company and the results being used by one individual does not diminish their availability to others. Pharmaceutical companies use the results from the Human Genome Project to develop new drugs and medical treatments and consumers have access to new cures. Public goods benefit the society as a whole.

Exercise 4.1: Public goods

- List at least 3 public goods and services from local and federal governments that you use regularly.

- How much are you willing to pay for them?

- Are you able to afford it if you have to pay for the entire costs?

Is Taxation Fair?

The government can provide public goods through taxation, as it can collect tax revenue from all members of the society. This ensures that everyone contributes to the cost of public goods because everyone benefits from them. Structuring these contributions lead to the question of fairness. Should everyone contribute equally? Or should those with more resources contribute more? Should there be provisions that ensure people can afford the basic necessities such as housing and food before having to pay taxes?

Exercise 4.2: Fair taxation

- How would you define a fair share of taxes?

- On a scale of 0 to 10, with 0 being completely unfair and 10 being completely fair, how would you rate the U.S. federal tax system?

- Provide reasons for your rating.

Farrar et al. (2020) identified three primary dimensions of tax fairness. The first dimension is how income or wealth is related to taxes, which addresses the fairness of the tax system. The second is whether taxpayers receive government services equitable to taxes paid, which addresses how tax revenues are spent. The third dimension measures the administration of the tax collection process, which relates to how tax laws are enforced.

Fairness in taxation is important. More accurately, perception of a fair tax system is important because fairness is in the eyes of the beholder. One of the triggers for the revolutionary war that led to the founding of the United States was taxation without representation. At the federal level, all taxes must be approved by Congress and then signed into laws by the president. At the state and local levels, taxes often require approval by voters directly. Studies (Marshall et al. 2024) found that taxpayers are more likely to comply with tax laws when they perceive the taxation system as fair and tax revenues are used on goods and services they value. In fact, Nathan et al. (2024) found that taxpayers are willing to pay more in taxes if they believe that others are contributing their fair share. It is quite common for taxpayers to vote in favor of higher property tax to purchase a new fire engine or upgrade school buildings. Interestingly, Eriksen and Fallan (1996) found that increases in tax knowledge lead to increased perceived fairness in taxation and seriousness of tax evasion.

Taxation Systems and Fairness

The three common forms of taxation systems are: progressive, flat, or regressive. In a progressive tax system, higher income earners pay a higher percentage, not just dollar amount, of their income in taxes. In other words, tax rates become progressively higher with higher income. The U.S. federal income tax is an example of a progressive system. In a flat tax system, everyone pays the same percentage of their income in taxes, regardless of income level. Examples of a flat tax system include many state and local income tax and the Medicare tax. In a regressive tax system, lower income earners pay a higher percentage of their income in taxes. Sales tax is an example of a regressive tax system because lower income taxpayers spend a larger percentage of their income on purchases compared to higher income taxpayers. Most people consider a regressive tax system unfair.

Forms of Tax Systems

- In a progressive tax system, higher income earners pay a higher percentage of their income.

- In a flat tax system, everyone pays the same percentage of their income in taxes, regardless of income level.

- In a regressive tax system, lower income earners pay a higher percentage of their income in taxes.

Taxes, Government Policies, and Fairness

In addition to using tax revenues to fund public services, governments often use tax as a tool to implement other policies. They can use tax credits, which are like discounts on your taxes, as incentives to promote specific goals. For example, President Bush signed the Energy Policy Act of 2005 establishing energy efficiency tax credits for purchasing appliances that meet certain energy efficiency requirements. The goal of this policy is to encourage taxpayers to reduce energy consumption. President Obama made permanent the American Opportunity Tax Credit, which provides tax credits for college students. The goal of this policy is to have an educated workforce for the country. Taxes are sometimes used as deterrents against activities that negatively affect public health. Examples include taxes on cigarettes and alcohol. Since each president and congress often have different policy preferences, tax laws undergo continuous changes with additions and deletions to various parts.

It is easy to conflate dislike about a particular policy with unfairness. Let us use a lunch group as an analogy. One day the group decided to get pizza for lunch even though you and a few others in the group preferred burger. You were somewhat unhappy about the decision but you would not think it was unfair because you and fellow burger lovers had a chance to voice your preference. You would hope that next time the group would go for burgers. You might even find that you enjoyed the pizza a little. Perhaps the group would eventually find a place that served both pizza and burger. Since the U.S. is a representative democracy, citizens have the opportunity to express their preferences on government policies through voting.[1] Unfortunately, sometimes taxpayers’ perception of whether the government services they receive is fair relative to taxes paid may be affected by whether they like the specific government policies and spending priorities.

Tax Loopholes and Fairness

Some tax laws may appear incoherent and difficult to understand due to special tax provisions (tax loopholes) created to benefit a small selected group of taxpayers. These provisions are not part of an overall policy. One example is Carried Interests (McCaffery and Jones, 2024). Carried Interests are performance bonuses earned by partners of private equity, venture capital, and hedge funds. Unlike other performance bonuses, Carried Interests earned by these partners are subject to a lower tax rate. It is important to distinguish tax loopholes that do not serve any purpose from tax codes that are designed to promote specific government policies. Use the following questions to identify tax loopholes:

- Does the tax code relate directly to a stated government policy or does the rationale seem convoluted?

- Does the tax treatment on similar incomes or expenses apply to all taxpayers or just a limited group of individuals?

Tax loopholes are legal and their sole purpose is to avoid or reduce taxes. The public’s perception of the tax system’s fairness is negatively impacted by tax loopholes that benefit only a small number of wealthy taxpayers. As noted in an earlier section, taxpayers are more likely to comply with tax laws when they perceive the tax system as fair. The existence of tax loopholes may lead to less compliance and lower tax revenues.

How Well Does the IRS Perform?

The mission of the IRS is “to provide America’s taxpayers top quality service by helping them understand and meet their tax responsibilities and to enforce the law with integrity and fairness to all.” In a 2024 survey, 35 percent of respondents said they were very satisfied, 40 percent said they were somewhat satisfied, and 10 percent said they were not satisfied at all with their personal interaction with the IRS. In the same survey, 68 percent of respondents agreed with the statement, “I trust the IRS to fairly enforce the tax laws as enacted by Congress” and 63 percent trusted the IRS to help them understand their tax obligations. From 2020 to 2021, the IRS estimated total true tax liability to be $4,565 billion, of which $3,877 billion was paid voluntarily and on time, about 85 percent. IRS audits resulted in $63 billion in additional tax revenue. Uncollected tax (called net tax gap) was $625 billion. A study (Boning et al 2024) estimated that $1 spent auditing taxpayers above the 90th income percentile generates more than $12 in tax revenue, while audits of below-median income taxpayers yields $5. In addition to direct revenues from an audit, the study estimated that after an initial audit a taxpayer is more likely to comply in the future and this deterrence effect produces at least three times more additional revenue. Even though more audits can reduce the net tax gap and generate more revenue, your chance of being audited is very low, especially if you make less than $400,000. From 2013 through 2021, the IRS audited only 0.44 percent of individual tax returns.

Are Tax Laws Complicated?

The first thing to remember about tax laws is that they change frequently and some items, such as deduction amounts and income limits, are updated each year to account for inflation. The Internal Revenue Service (IRS) is responsible for administering tax laws and collecting federal taxes. The IRS also provides a lot of valuable and useful information for taxpayers on their website (www.irs.gov), including the most up-to-date tax forms and instructions. They even have a phone service you can call if you have questions. Secondly, even though the entire set of tax laws is complicated, specific tax codes governing individuals whose primary source of income is wages and salary are relatively straightforward. This chapter provides a clear step-by-step guide to calculate basic federal taxes.

Types of Incomes and Taxes

Though the tax laws and tax forms are written in English, they are anything but plain. The IRS and tax professionals use a lot of jargon and acronyms. Let us first demystify these vocabularies. The IRS distinguishes earned income, which includes wages, salaries, tips, bonuses, commissions, and most forms of employer compensation, from other forms of income. The reason for this distinction is because only earned income is subject to Social Security taxes and Medicare taxes levied under the Federal Insurance Contributions Act (FICA). These FICA taxes are unique because employers are required to pay half of these taxes. Self-employment income is income earned working for oneself as a sole proprietor or independent contractor, including full-time and part-time gigs. Another form of income that warrants more explanation is capital gain. Capital gain (or loss) is defined as the difference between the selling price and purchase price of an asset, such as a house, a stock, a mutual fund, or a business. When you receive money from selling an asset, you do not pay tax on the entire selling price, just the capital gain. If you sell an asset at a loss, you do not pay any tax on the sale. In fact, you may be able to use the loss to reduce your taxes. Long-term capital gain applies to assets that have been held for more than one year and is subject to a different, usually lower, tax rate than other income. Investment incomes include interest income from bank accounts and bonds, dividend income from stocks and mutual funds, and rental property income. Passive incomes are incomes from business activities that you do not manage or actively participate in. Other forms of income may include prizes, awards, and gambling winnings. One exception is gift income. Receivers do not pay tax on gifts received, donors of the gifts do.

Types of Income

- Earned income

- Wages, salaries, tips, bonus, commissions, and most forms of compensation from employers.

- Self-employment income

- Sole proprietorship, independent contractor, gig work, may be full-time or part-time.

- Capital gain (loss)

- Capital gain (loss) = selling price of an asset – purchase price of an asset.

- Long-term capital gain applies to assets held over one year.

- Investment incomes

- Interest income, dividend income, rental property income.

- Passive income

- Incomes from business activities that you do not manage or actively participate in.

- Other incomes

- Prizes, awards, gambling winnings.

Taxes can be applied to income, property, and purchases. Income tax is the most common type of tax and applies to earned income, investment incomes, capital gains, passive income, and prizes from gambling and competitions. Income tax exists at the federal, state, and sometimes local levels. Property tax varies by state and town and can apply to houses, automobiles, boats, motorcycles, and sometimes even personal property. Estate (Inheritance) tax is taxes paid on inheritance passed from one generation to the next. Unlike income or property taxes, estate tax is paid only once in a lifetime. The federal estate tax has a high exemption amount, which changes each year. You can find out the latest estate tax exemption amount from the IRS website or use the search term “federal estate tax exemption”. The exemption amount is the amount to be excluded before any tax is applied. For example, if the exemption amount is $13 million and the estate is worth $15 million, the estate tax will apply to $2 million ($15 million – $13 million). Any inheritance less than the exemption amount will not be taxed. The Tax Policy Center estimated that only about 4,000 estates were taxable in 2023, less than 0.2 percent of people expected to die that year. Some states also have inheritance taxes in addition to the federal estate tax. Gift tax is paid by the donor, the person giving the gift. There is an annual exclusion amount below which gifts are not subject to tax. This exclusion amount changes each year and is higher than most ordinary gifts. As an example, the annual gift exclusion for 2024 is $18,000 per person. Therefore unless you spend more than $18,000 in gifts to a single person, you do not have to worry about paying gift tax.

Sales tax on purchases varies by state. The U.S. does not have a national sales tax on goods and services. Some states have sales tax as high as 9 percent or more, while others have none. Many states also tax hotels and restaurant meals. These taxes can sometimes be a surprise to consumers, especially tourists, because they are not included in the listed prices. Excise taxes are levied on specific goods like alcohol and gasoline, and are state specific.

Exercise 4.3: Sales Tax

- Look up the top 5 states with the highest sales tax.

- Look up states with no sales tax.

- Do your findings surprise you? Explain your reactions.

Social Security and Medicare taxes are different from other forms of taxes because these taxes are tied directly to specific individual benefits. Established by the Federal Insurance Contributions Act (FICA), these taxes perform like insurance premiums. Social Security taxes provide for income and Medicare taxes provide for hospital care due to old age or disability. Medicare taxes are 2.9 percent of earned income, with the employee paying 1.45 percent and the employer paying 1.45 percent. There is no exemption amount for Medicare taxes. There is a cap which limits the amount of income subject to Social Security taxes. This limit changes each year. All earned income below the limit is subject to Social Security tax of 12.4 percent, with the employee paying 6.2 percent and the employer paying 6.2 percent. For self-employment income by gig workers, independent contractors, and sole proprietors, the taxpayers must pay the entire Social Security (12.4 percent) and Medicare (2.9 percent) taxes.

Calculating Social Security and Medicare Taxes

Social Security and Medicare taxes are a form of flat tax and the calculation is very straightforward. For earned income, Medicare tax for the taxpayer equals earned income multiplied by 1.45 percent. Social Security tax equals the minimum of earned income or social security taxable limit multiplied by 6.2 percent. For self-employment income from gig or independent contractor work, the taxes would be doubled. The following cases illustrate how to compute these taxes. The first case demonstrates a taxpayer with earned income below the social security limit. This is the most common scenario. In the second case, the earned income exceeds the social security limit and the third case shows how FICA taxes are computed for self-employment income. Notice that the taxpayers in case 1 and case 3 took in the same amount of income but the self-employed taxpayer paid double the amount in FICA taxes.

Example: Social Security and Medicare Taxes

Earned income limit and FICA tax rates for the current year:

- Earned Income Limit for Social Security = $168,600

- Medicare tax rate = 1.45 percent for earned income, 2.9 percent for self-employment income

- Social Security tax rate = 6.2 percent for earned income, 12.4 percent for self-employment income

Case 1

- Earned income = $65,000

- Medicare tax = $65,000 x 0.0145 = $943

- Social Security tax = minimum($65,000,$168,600) x 0.062 = $65,000 x 0.062 = $4,030

Case 2

- Earned income = $260,000

- Medicare tax = $260,000 x 0.0145 = $3,770

- Social Security tax = minimum($260,000, $168,600) x 0.062 = $168,600 x 0.062 = $10,453

Case 3

- Self-employment income = $65,000

- Medicare tax = $65,000 x 0.029 = $1,886

- Social Security tax = minimum($65,000,$168,600) x 0.124 = $65,000 x 0.124 = $8,060

Types of Taxes

- Income taxes (federal, state, and local)

- These are the most common. If you earned wages, interests, dividends, or prizes you pay income taxes at the federal, state, and sometimes city/town level.

- FICA taxes

- Medicare taxes (federal)

- Medicare taxes are 1.45 percent of your earned income (another 1.45 percent paid by your employer.

- Social Security taxes (federal)

- Social Security taxes are 6.2 percent (another 6.2 percent paid by your employer).

- Maximum income subject to SS taxes changes every year.

- Note for self-employed and gig workers: you pay all the Medicare (2.9 percent) and Social Security (12.4 percent) taxes.

- Medicare taxes (federal)

- Property taxes (state and local)

- Vary by state and town. Most states have property taxes on houses and automobiles. Some states impose property taxes on other personal properties.

- Sales tax

- Excise tax

- Tax on specific goods and services such as alcohol, gas.

- Estate tax (also known as inheritance tax)

- Federal estate tax

- Only estate beyond the lifetime exemption amount is subject to tax.

- In 2023, 0.2 percent of estates (4000 total) had to pay estate tax.

- Some states also have estate (inheritance) tax.

- Federal estate tax

- Gift tax

- Paid by the donor (the person giving the gift).

- Each gift below the annual exclusion amount is not taxed.

Filing Status

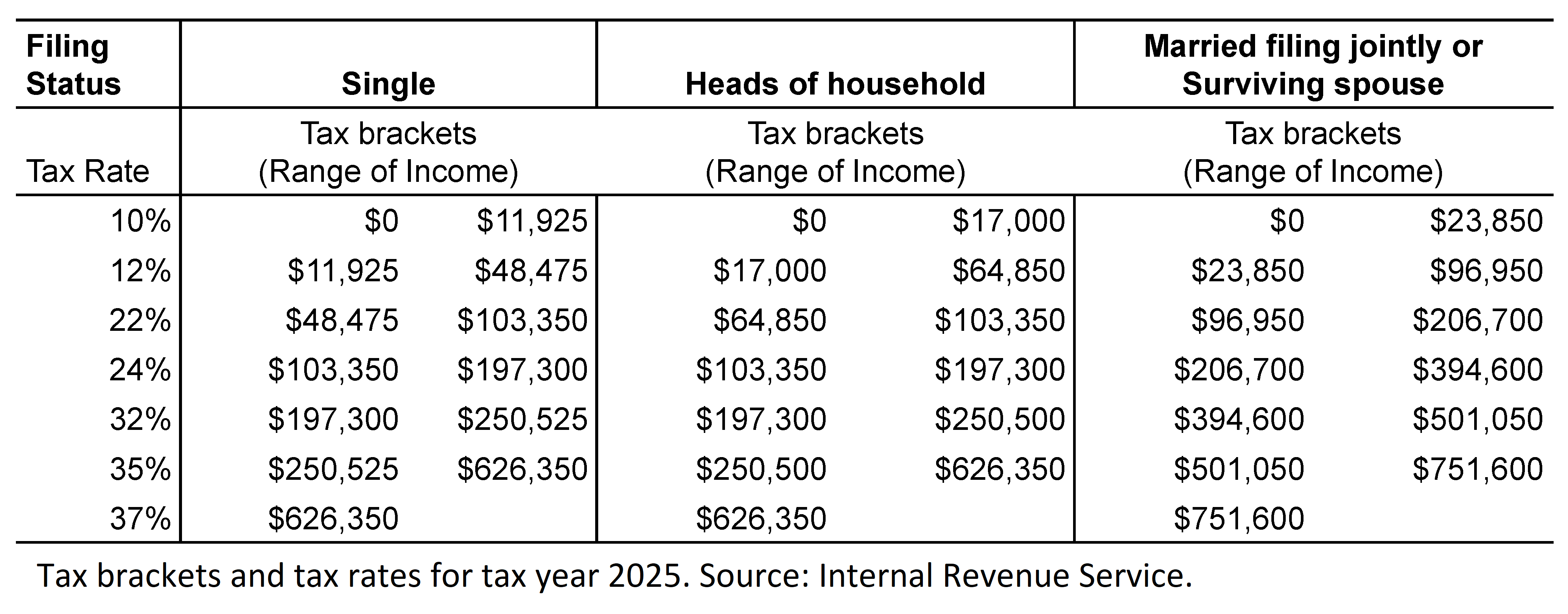

As noted in the previous section, the U.S. federal income tax is a progressive system, which means higher incomes are taxed at a higher tax rate. In addition, the system takes into account the burden of living expenses on the taxpayers by designating five different filing status:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying surviving spouse with dependent child

The rationale is that different filing status reflects different responsibilities. A taxpayer with a single status has no dependents and is only responsible for one’s own living expenses. Head of household is an unmarried individual with one or more dependents and therefore higher living expenses. The filing status is important because it affects the federal income tax rate and the deduction amount. The IRS provides detailed definitions for each status on their website. They also have an interactive tool to help you determine your filing status. Use the search term “filing status” in the search box on the IRS website. If more than one status applies to you, you can choose the one that will give you the lowest tax. Married couples usually combine their income and file a joint return. There are special circumstances, such as a couple considering divorce, or one spouse suspecting the other of tax evasion, that make married filing separately a better option. Another case that may make sense to file separately is if one spouse makes a lot more money and the lower income spouse can reduce their income-based student loan payment amount by filing separately. Even if your parents or someone else claims you as a dependent, you may still have to file a tax return. Use the search term “filing requirements for dependents” on the IRS website to find out the latest requirements.

Personal Financial Plan Assignment 4: Filing Status

Determine your filing status using the IRS interactive tool. Go to the IRS website (www.irs.gov). Search for “filing status” in the search box on the IRS website.

Here is a video to help you.

Withholding and Estimated Tax Payments

Federal taxes are “pay-as-you-go”, which means that taxpayers need to pay most of their taxes during the year, as they receive income, not at the end of the year. There are two ways to satisfy the pay-as-you-go requirement. One is through withholding and the other is through quarterly estimated payments. Insufficient withholding or underpayment of estimated taxes may result in penalties.

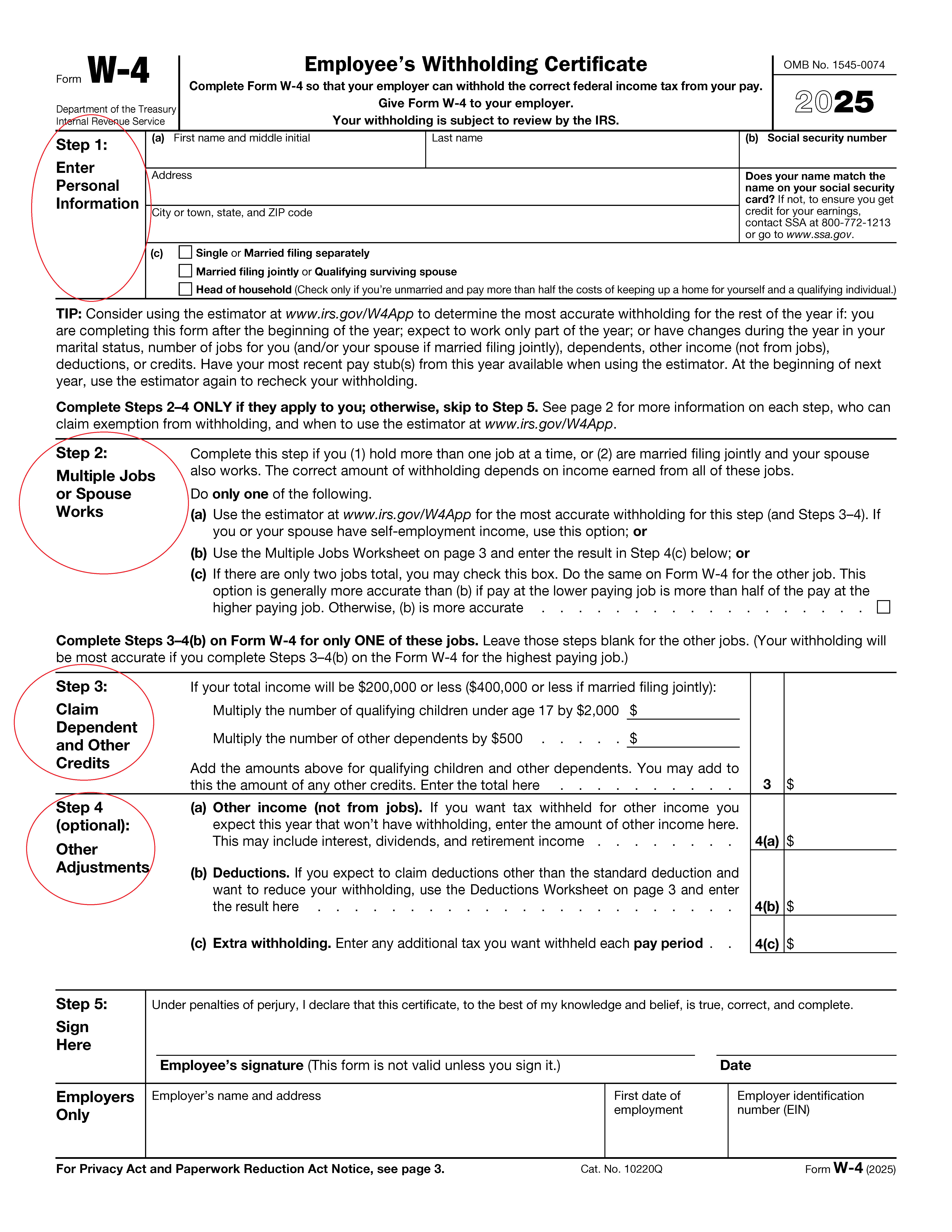

Earned income is usually subject to withholding, which means that employers estimate taxes on behalf of the employees and send estimated federal income tax, Social Security tax, and Medicare tax payments to the federal government directly each pay period. The amount of withholding is determined based on information filled out by employees on the Withholding Certificate, commonly known as Form W-4 (Figure 4.1) The first step to decide is your filing status as explained in the last section. In the second step, check box (c) if you have more than one job or if you are married filing jointly and your spouse works. Otherwise leave the boxes blank. You only need to complete step 3 if you have dependents. If earned income is your primary source of income, use box (a) in step 4 to include other income, such as investment income or self-employment income. Be sure to do this on the W-4 for only one job, the one with the highest pay. If your other income is high relative to the earned income from the job, skip step 4 and you will need to make estimated tax payments separately by yourself. If your state has an income tax, you will need to fill out a similar form to withhold state taxes. The employer will send estimated state tax payment to the state for you. Federal and state withheld taxes are the most common deductions on a paycheck.

When you start a new job, you will be asked to fill out Form W-4 along with other employment documents. You should fill out a new Form W-4 when there are changes to your filing status or number of dependents, such as getting married, divorced, or having a child through birth or adoption.

Making Estimated Tax Payments

If your primary source of income is from investment or self-employment such as gig work, you will need to pay estimated taxes on your own, once each quarter. The payment dates are April 15, June 15, and September 15 of each year and January 15 the following year. As an example, for the tax year 2025, you will need to complete an estimated tax return for individuals (Form 1040-ES) and make the first quarterly payment on or before April 15, 2025, followed by payments on June 15, 2025 and September 15, 2025. The last quarterly payment will be on January 15, 2026. Preparing estimated taxes essentially means you have to file taxes twice, the first is the estimation and the second is the actual tax return (Form 1040). In the above example, the estimation is filed on April 15, 2025 and the regular return will be filed on April 15, 2026. The steps for completing the estimated return are similar to those for completing a regular return and we will explain these in the next section. If you expect your self-employment income to be similar from year to year, you can use numbers from the most recent tax return for the estimated return. Continuing with the example, you could use information from the 2024 return (Form 1040) to complete the estimated tax return for 2025 (Form 1040-ES) and file both on or before April 15, 2025. If your income changes significantly you will need to increase subsequent quarterly payments to avoid penalty. You can make estimated payments using the IRS Direct Pay service online or send a check with a payment voucher (Form 1040-V). Other payment options, for which the providers charge a service fee, include debit and credit cards and digital wallets.

Computing Federal Income Taxes

Understanding Adjusted Gross Income, Deductions, and Taxable Income

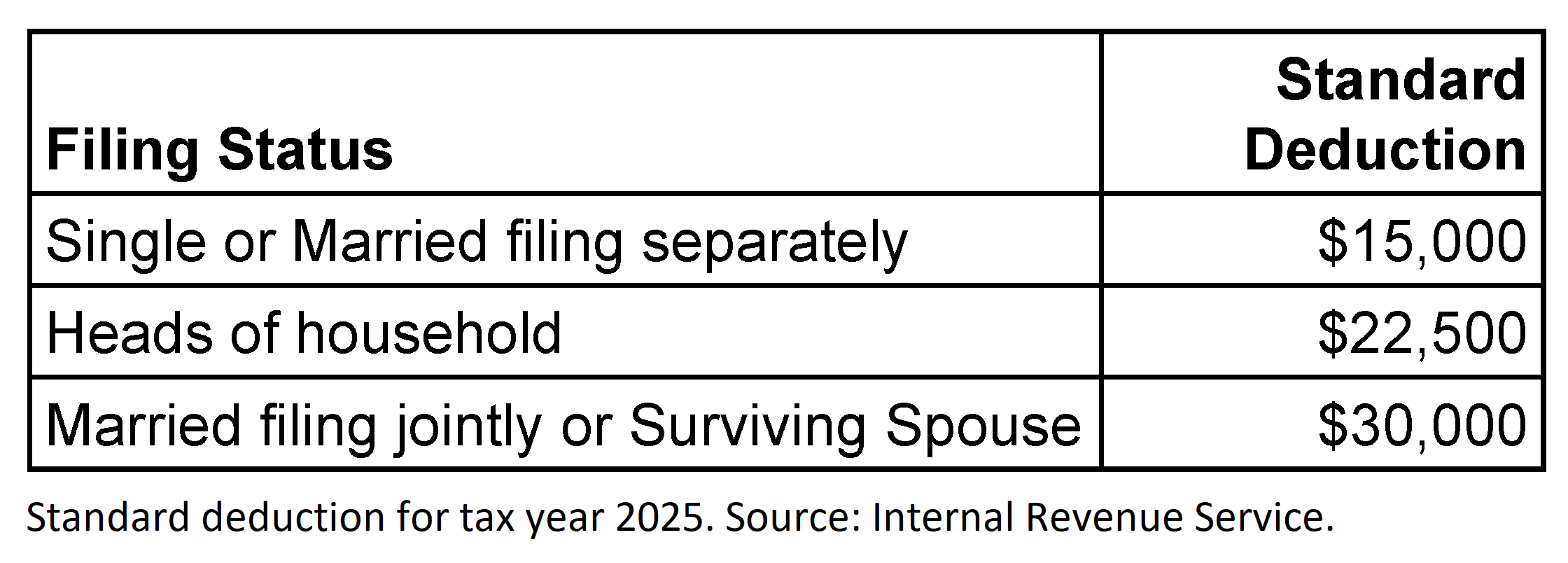

This section outlines a step-by-step process for calculating individual federal income tax. The first step is to compute gross income, which includes all sources of income. The second step is to determine exemptions and exclusions. Exemptions are incomes that are not taxed by the federal government. A common example is interest income from bonds issued by states or municipalities. All incomes, including capital gains, on certain accounts such as Roth IRA and 529 College Savings Plan, are also tax exempt. We will discuss these investment options in detail in a later chapter. Some incomes are tax deferred and excluded from the current year’s income tax. Examples include contributions to qualified retirement accounts such as 401k, 403b, or traditional IRA. You do not pay income tax on these contributions in the current year. When you withdraw money from these retirement accounts, you will pay income tax at that time. Therefore, income used for these contributions are tax deferred. Another common exclusion is interests on student loans. You can deduct up to $2,500 in student loan interests provided your income is below the income limit. Adjusted gross income (AGI) equals gross income less exemptions and exclusions. The tax laws allow taxpayers to deduct certain expenses before assessing income tax. The standard deduction is a flat amount for each filing status and applicable to all taxpayers. The deduction amount is higher for filing status with dependents than for single taxpayers to reflect higher living expenses necessary to support the dependents. The standard deduction amounts change each year to account for inflation. For example, in 2025 the standard deduction for single filers was $15,000 and for heads of household was $22,500. Figure 4.2 shows the standard deductions for each filing status for 2025. Under certain circumstances, such as large medical expenses or mortgage interest payments, taxpayers may choose itemized deductions to get a higher deduction. Itemized deductions requires the taxpayer to list and document expenses that are tax deductible. No documentation is needed for the standard deduction. Taxable income is defined as adjusted gross income minus deductions.

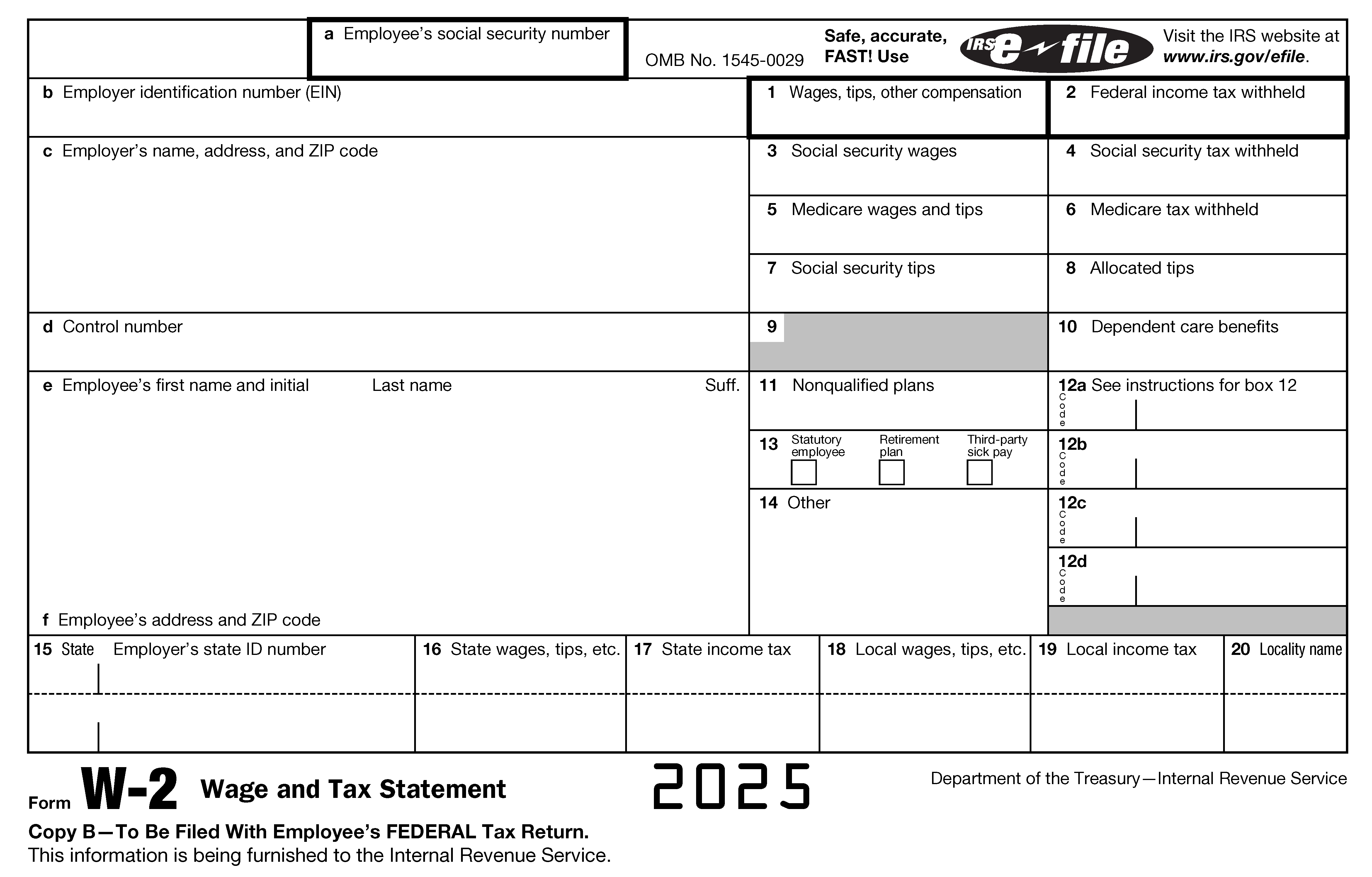

The most time consuming and tedious part of preparing taxes is collecting tax documents related to income and, if taking itemized deductions, receipts. Each employer is required to provide information on earned income and tax withholdings to the IRS and to its employees on the Wage and Tax Statement, Form W-2 (Figure 4.3). All other incomes are reported on one of the Information Returns (1099s). Most common examples of information returns include Form 1099-INT for interest earned, Form 1099-DIV for dividends earned, Form 1099-NEC for nonemployee compensation, and Form 1099-MISC for various types of income such as prizes, awards. You should also document other income earned but not reported to the IRS, such as lawn mowing, house cleaning, or pet sitting. Incomes that are tax exempt are reported on the respective forms. For instance, tax exempt interest earned are reported on Form 1099-INT along with other interest income. Contributions to tax deferred retirement accounts, such as an Individual Retirement Account (IRA), are reported on IRA Contribution Information (Form 5498). Student loan interests are reported on Form 1098-E. Employers and financial institutions are required to send these forms to the IRS and to taxpayers by the end of January or February so taxpayers have sufficient time to prepare their tax returns. To make things easy for yourself, have a dedicated folder for storing all these forms as they arrive so that when it is time to do your taxes, all these documents are already in one place. If you choose to have your documents delivered electronically, create a digital folder and download the forms to it. You can also take pictures of the forms and store them in a digital folder. Organization is the key to simplify your tax preparation.

If you take the standard deduction, no documentation is needed. If you take itemized deductions, you should have receipts for each item. The most common deductions are mortgage interests, state and local taxes including real estate property tax, charitable donations, and medical expenses. Mortgage interests are reported on Form 1098. Note that only interest on the first $750,000 of the mortgage is tax deductible. State and local taxes deduction is currently capped at $10,000 total, including all income and property taxes. Charitable donations can be in the form of cash or property and the deduction is limited to 50 percent of the donor’s adjusted gross income. Receipts for donations should be provided by the charitable organizations. Unreimbursed medical and dental expenses greater than 7.5 percent of the taxpayer’s adjusted gross income are tax deductible. The specific amounts and percentages indicated above are effective under the current tax laws as of 2025.

We will use two examples to illustrate how to compute adjusted gross income, deductions, and taxable income. The first example is Jordan, a 24 year-old living on their own. The second example is a married couple Maya and Isis.

Example: Determining adjusted gross income and taxable income for Jordan

Jordan is 24 years old and shares an apartment with a roommate. Last year, their earned income from Form W-2 was $65,000. They received $2,000 as graduation gifts from their parents. Jordan paid $1,500 in interest on student loans.

Determining Gross Income:

Jordan’s earned income of $65,000 was taxable. The graduation gift was not taxable. Therefore, gross income is $65,000.

Determining Adjusted Gross Income (AGJ):

The income limit for student loan interest deduction was $80,000 for that year. Since Jordan’s earned income was below the limit, student loan interest of $1,500 was deductible.

Adjusted Gross Income (AGI) = $65,000 – $1,500 = $63,500.

Determining Deductions: Jordan decided to take the standard deduction, which was $15,000 that year. No documentation or calculation is needed to take the standard deduction.

Determining Taxable Income:

Taxable income = AGI – standard deductions = $63,500 – $15,000 = $48,500.

Example: Determining deductions and taxable income for Maya and Isis

Maya West and Isis Khan are married and decided to file their tax returns jointly. Earned income for Maya was $65,000 and for Isis was $73,000 last year based on information from their W-2 forms. They also received a Form 1099-INT showing they received $2,000 in interest income and they contributed $7,000 to an IRA.

Maya and Isis owned a house with a mortgage balance of $350,000. They paid $21,000 in mortgage interests last year. They also paid state tax and real estate property tax totaling $12,800. When they chose their insurance plan, they decided on a high deductible option. Unfortunately, Maya was diagnosed with early stage cancer. Though the treatment was successful, they had medical bills of $15,000 not covered by their health insurance.

Determining Gross Income:

All of Maya and Isis’s incomes were taxable.

Gross income = $65,000 + $73,000 + $2,000 = $140,000

Determining Adjusted Gross Income (AGJ):

Contributions to IRA are tax-deferred.

Adjusted Gross Income (AGI) = $140,000 – $7,000 = $133,000

Determining Deductions: The standard deduction for married couples filing jointly was $30,000 for that year. Let us compare that to itemized deductions for Maya and Isis.

Mortgage interest:

Since their mortgage amount was less than the $750,000 limit, they could deduct the entire $21,000 in mortgage interests.

State income and property taxes:

Their state and property tax of $12,800 was greater than the $10,000 cap, they could only deduct $10,000.

Medical expenses:

Medical expenses greater than 7.5 percent of AGI are tax deductible. Their AGI was $133,000. The exclusion amount = $133,000 x 0.075 = $9,975. Their medical expenses were $15,000. Therefore, the amount of medical expenses that could be deducted = $15,000 – $9,975 = $5,025.

Total itemized deductions = Mortgage interests + Allowable state and property taxes + Deductible medical expenses = $21,000 + $10,000 + $5,025 = $36,025.

Since the itemized deduction amount of $36,025 was greater than the standard deduction of $30,000, Maya and Isis should itemize their deductions.

Determining Taxable Income:

Taxable income = AGI – deductions = $133,000 – $36,025 = $96,975

Understanding Tax Brackets, Marginal Tax Rate, and Average Tax Rate

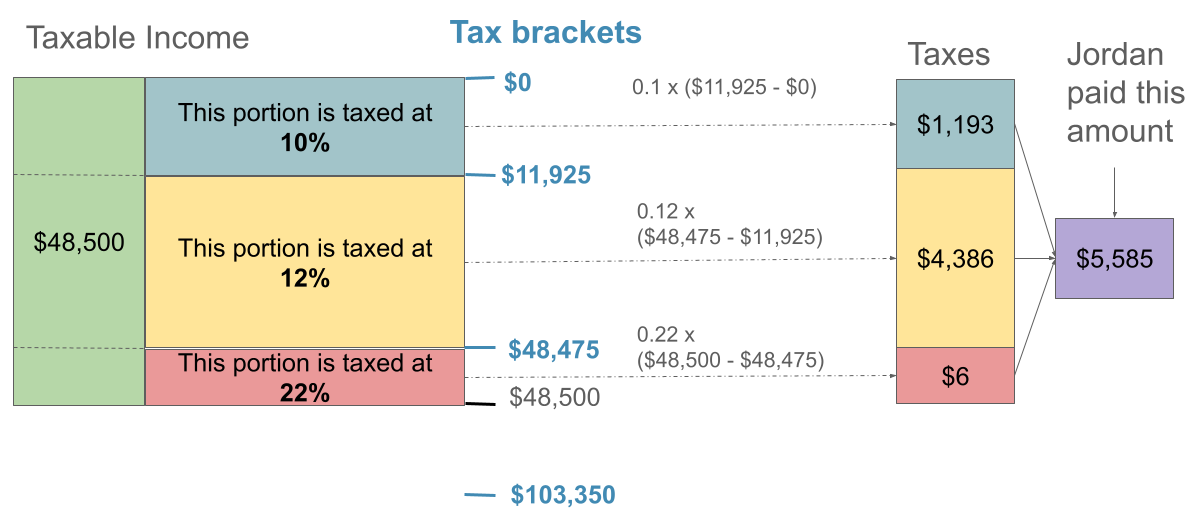

As noted earlier in this chapter, the U.S. federal income tax is a progressive system, with higher tax rates for higher incomes. This system is implemented by separating taxable income into tax brackets with income in each bracket taxed at a different rate. When your income jumps to a higher tax bracket, you do not pay the higher rate on your entire income. You pay the rate for each bracket that your income falls into. Marginal tax rate refers to the tax rate that will apply to the next dollar of income. Average tax rate is total tax paid divided by taxable income. Marginal tax rate is useful for making future decisions. For example, if you take on an extra shift, the additional take home pay will be taxed at the marginal tax rate. Average tax rate is useful for estimating total tax liabilities. For example, you can apply last year’s average tax rate to expected future income to compute estimated taxes. The U.S. federal tax system also takes into account the burden of living expenses by classifying taxpayers into different filing status. Each filing status has different income brackets. Figure 4.4 shows the tax rates for three filing status in 2025, which range from 10 percent to 37 percent. Let us revisit Jordan’s case to demonstrate how the progressive tax rates and tax brackets work.

Example: Computing federal tax for Jordan

Jordan had taxable income of $48,500 in 2025 with a filing status as single. From Figure 4.4, we see that $48,500 falls in the 22 percent tax bracket, which applies to income between $48,475 and $103,350. The marginal tax rate for Jordan was therefore 22 percent. However, the entire taxable income of $48,500 was not taxed at 22 percent. Figure 4.5 illustrates how taxable income is divided into tax brackets. The first $11,925 of taxable income was taxed at 10 percent. The amount of taxable income between $11,925 and $48,475 was taxed at 12 percent. Only the last $25 of the taxable income ($48,500 – $48,475) was taxed at 22 percent.

Total tax and average tax rate are calculated as follows:

Total tax = 0.1 ($11,925 – $0) + 0.12 ($48,475 – $11,925) + 0.22 ($48,500 – $48,475) = $5,585.

Average tax rate = $5,585 / $48,500 = 0.1151 = 11.51 percent

Example: The value of itemized deductions to Maya and Isis

In the previous section, Maya and Isis found that their itemized deductions totaled $36,025, which was higher than the standard deduction of $30,000. How much is the additional $6,025 in deduction worth to them?

The adjusted gross income for Maya and Isis was $133,000. If they used the standard deduction of $30,000, their taxable income would be $103,000 ($133,000 – $30,000). If they used the itemized deduction, their taxable income would be $96,975 ($133,000 – $36,025). Both amounts of taxable income fall in the 22 percent tax bracket for married couples filing jointly in 2025. This means the marginal tax rate for Maya and Isis was 22 percent. By increasing their deduction by $6,025, Maya and Isis would reduce their tax paid by $1,326 ($6,025 x 0.22).

Computing Federal Income Tax

- Gross Income:

- Earned Income: Wages, Commissions, tips etc.

- Investment Income: Interest, dividend, rental income etc.

- Passive Income: Income from

- business you do not manage.

- Short-term and Long-term Capital Gain: profit from investing.

- Exemptions and Exclusions: Exemptions and exclusions reduce gross income to arrive at Adjusted Gross Income (AGI). Tax exempt income is not taxed. Tax deferred income is not taxed in the current year but will be taxed at a later time.

- Adjusted Gross Income (AGI): AGI is defined as gross income minus exemptions and exclusions.

- Deductions: These are allowances for living expenses.

- Standard Deductions: A fixed amount based on filing status, disability, and age.

- Itemized Deductions: Individual expenses that can be deducted, including charitable donations, medical expenses, mortgage interest, real estate property tax, and state and local income tax. There are limits (caps) or exclusions for some of these expenses.

- Taxable Income: Taxable income is defined as AGI minus deductions.

- Tax Brackets and Tax Rates: The US federal income tax system is progressive, meaning higher income brackets are taxed at higher rates.

- Marginal Tax Rate: The tax rate applied to the next dollar of taxable income (i.e., the tax bracket you are in).

- Average Tax Rate: Total tax paid divided by taxable income.

Tax Credits

Tax credits directly reduce the amount of tax owed. In contrast, tax exemption and deductions reduce taxable income and the amount of tax savings depends on the marginal tax rate of the taxpayer. For example, an individual has a 22 percent marginal tax rate and tax liability of $2,500. In this example, a $1,000 tax credit reduces tax liability by $1,000, while a $1,000 deduction reduces taxable income by $1,000 and tax liability by $220 ($1,000 x 0.22).

There are a wide range of tax credits, and the amount available varies each year. Some tax credits are refundable, which means the taxpayer gets a refund even if no tax is owed. Taxpayers who qualify for refundable tax credits should file tax returns even if they do not owe taxes and are not required to file so they can claim these tax credits. Not all tax credits are refundable. For nonrefundable tax credits, once the tax liability is reduced to zero, any leftover amount would become useless. Some tax credits are partially refundable, which means taxpayers can get a percentage of the leftover amount as a refund after tax liability is reduced to zero. Most tax credits have income limits, which means taxpayers with incomes higher than the limits do not qualify for them.

A common refundable tax credit is the Earned Income Tax Credit (EITC), which is intended to help low-to-moderate income workers get a tax break. According to a report by the Congressional Research Service, 26 million taxpayers (16 percent of all taxpayers filing an individual income tax return) received the Earned Income Tax Credit in 2020 and the average credit was $2,276 per return. Other common tax credits include the American Opportunity credit and Lifetime Learning credit for college expenses, and Child tax credit and Child and Dependent Care credit. The IRS website has information for eligibility and up-to-date information on each type of tax credits.

Tax Filing and Tax Resources

Federal income tax deadline is April 15th of each year. You can file your tax return electronically or via postal mail by completing the individual federal tax form (Form 1040). If the amount of tax withholding or estimated payments is greater than the total tax liability, the taxpayer will receive a tax refund. Otherwise, the taxpayer must pay the remaining amount owed. There are many resources available to help you with tax returns, ranging from free services, free and paid software, to expensive tax lawyers.

The Volunteer Income Tax Assistance (VITA) program offers free in person help to low-to-moderate income taxpayers who need assistance in preparing basic tax returns. The IRS manages the overall VITA program and provides training materials to volunteers. Each VITA site is overseen by local volunteers. Universities and colleges, libraries, and community centers are often locations for VITA sites where you can get help. You may want to volunteer for the VITA program yourself. You will receive free training, learn how to prepare taxes, give valuable service to the community, and gain experience for yourself. Leaders at the VITA sites conduct a quality review check for every return before it is filed. In 2022, there were more than 3,200 VITA sites nationwide and prepared over 1 million tax returns.

In addition to the VITA program, the IRS also offers the IRS Direct File and the IRS Free File programs which allow taxpayers meeting certain qualifications to prepare and file federal income tax returns online. These qualifications include the amount and types of income and the types of deductions and tax credits. These programs typically do not support itemized deductions. Both programs have interactive screening questions on the IRS website to help taxpayers determine if they qualify.

The IRS Direct File program was developed by the IRS and launched in 2024. The Direct File software is unique in that it automatically imports data from various tax forms (such as W-2 and 1099s) already reported to the IRS by employers and financial institutions, eliminating the need for taxpayers to enter them manually. You should still keep a copy of the tax forms for your record. In 2025, the IRS Direct File software supports wage income (W-2), Social Security income (SSA-1099), unemployment compensation (1099-G), interest income (1099-INT), and retirement income (1099-R). Since the IRS already has this information, it does not need access to your payroll or bank accounts. The income limit to use IRS Direct File changes each year to account for inflation. In 2025 it was $200,000 for single filers and $250,000 for married couples filing jointly. The Direct File software supports a number of tax credits including Earned Income Tax Credit, Child Tax Credit, Child and Dependent Care Credit, Credit for the Elderly or the Disabled, Premium Tax Credit, and Retirement Savings Contributions Credit. It also supports standard deduction, student loan interest deduction, deduction for educator expenses, and health savings account contributions. Some states have joined the IRS Direct File program and allow taxpayers to file state taxes using the Direct File software. Since this program is run by the IRS, the information you enter is protected by the same security and privacy protocol as IRS tax data.

Unlike the IRS Direct File program, the IRS Free File program is a partnership between the IRS and a number of commercial tax software providers. Be careful when choosing an IRS Free File provider and watch out for scammers and imposters. Use the IRS website to find a legitimate provider. Do not use search engines. IRS Free File partners offer a limited version of their commercial tax software for free to qualified taxpayers. In 2025 the income limit was $84,000 and this amount changes each year to reflect inflation. The types of tax credits and deductions supported vary by software and are more restrictive than those available on IRS Direct File. It is not always easy to determine what features the free software supports. When you need a tax credit or deduction feature that is not included in the free version, the software will prompt you to upgrade to the paid version. This could be a frustrating experience. With IRS Direct File, the supported features are clearly stated.

If you do not qualify for any of these free programs, you can purchase commercial tax software or use a tax preparer. The price of commercial tax software depends on the types of income, deductions, tax credits, and the number of state returns it supports. Some software include import functions to gather data automatically from your financial institutions and payroll services. However, to use this function the software will need permission to access your payroll, bank and investment accounts. The degree of security and privacy protection varies by software provider. This is also true for IRS Free File providers who are the same companies. Some software offers an offline version that allows you to prepare the returns on your computer, instead of online. You can also choose to print out the completed forms and file via postal mail instead of e-file. These options may be valuable to some taxpayers, especially those who want more control over where and how their tax and financial data are stored.

The biggest advantage of tax software, including IRS Direct File, is the use of interview style questions to guide taxpayers through their tax returns. These questions replace the need for taxpayers to read long instructions written in legalese. Once a taxpayer gathers all tax related documents, using a tax software to complete and file tax returns is relatively easy.

If you opt to have a paid preparer do your tax returns, choose the preparer carefully and wisely because you are ultimately responsible for the accuracy of every item reported on the return. At the minimum the preparer should have a preparer tax identification number (PTIN). Only attorneys, Certified Public Accountants (CPAs), and enrolled agents certified by the IRS can represent taxpayers in case of audits, appeals, and other tax matters. Good preparers will ask to see your records and receipts. Avoid preparers who claim they can get larger refunds than others or who base their fees on the refund amount. Before hiring a tax preparer, check their history and references.

If you are unable to submit your tax returns by the April 15 deadline, you have the option to file for an extension, granting you until October 15 to complete your returns. The extension applies to the return, not tax payments. You need to make estimated payments on any amount owed by April 15 to avoid penalties. These payments can be made through the IRS website, where you can indicate that you are filing for an extension. If you are expecting a refund, you have strong incentives to complete the return as early as possible to prevent scammers from stealing your refund.

If you discover you have made mistakes on your tax returns, you can correct the errors by filing an amended return (Form 1040x). The amended return has the same items as the original return. Most tax software can generate an amended return after you enter the corrected information.

Remember that you have a multitude of resources at your disposal to assist you with tax-related matters. The IRS provides a wealth of materials, including FAQs, informative brochures and videos designed to address common taxpayer questions. Additionally, there are free services available, such as VITA (Volunteer Income Tax Assistance), IRS Direct, and IRS Free File. However, the availability of these free services is contingent upon government funding and may fluctuate from year to year.

Tax Planning Strategies

Taxes are a complex but essential part of personal finance. The amount of tax withholding affects your take-home pay. If you do not withhold sufficiently, you will have a large tax bill on April 15 and may even incur penalty and interest. You can reduce your tax by taking advantage of tax saving opportunities. Some expenses are tax deductible and you should take into account their impact on taxes in your budget and personal financial plan. Some investments are tax deferred, such as retirement accounts and health savings accounts. Returns on some investments are tax exempt, such as Roth IRA, Roth 401k, and college savings plans. Tax deferred accounts reduce the current income tax but you have to pay tax when you withdraw money from these accounts. With tax exempt investments you do not get any tax reduction today but you do not pay any tax on income and capital gain from these investments. The benefits of tax exemption often outweigh those of tax deferral, especially in the long-run.

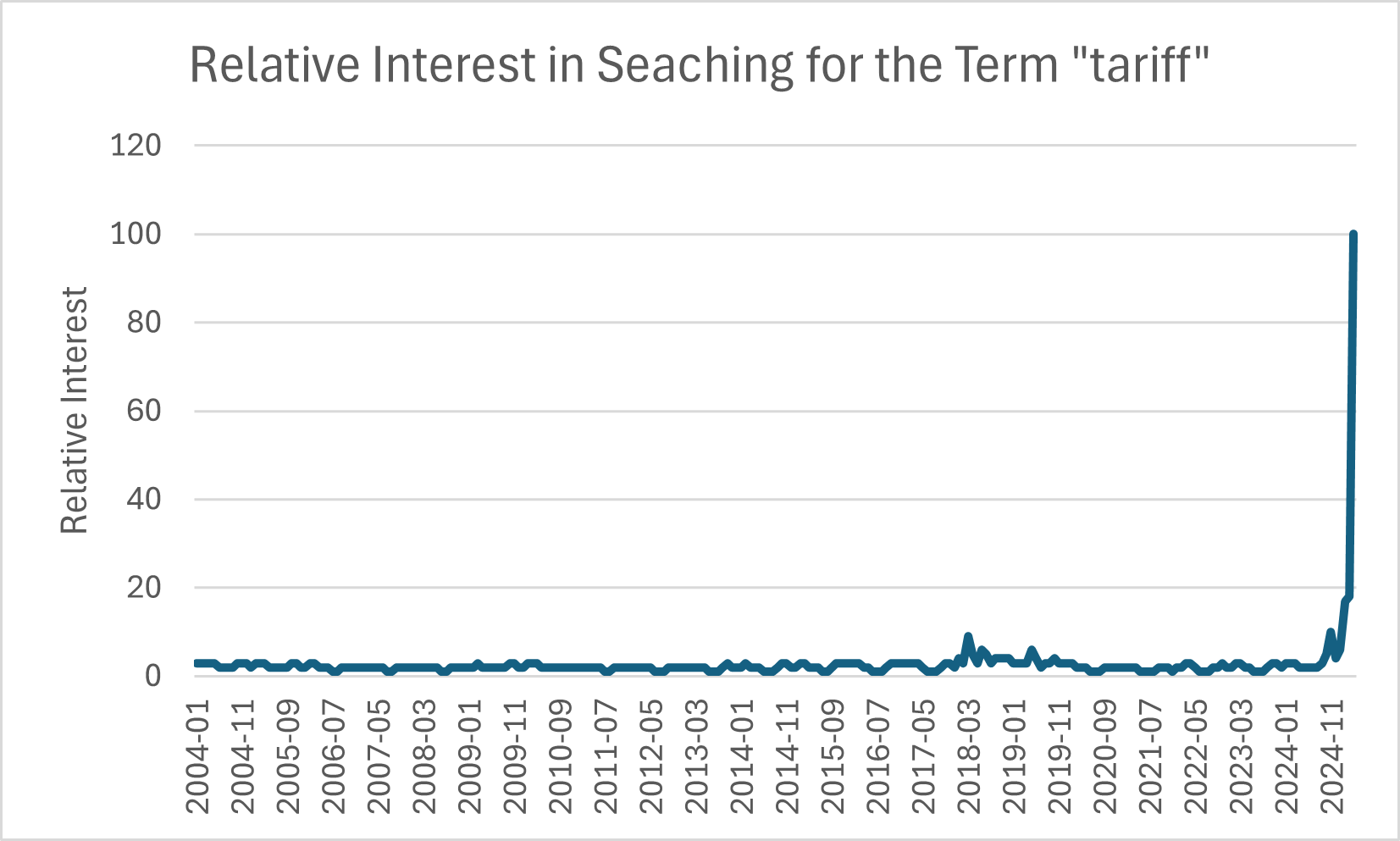

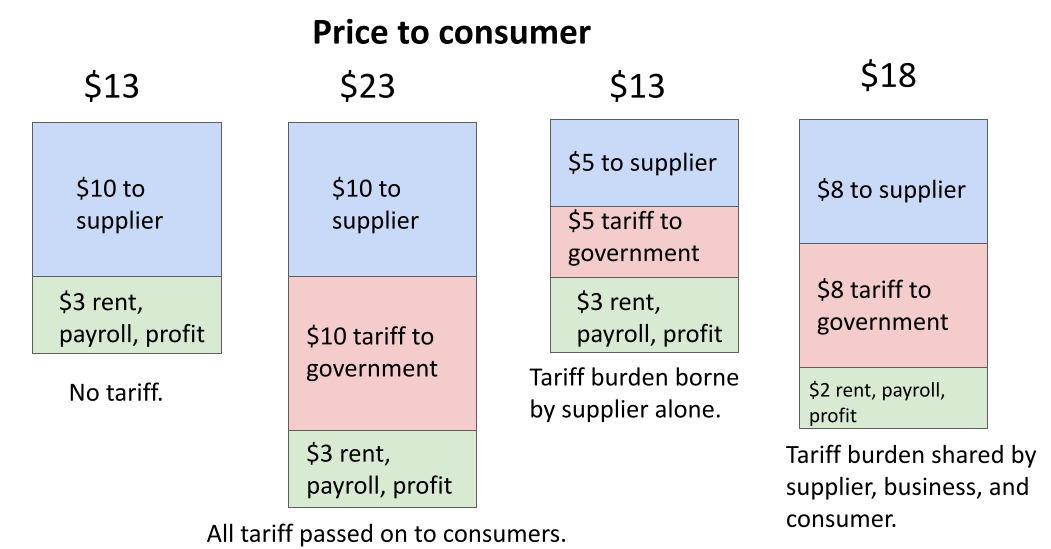

Is Tariff a Tax?

Tariff did not used to be a topic in a personal finance textbook. It belongs in an international economics or an import-export business textbook. That changed in April 2025 when President Trump declared tariffs on all countries that trade with the U.S. and sent consumers typing ‘tariff’ into search engines (Figure 4.6). In its simplest term, tariff is a purchase tax paid by businesses importing goods from another country. For example, a boutique buys t-shirts from a supplier from another country at $10 per t-shirt and sells them at $13 to its customers. The $3 mark-up covers payroll, rent, overhead, and profits to the boutique owner. If the U.S. government levies a 100 percent tariff, the boutique pays $10 ($10 x 1) to the government when the t-shirt arrives at a U.S. port. How tariffs affect the consumers depends on a number of factors. One extreme scenario is that the boutique passes the entire $10 tariff to its customers and now sells the t-shirt at $23. Another extreme scenario is that the supplier lowers the wholesale price from $10 to $5, absorbing all the burdens from the tariff. The most likely scenario includes a combination of negotiating with its supplier, taking a smaller profit, cutting payroll and other costs, and increasing prices. For instance, the supplier may lower the wholesale price to $8 to the boutique, resulting in a $8 tariff. The boutique lowers its mark-up to $2. The final price to the consumer goes up to $18.

Integrated Case 4

Tax Preparation

It is spring break and Blake Jackson wants to take the extra available time to get her taxes done. Her W-2 last year showed $20,456 in gross income with $1,893 in federal tax withholding. Her grandmother gave her $500 as a graduation present and instructed her to use the money to open an IRA account. During the summer she entered an eSport tournament and won $1000 in prize money.

Activities:

- What impact will the gift of $500 from her grandmother have on Blake’s adjusted gross income? Explain.

- What impact will the $1000 prize from the eSport tournament have on Blake’s adjusted gross income? Explain.

- What impact will her $500 IRA contribution have on Blake’s adjusted gross income? Explain.

- Compute Blake’s adjusted gross income for last year.

- What is Blake’s filing status?

- Look up the standard deduction for Blake from the IRS website.

- Compute Blake’s taxable income.

- What is Blake’s marginal tax rate?

Chapter Four Summary

This chapter provides a detailed overview of personal taxation and its role in financial planning.

Why We Have Taxes and What Makes Them Fair

Taxes are the primary way governments fund public goods and services like roads, schools, and national defense, which private companies cannot efficiently provide. The fairness of a tax system is judged by three main factors:

- The relationship between income and the amount of tax paid.

- The equitable distribution of government services funded by taxes.

- The fairness of the tax collection process itself.

Types of Tax Systems

There are three primary tax structures:

- Progressive Tax: Higher earners pay a higher percentage of their income in taxes (e.g. the U.S. federal income tax).

- Flat Tax: Everyone pays the same tax rate, regardless of income (e.g., Medicare tax).

- Regressive Tax: Lower earners pay a higher percentage of their income in taxes. Sales tax is a common example, as those with lower incomes spend a larger portion of it on goods.

Taxes are also policy tools, with tax credits incentivizing behaviors (like energy efficient appliances) and excise taxes discouraging others (like smoking).

How Federal Income Tax Is Calculated

Calculating your federal income tax is a multi-step process:

- Gross Income: This includes all your income from various sources (wages, investments, self-employment, etc.).

- Adjusted Gross Income (AGI): This is your Gross Income minus specific tax-deferred contributions (like to a 401k or traditional IRA) and other exclusions.

- Deductions: You can subtract either a Standard Deduction (a fixed amount based on your filing status) or Itemized Deductions (specific expenses like mortgage interest and large medical bills). You choose whichever is larger.

- Taxable Income: This is your AGI minus your chosen deduction. This is the amount of income your tax is actually calculated on.

- Tax Liability: Your tax is calculated using a progressive system of tax brackets. Different portions of your income are taxed at increasing rates. Your marginal tax rate is the rate applied to your last dollar of income.

- Tax Credits: These are subtracted directly from the tax you owe. They are more valuable than deductions because they provide a dollar-for-dollar reduction in your tax bill.

Paying and Filing Your Taxes

Taxes are collected on a “pay-as-you-go” basis throughout the year.

- Withholding: Employees elect to have federal income and FICA (Social Security and Medicare) taxes automatically deducted from their paychecks based on their Form W-4.

- Quarterly Payments: Self-employed individuals and those with significant investment income must make estimated tax payments four times a year.

The tax filing deadline is typically April 15th. You can file using free services like VITA, paid commercial software, or a paid preparer.

Key Tax Planning Strategies

Effective tax planning aims to legally minimize your tax liability. Key strategies include:

- Manage Withholding: Adjust your W-4 to avoid owing a large sum (under-withholding) or giving the government an interest-free loan (over-withholding).

- Utilize Tax-Deductible Expenses: Plan for expenses that can be itemized, such as charitable donations.

- Leverage Tax-Advantaged Accounts:

- Tax-Deferred Accounts: Contributions to traditional 401(k)s, traditional IRAs, and HSAs are made pre-tax, lowering your current taxable income. Taxes are paid upon withdrawal in retirement.

- Tax-Exempt Accounts: Contributions to Roth IRAs and 529 College Savings Plans are made with after-tax money, but investment growth and withdrawals are completely tax-free.

End of Chapter Questions – Chapter 4

- Explain why taxes are necessary.

- Define public goods and give three examples.

- Explain the “free-rider problem” and how taxation helps address it in the context of public goods.

- Define fairness in the context of taxation.

- Differentiate between a progressive tax system and a regressive tax system, providing an example for each.

- What are the different types of income and taxes individuals encounter?

- Explain how the “pay-as-you-go” tax system in the U.S. works.

- Briefly describe two ways taxpayers can satisfy the “pay-as-you-go” requirement for federal taxes.

- Explain the purpose of Form W-4.

- How does an individual’s filing status impact their federal income tax calculation?

- Define Adjusted Gross Income (AGI), deductions, and taxable income, and explain how they are calculated.

- Explain the difference between Adjusted Gross Income (AGI) and Taxable Income.

- Explain tax brackets, marginal tax rate, and average tax rate in the U.S. progressive tax system.

- Explain why marginal tax rate is important for making future financial decisions.

- Explain the difference between tax deductions and tax credits.

- What resources are available to individuals for tax preparation and assistance?

- What is the main distinction between a tax loophole and a tax code designed to promote a specific government policy?

- Identify two free resources available to taxpayers for preparing their federal income tax returns.

- What is a tariff?

- A discussion of the fairness of the American voting system is beyond the scope of this book. It is an important topic that warrants studying by all citizens. ↵

A free rider problem occurs when people can benefit from a public good or service without paying for it.

Public goods and services have two key characteristics. The first is that it is costly or impossible for one user to exclude others from using the good or service. The second is that one person's use of the good or service does not diminish the benefits to others.

The Cambridge dictionary defines fairness as the quality of treating people equally or in a way that is right or reasonable.

A tax system in which the average tax burden increases with income.

In a flax tax system a single tax rate applies to all taxpayers regardless of income.

A regressive tax system is one where the tax burden disproportionately affects lower-income individuals, as the tax rate decreases as income increases.

Carried interest is a share of profits from a private equity, venture capital, or hedge fund paid as incentive compensation to the fund's general partner. It is usually paid after a fund achieves a specified minimum return.