9 Purchasing, Financing, and Insuring a Home

Chapter Nine Learning Objectives

- Determine how much house you can afford.

- Evaluate different types of mortgages.

- Calculate estimated mortgage payments and amortization table.

- Understand closing costs.

- Identify important factors to consider when selecting a house.

- Understand all the steps involved in buying a house.

- Evaluate the advantages and disadvantages of buying versus renting.

- Explain the purpose and types of renter’s and homeowner’s insurance.

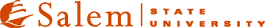

Owning your home is an American dream for many people. In the United States, around 65 percent of people owned their own homes in 2025, similar to the historic average since 1965 (Figure 9.1). Notice that the homeownership rate tended to fluctuate with economic conditions, with more people owning homes during economic expansions and fewer homeowners following recessions. This pattern of reversal was especially significant in the 2000s. From the late 1990s through the mid 2000s, the homeownership rate accelerated to historic heights during the housing bubble. When the bubble burst in 2007, followed by the great recession in 2008 and unprecedented number of home foreclosures, the homeownership rate plummeted.

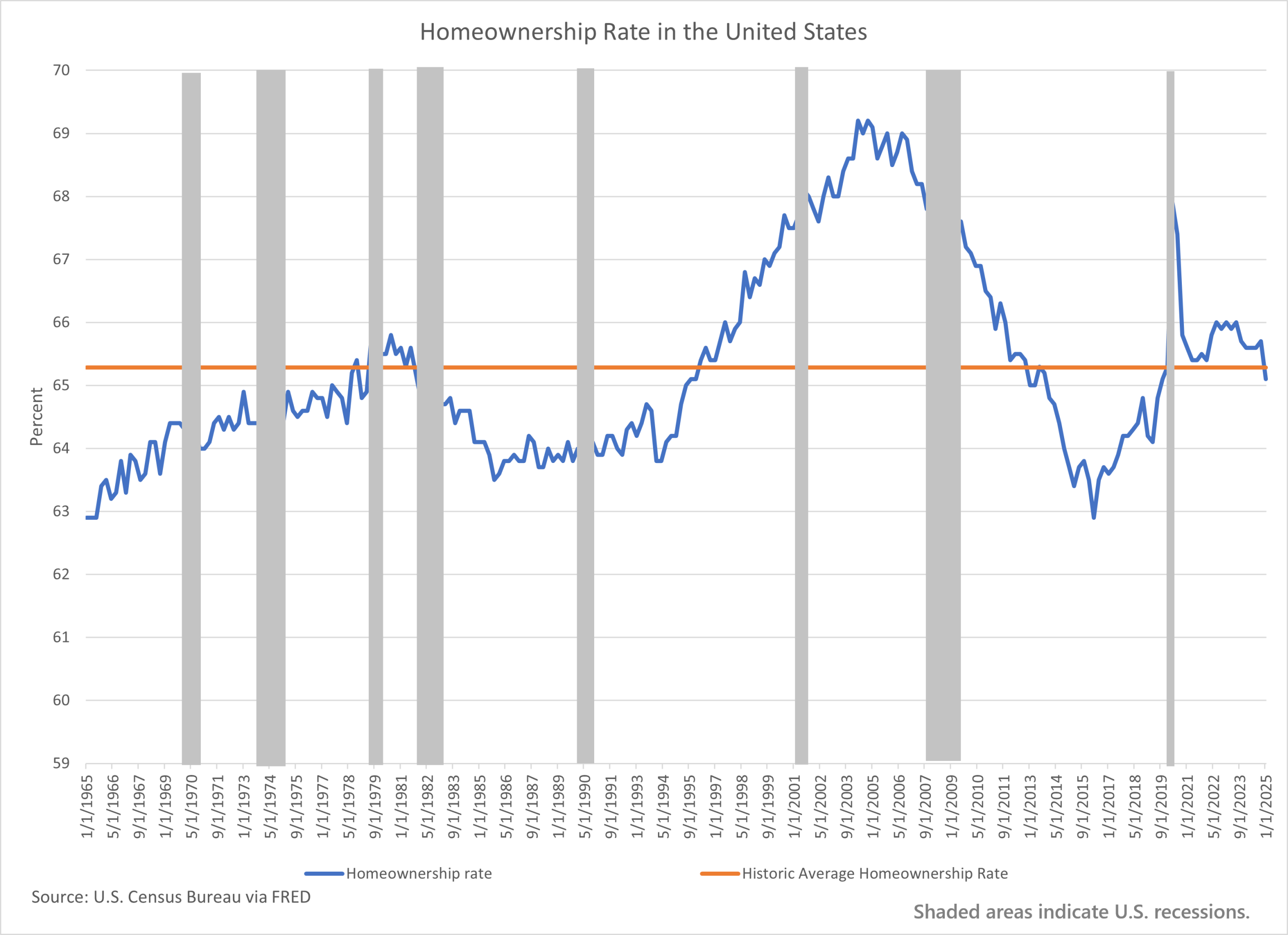

Homeownership patterns also vary greatly by geographic region and by race. Homeownership rates in the Midwest and the south consistently exceeded those in the west and the northeast (Figure 9.2).

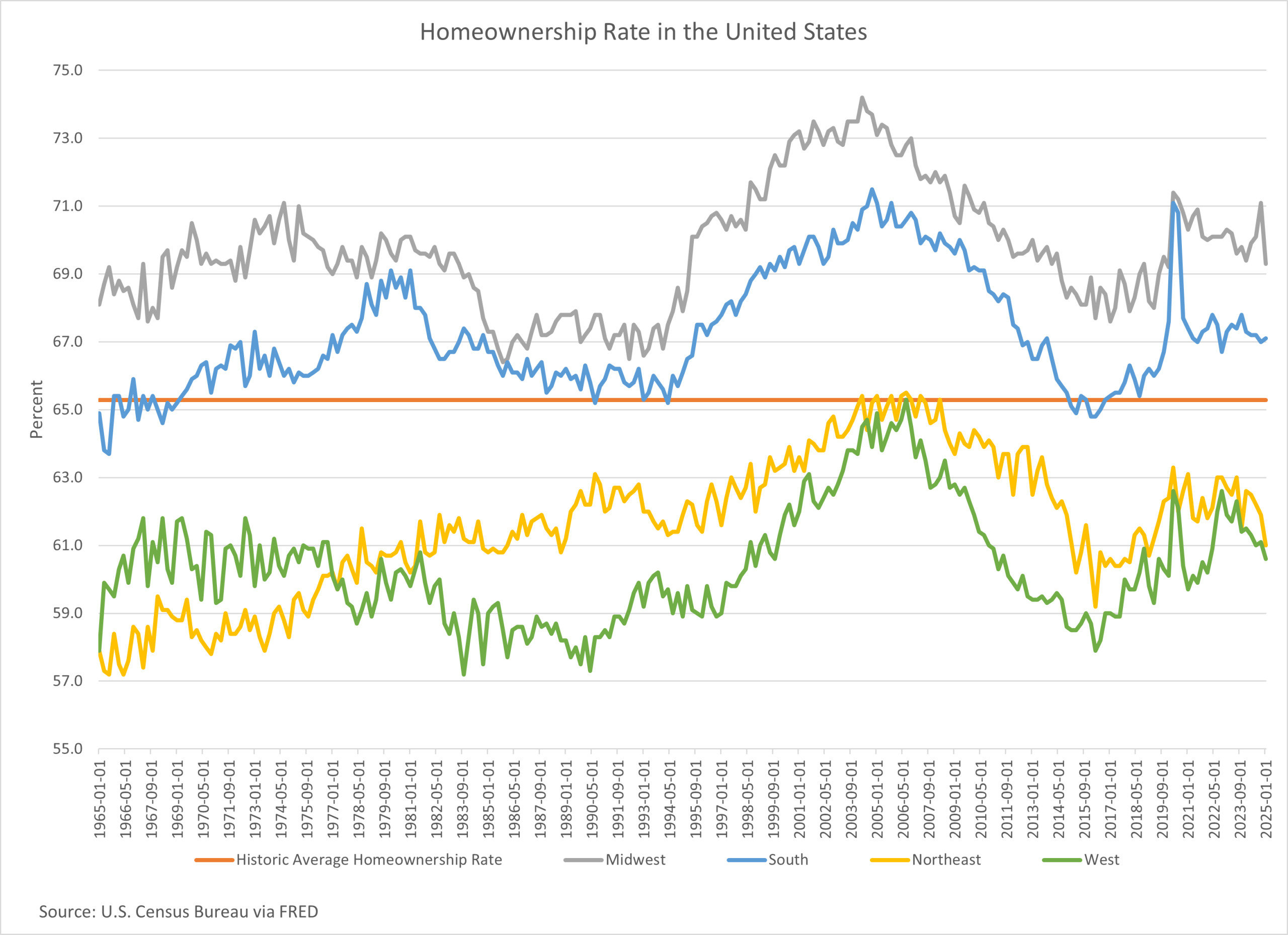

The contrasts among racial groups are even more striking. The homeownership rate among Whites nearly doubled that of Blacks and Hispanics (Figure 9.3).

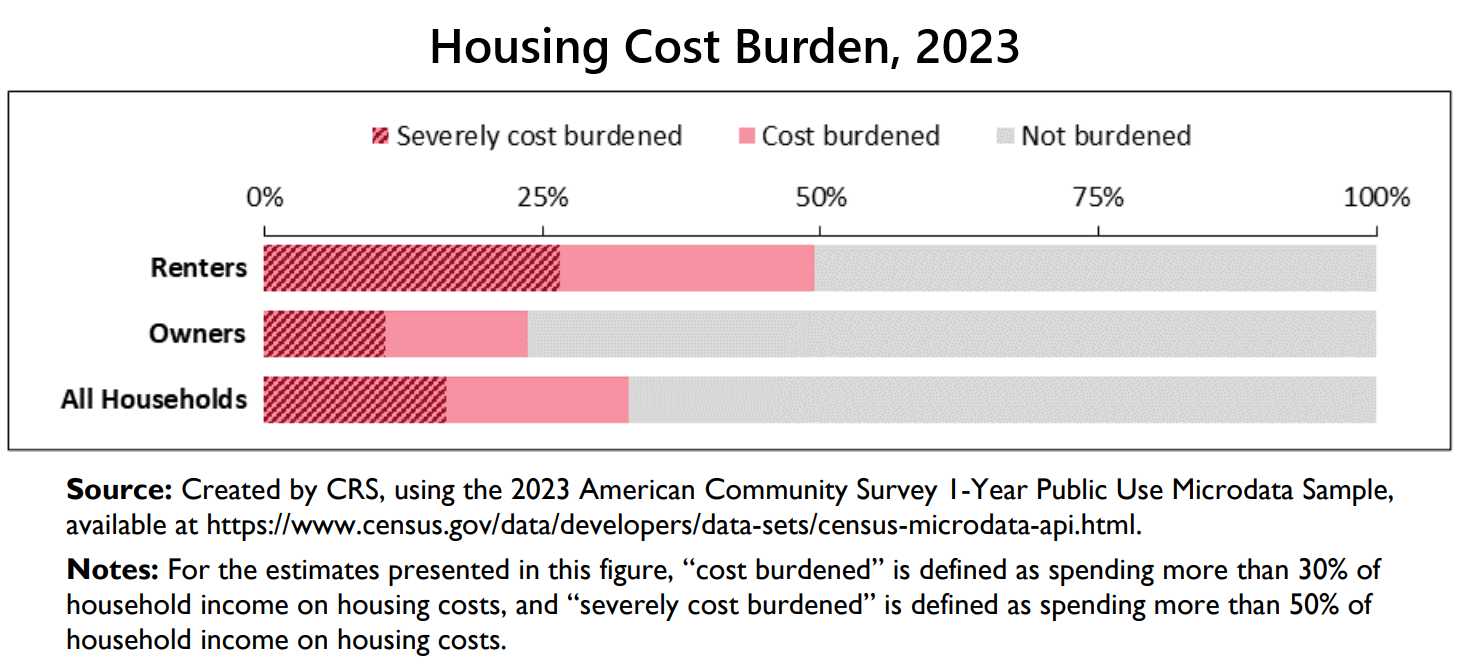

Achieving and maintaining the American dream of owning a home appears to be more and more difficult as housing prices increasingly outpaced wages over the past 40 years. As shown in Chapter 5, the median house price was 3.51 times median annual household income in 1985. This ratio has increased to 5.17 times in 2025. The cost of housing, both rent and mortgage, has become an important issue. In one survey, 82 percent of respondents agreed that housing affordability is a problem where they live[1]. Federal housing policies define housing to be “affordable” if rent or mortgage plus utilities cost no more than 30 percent of the household income after adjusting for family size[2]. In 2023 almost half of renter households and nearly one quarter of owner households were considered housing cost burdened (Figure 9.4). That was 22.6 million renter families and 20.3 million owner families. About half of these households were considered severely cost burden, meaning they spent more than half their household income on housing. This situation could generate severe financial stress, especially for two-income households. If one of the earners were to lose their job, the family could become homeless.

Solving the housing affordability problem requires changes in national and local policies and is beyond the scope of this textbook. Your own personal values, family background, economic conditions, and cultural beliefs will likely affect how important homeownership is to you. With careful and strategic financial planning, you can improve your chances of achieving your housing goal, whether it is renting or owning. In this chapter, we will examine the trade-offs of renting versus owning a home, different types of mortgages, the total cost of home ownership, and renters and homeowners insurance.

Activities: (Use data for your city or town if possible. Otherwise, use county or state data.)

- Find the median rent in your city or county or state.

- Explain whether you are ready to move out on your own. Your explanation should include affordability based on your budget. Include non-monetary factors in your decision.

- Find out the median house price in your city or county or state. (Hint: The National Association of Realtors conducts regular surveys on housing prices. https://www.nar.realtor/research-and-statistics/housing-statistics/county-median-home-prices-and-monthly-mortgage-payment)

- Compute the ratio of the median house price to your household gross income. (Ratio = Median house price / Household gross income)

Are You Ready to Rent Your Own Place?

Moving out on your own is a huge step for young people. Some even consider it a transition marker to adulthood[3]. Living independently from your family gives you more freedom and opportunities for personal growth by taking on financial and daily life responsibilities. It is normal to find such a big step intimidating. Acknowledge your needs and identify people within your network (friends, family, mentors) who can provide support and guidance. Creating a detailed plan to manage potential challenges can increase your chances of success and boost your confidence. The good news is that you have already learned many of the tools needed. The first step is to review your budget so you can determine how much you can realistically afford on rent and other living expenses. Chapter 3 explained the steps to create a budget. By keeping your rent, utilities, and renters insurance premium to be less than 30 percent of your gross income, you can avoid becoming housing cost burdened. This is important because these expenses are essential and fixed, therefore difficult to adjust if unexpected job loss or medical problems happen suddenly.

In addition to ongoing expenses, it costs money to begin the rental search process. Landlords often charge an application fee, which is non-refundable whether your application is accepted or not. The national average was $50 per applicant and the fee was intended to cover background and credit checks. Some states have regulations on the amount of application fees. To avoid unpleasant surprises it is a good idea to review your credit report to ensure its accuracy before submitting a rental application. Chapter 6 detailed how to obtain and read your credit report and to request error corrections if necessary. Some landlords even list the credit score they require from their tenants. You may need a cosigner if your credit history or credit score is insufficient.

Most rental agreements require a significant initial financial commitment. This typically includes the first month’s rent, the last month’s rent, and security deposit. For instance, if the rent is $2,000 per month, you may need $6,000 up front at the time of the lease signing: $2000 (first month) + $2000 (last month) + $2000 (security deposit) = $6000. If you plan to move out of your family home, saving sufficient funds for the initial financial commitment, in addition to an emergency fund, will be one of your short-term financial goals.

Some landlords require tenants to purchase renters insurance. Renters insurance policy covers losses of personal assets, limited coverage on loss of use of the residence, and liability from injury to others on the property. It is important to understand what events are covered. For instance, the insurance will pay for temporary stay at a hotel if there is a fire. Another example is the loss of a laptop, which is a personal asset. The insurance may cover a laptop if it is damaged in a fire or if it is stolen. Be sure to file a police report to document the event. It will not cover the laptop if you dropped it or if your roommate stole it. The last case is not covered because your roommate has easy access to your personal assets. The premiums on renters insurance is usually relatively inexpensive and is worth getting even if you are not required to. In 2025, the national average cost for renters insurance is around $14 per month. Of course, the exact amount for you will be different depending on your location and individual circumstances. Obtain a quote from an insurance agent so you can include it in your budget.

The next step is researching available apartments or houses. Websites such as Realtor.com, Zillow.com, or Apartments.com are popular resources. Important factors to consider include location, the monthly rent amount, which utilities are included, tenant responsibilities, and lease term. Other items that may be important include parking, storage, laundry facilities, and overnight guests and pet policies. If utilities are not included in the monthly rent, you can request that information from the landlord for your budget. Many rentals have fixed-term leases, usually one year. Some offer a month-to-month term at a higher rent. Shorter lease terms provide more flexibility if you expect to move soon. The rent is usually higher for shorter terms to compensate the landlord for the increased turnover risk. This is the risk that the rental remains vacant after a tenant moves out. If you sign a one year lease, you may be responsible for rents for the entire year, even if you move out before the lease ends. Ask the landlord about the penalty for breaking the lease and how much notice you need to give before moving out. Write down detailed notes for each rental unit you visit so you can compare them at home. Below are some suggested questions to ask potential landlords.

Questions to ask the landlord when shopping for a rental:

Financial and legal questions

- How much is the application fee?

- What is the monthly rent, and what is included in it (utilities, etc.)?

- What is the average cost of utilities not included in the rent?

- What is the security deposit amount and when is it due?

- Is renters insurance required?

- What is the total amount due at lease signing?

- What appliances are included in the unit?

- Are there any additional fees for other amenities such as laundry, storage, pool, etc.?

- Are there any move-in specials or discounts?

- What is the policy on late rent payments and the amount of late fees?

- What is the duration of the lease?

- What are the options for lease renewal?

- Are there any penalties for breaking the lease early?

- Can the lease be sublet, and if not, what are the penalties?

- What are the rules for adding or removing roommates?

- What is the process for moving out at the end of the lease?

Other questions:

- How are maintenance requests handled?

- Who is responsible for repairs, and how quickly are they addressed?

- What is the process for reporting maintenance issues?

- Are there any plans for building maintenance or renovations?

- What is the pet policy?

- What is the overnight guest policy?

- How are trash and recycling handled?

- What is the parking arrangement for tenants and guests?

- What is the building’s security like?

- Are the locks changed between tenants?

- How is the neighborhood (noise levels, safety)?

- What is the overall community like?

Are you Ready to Buy a House?

Buying a home is the biggest financial decision for most people and perhaps one of your financial goals. It is common to have rented your own place before considering buying a home. You will have learned many valuable lessons and time to build up your credit history by renting first. Owning a home is a lot more complicated and comes with a lot more responsibilities than renting. We will discuss all aspects of the home purchase process in this chapter. The first step is to review your budget and your account balances to determine how much house you can realistically afford. There are three criteria you can use as guidelines. The first is to keep the house value to be less than 3 to 5 times your annual household income. The second is to avoid house cost burden by keeping mortgage, property taxes, utilities, homeowners insurance premiums, and other housing costs to be less than 30 percent of gross monthly income. Other housing costs may include Home Owners Association (HOA) fees, condo fees, membership fees, etc.. The third criteria is to maintain a debt payment-to-income ratio (DTI ratio) to be less than 30 to 35 percent of gross monthly income. Chapter 6 explained how to compute the DTI ratio, which is defined as monthly total debt payments divided by monthly gross income.

The amount of down payment will have a great impact on the monthly mortgage amount. We will discuss different types of mortgages later in this chapter. There are government programs to help first-time and low to moderate income homebuyers. In this section, we will use conventional mortgages as the default. If the down payment is less than 20 percent, lenders will usually require the borrower to purchase Private Mortgage Insurance (PMI) or Mortgage Insurance (MI). Mortgage insurance is an expensive additional cost and the premium can range from 0.5 to 1.5 percent of the outstanding loan amount. As an example, with a 1 percent MI premium on a $360,000 loan, you will need to pay an extra $300 per month (MI premium = $360,000 x 0.01 / 12 = $300).

In addition to down payment, you will need to pay closing costs which include prepaid interest on the mortgage, escrowed property taxes, escrowed homeowners insurance premium, and other expenses when you buy a house. The term escrowed means that you are putting money into a special account managed by your lender to pay these expenses. These costs can range from 4 to 6 percent of the loan amount. The key takeaway is that you need more than just the down payment at the closing. Most conventional loans typically require a down payment of at least 5 percent. To avoid the PMI premium, you need a down payment of 20 percent or more. According to the National Association of Realtors, the median down payment for all homebuyers was 18 percent in 2024.[4] For first-time homebuyers, the median down payment was 9 percent. If buying a house is something you want to plan for, an intermediate-term financial goal would be to save sufficient funds to cover down payment and all the associated costs at closing.

Down Payment Amount = Loan Amount x Down payment percent / (1 – Down payment percent)

Total Closing Expenses = Loan Amount x 4 to 6 percent

Total Amount Needed at Closing = Down Payment Amount + Total Closing Expenses

For instance, if you plan to put down 10 percent and you qualify for a $360,000 mortgage, your down payment amount will be around $40,000. Total closing expenses will be $18,000 assuming they are 5 percent of the mortgage amount. You will need to save $58,000. If you want to eliminate the PMI premium, you will need 20 percent as a down payment, which will be $90,000. The total amount you need to save will be $108,000.

- Estimated loan amount = $360,000

- Total closing expenses = $360,000 x 0.05 = $18,000

- Down payment amount at 10 percent = $360,000 x 0.1 / (1 – 0.1) = $40,000

- Total amount needed at closing = $40,000 + $18,000 = $58,000

- Down payment amount at 20 percent = $360,000 x 0.2 / (1 – 0.2) = $90,000

- Total amount needed at closing = $90,000 + $18,000 = $108,000

Another very important factor to consider when deciding to buy a house is your job stability. This is not just the risk of losing your job. You may need to relocate due to a promotion, corporate reorganization, or change of company for a better job. Moving is extremely expensive for homeowners. The average seller pays 8 to 10 percent of the house value in commissions, fees, and other costs. The average buyer pays 4 to 6 percent of the house value in closing costs and fees. This means that if you sell and then buy another house, both at $375,000, transaction costs alone can be over $50,000.

How Much House Can You Afford?

Now let us look at the mechanics of how to apply the above housing affordability criteria to estimate your target house buying budget. Applying the first criteria is very straightforward. Simply multiply your gross annual income by 3[5]. To apply the other two criteria, you need to collect housing related costs. Before shopping for a house, you should first shop for a mortgage and get a loan pre-approval. You are not guaranteed a loan nor are you committed to a lender with a loan pre-approval. When you get a loan pre-approval, the lender typically includes an estimated maximum loan amount, an estimated interest rate, and the loan term. Based on this information you can estimate the monthly mortgage payment using the time money of value tools from Chapter 5. This estimate does not include PMI. If your down payment is less than 20 percent, you need to add PMI to your estimate. Housing related costs include property tax, homeowners insurance premium, HOA or condo fees, and utilities. You can get this information from a realtor and an insurance agent or use the median values for your city or town. You will also need other monthly debt payments from your budget for criteria 3. To apply criteria 2, compute the total housing costs by adding the estimated monthly mortgage payment and all housing related costs including utilities. Divide the total housing costs by the monthly gross income to obtain the housing cost ratio. If this ratio is greater than 30 percent, reduce the loan amount and recompute the estimated monthly mortgage payment until the ratio is 30 percent or less. This is the affordable loan amount based on criteria 2.

Total Housing Costs per Criteria 2 = Estimated monthly mortgage payment including PMI + property tax + Homeowners insurance premium + HOA or condo fees + Utilities

Estimated Housing Cost Ratio = Total Housing Costs per Criteria 2 / Monthly Gross Income

To apply criteria 3, compute the total debt payment by adding the estimated monthly mortgage payment and housing related costs excluding utilities to other monthly debt payments. Divide this total debt payment by the monthly gross income to obtain the DTI ratio. If the DTI ratio is greater than 35 percent, reduce the loan amount and recompute the estimated monthly mortgage payment until the DTI ratio is 35 percent or less. This is the affordable loan amount based on criteria 3.

Total Debt Payments per Criteria 3 = Estimated monthly mortgage payment including PMI + property tax + Homeowners insurance premium + HOA or condo fees + Other monthly debt payments

Estimated DTI Ratio = Total Debt Payments per Criteria 3 / Monthly Gross Income

To determine the affordable loan amount under criteria 2 and criteria 3 is a trial-and-error process. You will need to try different loan amounts to find the value that satisfies each criteria. Using a spreadsheet will make the trial-and-error estimation process much easier. The following example provides a detailed step-by-step illustration of this process. It includes a spreadsheet template complete with formulas to help you create your own.

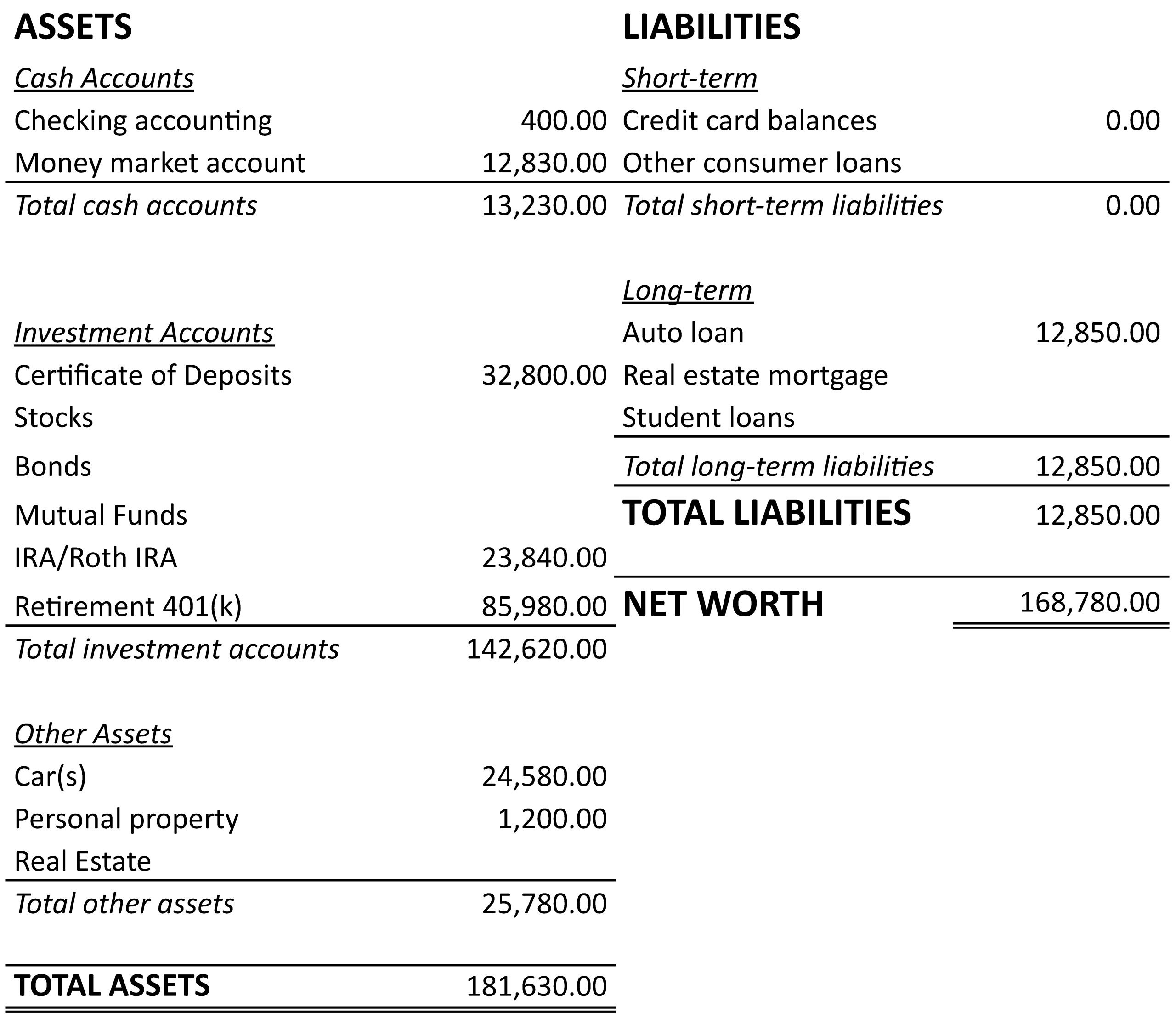

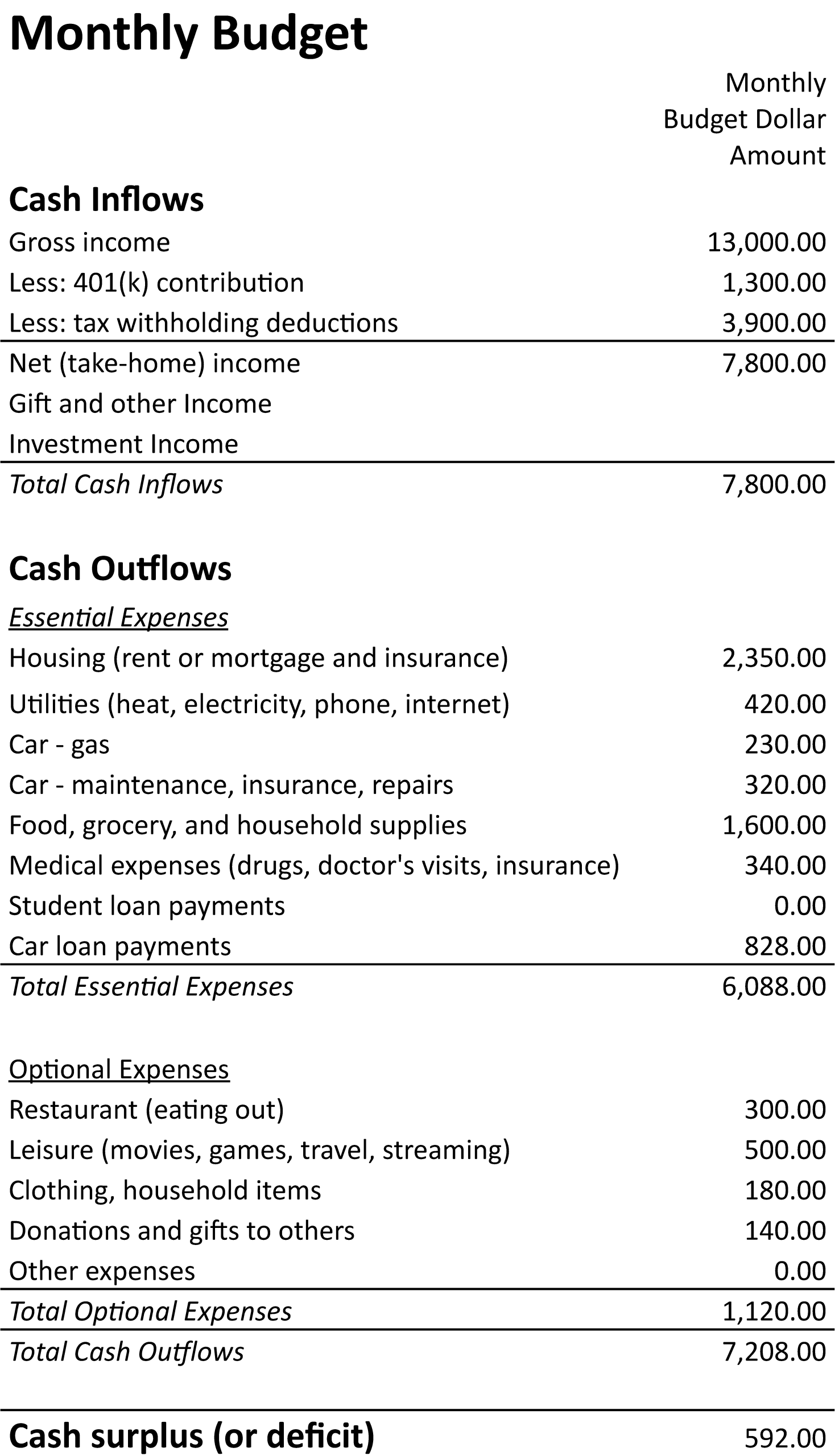

Example: The First Step of the Homeownership Journey of Maya and Isis

Since their wedding 3 years ago Maya and Isis had been saving for their dream of owning their own home. Instead of a lavish wedding and yearly vacations, Maya and Isis put aside money towards the down payment for their future home. They had accumulated $40,000 and believed they were ready. Their combined gross annual income was $132,000. They had heard of the 3 times gross income rule of thumb. According to this criteria, they could afford a $396,000 home. Maya and Isis had been careful with debt and credit card payments and both had credit scores over 750. They contacted their credit union and were pre-approved for a $360,000 30-year mortgage at a 6 percent interest rate. With $40,000 as down payment, they could get a $400,000 house. Everything appeared to be lining up perfectly.

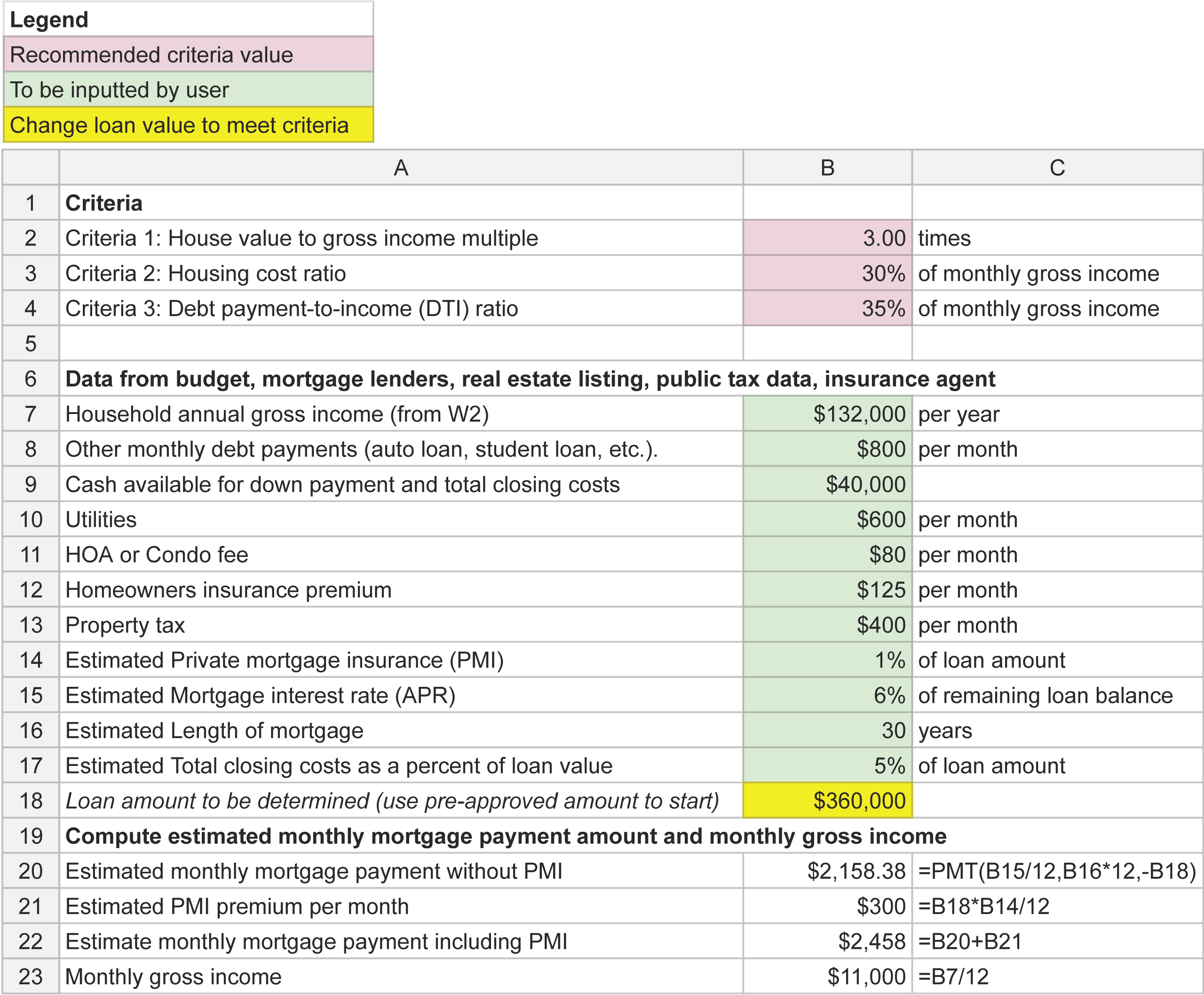

To better prepare themselves Maya and Isis studied up about home purchase. They realized they had missed some important costs in their original estimates. For instance, since their down payment would only be 10 percent of the house price they had hoped to be able to afford, they would need to pay a PMI premium. They also learned about house burden and did not want to become another statistic. Maya and Isis created a spreadsheet to help them analyze the house purchase decision in more detail. They collected data from their town’s website, the realtor, and insurance agent. Figure 9.5 shows the area of the spreadsheet containing the data they collected and the calculations for their monthly gross income and the estimated mortgage payments based on the pre-approved loan amount.

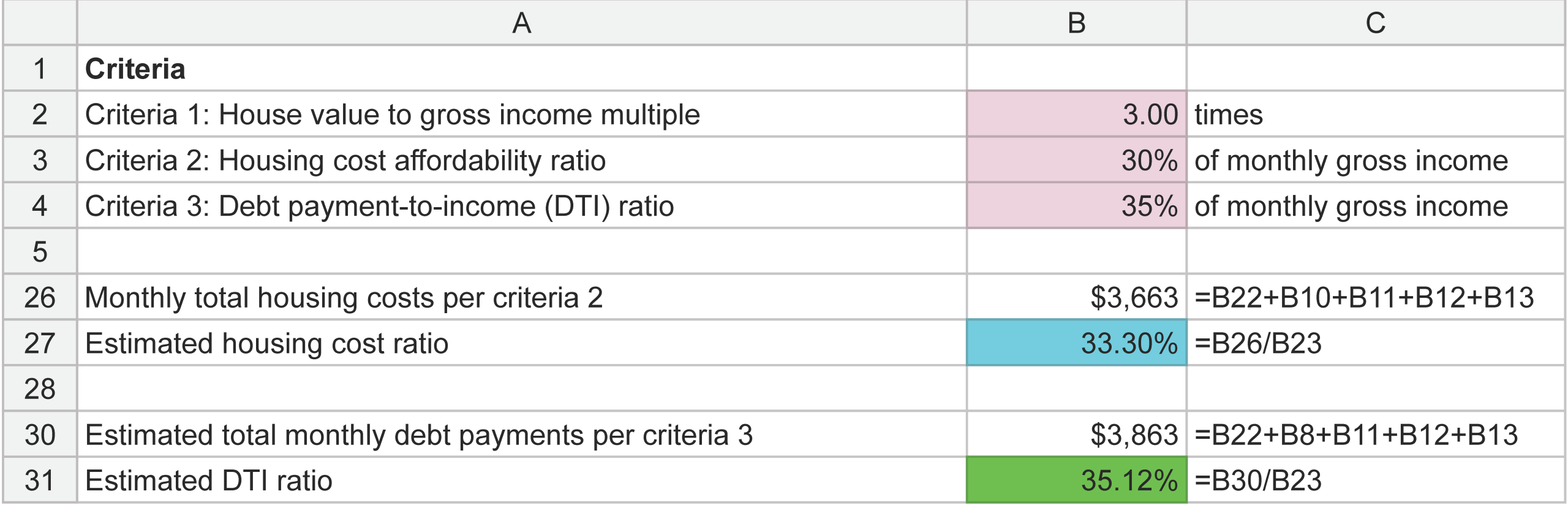

Maya and Isis applied three criteria to determine how much house they could afford. The first criteria was a house less than 3 times their combined annual gross income. The second was to limit the total housing costs to be less than 30 percent of their combined monthly gross income. The third was to limit the DTI ratio to less than 35 percent. Figure 9.6 shows the three criteria and the calculations for the housing cost ratio (criteria 2) and the DTI ratio (criteria 3).

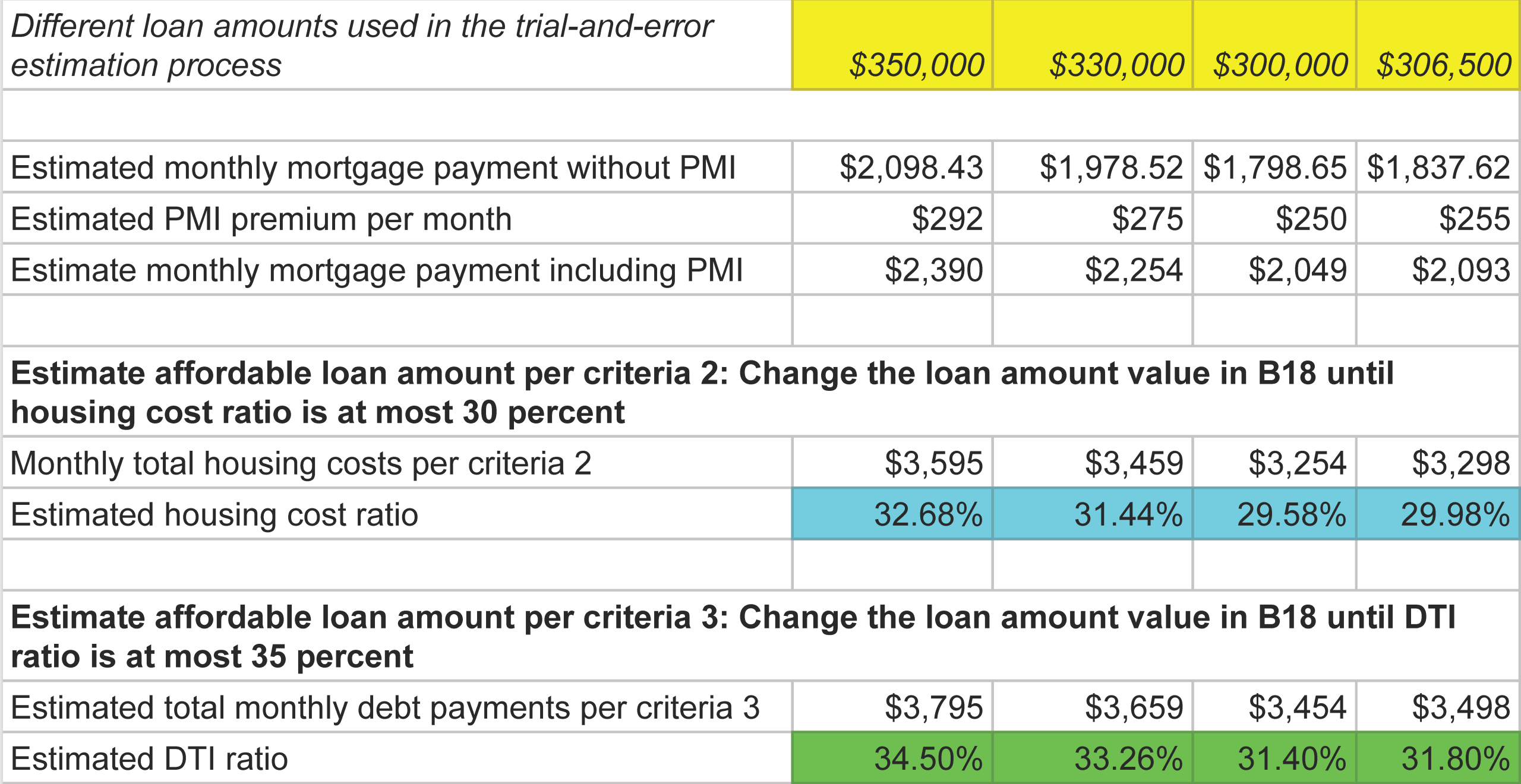

Using the pre-approved loan amount of $360,000, Maya and Isis found that the resulting housing cost ratio would be 33.30 percent, higher than their target. The DTI ratio was 35.12 percent, just around their target. Maya and Isis did not want to have such a high housing burden. They tried different loan amounts in their spreadsheet model to determine how large a mortgage they could afford. Figure 9.7 shows the resulting housing cost ratios and DTI ratios at the various loan amounts. Based on their analysis, Maya and Isis felt comfortable taking out a mortgage between $300,000 and $306,500.

Note: Here is the link to the spreadsheet template. You can download the template or make a copy in Google Sheets and try out this example on your own.

After you have identified the affordable loan amount, you can estimate how much house you can purchase. As noted earlier, aside from down payment, you also need to pay closing costs up front. Your lender may give you an estimate of these costs. Generally these costs can range from 4 to 6 percent of the loan amount. If you do not have an estimate from your lender, you can estimate on your own. Most people are limited by the amount of money they have saved. Once you figure out your affordable price range based on your savings and budget, stay in your range no matter what.

Estimated total closing costs = Affordable loan amount x Total closing costs percent

Affordable house price range = Affordable loan amount – Estimated total closing costs amount + Available savings

Quite often people are surprised at how large the closing costs are. Some lenders advertise “zero closing costs mortgage”. These lenders either charge these loans a higher interest rate or they roll the closing costs into the mortgages. In both cases, the borrower ends up paying more in interest payments. Note that even with a zero closing costs mortgage, the borrower still needs to pay some of the escrowed expenses up front. Let us continue with the example for Maya and Isis to illustrate how they arrived at their house purchase budget.

After careful analysis, Maya and Isis decided to limit their mortgage to $305,000. During their study, they learned that closing costs plus escrows often ranged between 4 to 6 percent of the mortgage. This meant the $40,000 they had saved would not all go toward the down payment. Based on their target loan amount, they estimated the amount needed at closing to be around $15,000. This left $25,000 for down payment. Maya and Isis set their house budget to be $330,000.

- Estimated mortgage amount = $305,000

- Estimated total closing costs = $305,000 x 0.05 = $15,000

- Available down payment = $40,000 – $15,000 = $25,000

- Affordable house price = $305,000 + $25,000 = $330,000

- Down payment percent = $25,000 / $330,000 = 0.075 = 7.5 percent

Their target house budget was less than 3 times their annual gross income. With $25,000 as down payment, their down payment percent was around 7.5 percent. This is lower than they had planned but still sufficient for conforming-conventional loans. Maya and Isis were glad they took the time to do the analysis before setting a house budget. They felt comfortable and confident that they could afford a $330,000 home.

During their analysis Maya and Isis noticed how significant the PMI premium was. They wondered how much would a 20 percent down payment be for a $305,000 loan. Using the formula they learned, they estimated the amount to be $76,250.

Down Payment Amount = Loan Amount x Down payment percent / (1 – Down payment percent)

Down Payment Amount at 20 percent for Maya and Isis = $305,000 x 0.2 / (1 – 0.2) = $76,250

Adding the down payment to $15,250 in total closing costs meant they would need $91,500 up front. That was more than double their current savings. Maya and Isis decided not to wait till they had sufficient savings for a 20 percent down payment.

Assume the mortgage loan amount is $300,000 and the loan term is 30 years with fixed monthly payments. The interest rate is 6 percent per year. The PMI premium is 1 percent of the outstanding loan balance. The borrower plans to make a 5 percent down payment. The total closing costs will be 5 percent of the loan amount.

Activities:

- Compute the monthly mortgage payment before PMI premium.

- Compute the monthly PMI premium.

- Compute total monthly mortgage payment including PMI premium.

- Compute the down payment amount.

- Compute the target house budget.

- Compute the estimated total closing costs.

- Compute the total amount needed at the closing.

Choosing a Mortgage and a Lender

There are many types of mortgages in today’s financial market. Banks and mortgage companies use a lot of acronyms, making the process of researching mortgage information challenging. In this section, we will explain these acronyms and terms, the key differences between different types of mortgages, and how to select the option that best meets your needs.

Types of Mortgages

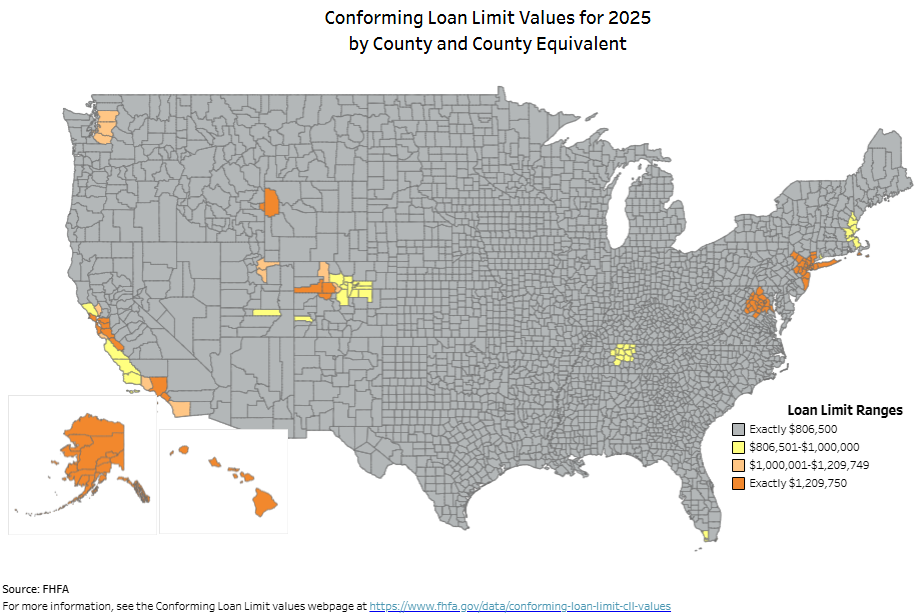

Mortgages are usually classified based on two factors. The first is whether the loan is insured or guaranteed by the government. Mortgages not insured or guaranteed by the federal government are considered conventional loans. The second is the size of the loan amount. When the loan exceeds the limits set by the Federal Housing Finance Agency (FHFA), it is considered a jumbo loan. Loans below the FHFA limits are called conforming loans. The FHFA sets these limits each year. In 2025, the limit on loan amount for a single-family home in most areas is $806,500 and up to $1,209,750 in some high-cost areas (Figure 9.8). Jumbo loans have higher qualification and down payment requirements and higher interest rates due to higher risk to the lenders. The focus of the discussion in this chapter is on conforming mortgages below the limits set by the FHFA.

The three main sources of funding for conventional mortgages are government sponsored enterprises (GSE), lending institutions (Portfolio), and private-label securities (PLS). The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) are the main suppliers of funds for GSE mortgages. Though the names of these enterprises contain the word “federal”, these are private corporations. They set rules and guidelines for lenders to evaluate borrowers. Mortgages meeting the GSE guidelines are considered conforming-conventional loans. The current GSE guidelines require the loan amount to be below the limits set by FHFA (conforming), credit scores of at least 620, DTI ratios of less than 36 percent, two or more years of consistent income and employment history, and down payment of at least 3 to 5 percent. Conforming-conventional loans (GSE loans) are the most common type of mortgages and usually the best option for borrowers who meet the guidelines.

Portfolio mortgages are funded directly by the lenders and have the potential for negotiation on terms, fees, rates, and non-traditional income sources. This type of mortgage may be considered by borrowers with unique financial situations such as self-employment or the need for a jumbo loan. Funding for PLS loans comes from private investors. PLS loans tend to be non-conforming mortgages including jumbo loans and subprime (sometimes called Alt-A) loans. For borrowers whose credit scores and income do not meet the GSE guidelines, the FHA and USDA loans described in the next section are usually better options than non-conforming conventional loans.

The federal government has four main programs that insure or guarantee mortgages to make homeownership accessible to homebuyers who may not qualify for conforming-conventional mortgages. VA loans are guaranteed by the U.S. Department of Veterans Affairs (VA) and FHA loans are insured by the Federal Housing Administration (FHA). USDA Guaranteed loans are guaranteed by the U.S. Department of Agriculture (USDA) and USDA Direct Loans are given directly through the USDA rural development agency. Except for USDA Direct loans, these loans are provided by private lenders such as banks and mortgage companies. The government insurance or guarantee lowers the qualification requirements and/or interest rates by reducing the risks to the lenders.

VA loans are available to veterans, active service members, and eligible surviving spouses. The main benefits of VA loans include zero down payment and no mortgage insurance regardless of the down payment percent. There are few restrictions on VA loans. They are a great option even for those who qualify for conventional mortgages.

FHA loans have lower credit scores and down payment requirements than conventional loans. In 2025, FHA loans require a minimum 3.5 percent down payment if the borrower has a credit score of 580 or higher. Borrowers with credit scores as low as 500 can qualify for a FHA loan with a 10 percent down payment. The borrower must use the property as their primary residence, move in within 60 days, and occupy it for at least a year. FHA loans have a maximum loan amount that varies by county. All FHA loans require borrowers to pay an upfront and an annual mortgage insurance premium. In 2025, the upfront premium is 1.75 percent of the total loan amount to be paid at closing. The annual premium rate varies with an average rate of 0.55 percent of the remaining loan balance. These insurance premiums are comparable to private mortgage insurance (PMI) premiums. If you have good credit and a reasonable down payment, FHA loans may be more expensive than conventional loans for you. For borrowers with low credit scores or a small down payment, FHA loans may be cheaper. The mortgage loan market fluctuates quite a bit and it is important to check all your options.

USDA Direct Loans are for low- and very-low-income homebuyers. Unlike the other government mortgage programs, USDA Direct Loans are provided by the USDA rural development agency, not through private lenders. There are many restrictions and qualification requirements for USDA Direct Loans. These include income limit, location and condition of the property, property size, and other household characteristics. The household adjusted income must be at or below the low-income limit for the area. The homebuyer must be a U.S. citizen or qualified noncitizen, currently living in unsafe and unsanitary housing, and is unable to obtain a loan from other sources. The property must be in an eligible area and must not exceed 2,000 square feet. USDA Direct Loans have zero down payment, no closing costs, and payment assistance to reduce monthly mortgage amounts. If your income is very low but you have the ability to make reasonable payments, USDA Direct Loans may enable you to become homeowners.

USDA Guaranteed Loans are available to low- and moderate-income homebuyers whose household income is below 115 percent of an area’s median income. Unlike USDA Direct Loans, USDA Guaranteed Loans are provided by private lenders. There are much fewer restrictions on USDA Guaranteed Loans. In addition to the income limit, the property must be in an eligible area and be the primary residence. Benefits of USDA Guaranteed Loans include lower credit score requirement, zero down payment, and instead of PMI premium, the homebuyer pays a guarantee fee equal to 1 percent of the loan amount at closing and an ongoing fee of 0.35 percent of the remaining balance each year. You can check your income and property eligibility for both types of USDA loans at the USDA rural development website.

In addition to federal programs, there are state specific programs to help low- and moderate-income homebuyers and first-time homebuyers. The National Council of State Housing Agencies (NCSHA) has a listing of state housing finance agencies in all 50 states[6]. These state programs include affordable mortgages and down payment assistance. For instance, Massachusetts offers the ONE Mortgage Program which provides low interest rates, no mortgage insurance requirements, and mortgage payment assistance. Other states, such as Arizona, California, Alabama, have programs to help first-time homebuyers with down payment. If your household income is below your state’s median, you may qualify for these programs.[7]

Mortgage Requirements by Loan Type (Data from 2025)

| Conforming-Conventional Loan | VA Loan | FHA Loan | USDA Guaranteed Loan | |

| Minimum Down Payment | 3 to 5 percent | Zero | 3.5 (10) percent | Zero |

| Minimum Credit Score | 620 | 620 (some flexibility) | 580 (500) | None officially. 620 to 640 preferred. |

| Actual Average Credit Score (2023) | 738 | 692 | 645 | 684 |

| Mortgage Insurance | PMI if down payment is less than 20 percent. 0.5 to 1.5 percent per year. | None | 1.75 percent up front + 0.5 to 0.55 percent per year. | 1 percent up front + 0.35 percent per year. |

| Maximum Loan Amount | Below jumbo limits set by FHFA. | None | Set by FHA. Varies by county. | Set by USDA. Property must be in an eligible area. |

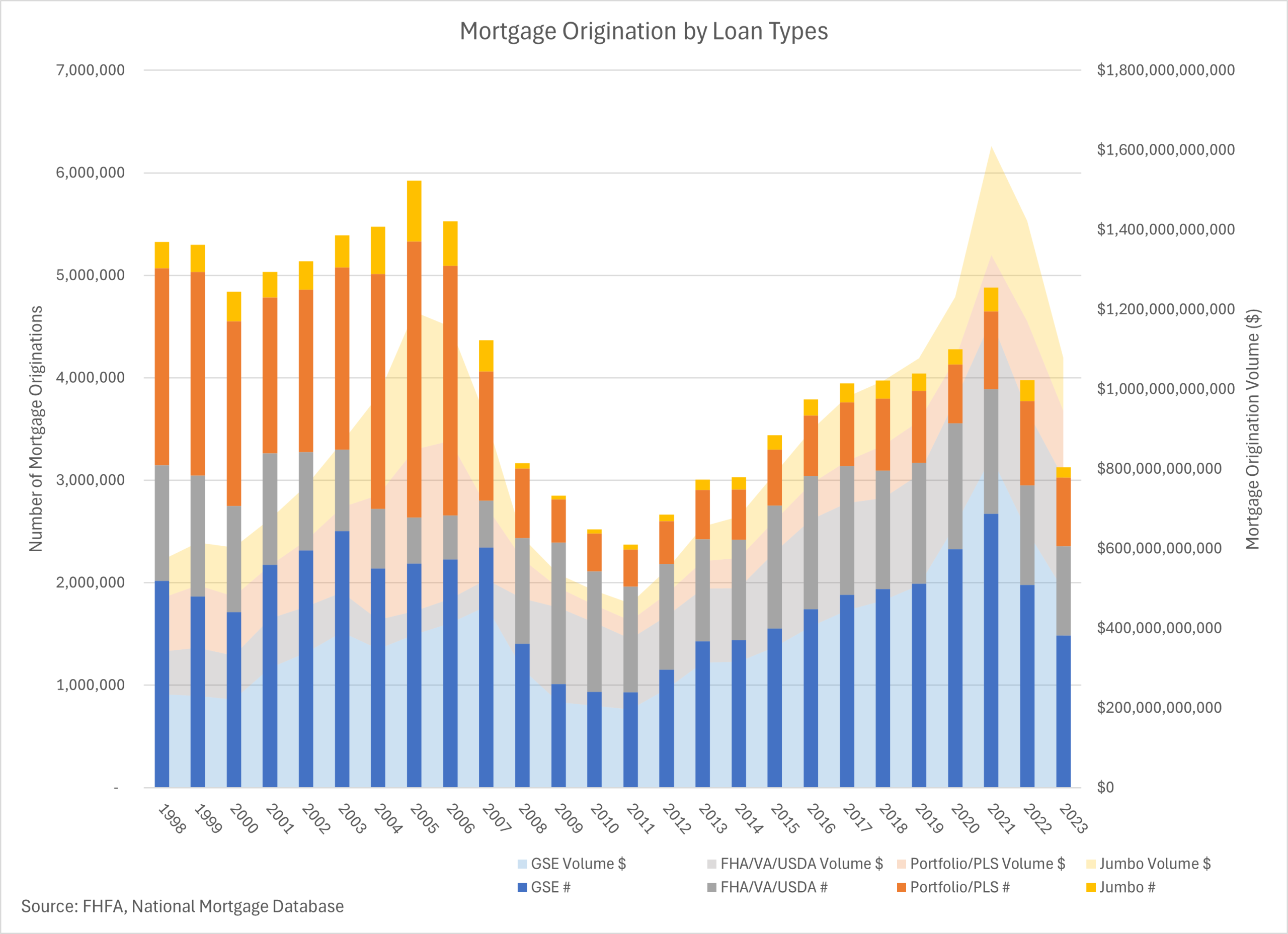

When a homebuyer takes out a mortgage, it is called a loan origination. Figure 9.9 shows the number of mortgage originations and the dollar amount (volume $) by loan type since 1998. The majority of mortgages have been conforming-conventional (GSE) loans, followed by FHA/VA/USDA loans. In 2023, over 3 million loans were originated and lenders loaned out over $1 trillion in mortgages, almost half of which were conforming-conventional loans. Among first-time homebuyers, 52 percent used conventional loans, 29 percent used FHA loans, and 9 percent used VA loans. The number of subprime mortgages funded by PLS dropped significantly following the 2008 financial crisis after anti-predatory mortgage lending laws were enacted. In general, lending standards have become stricter since 2008.

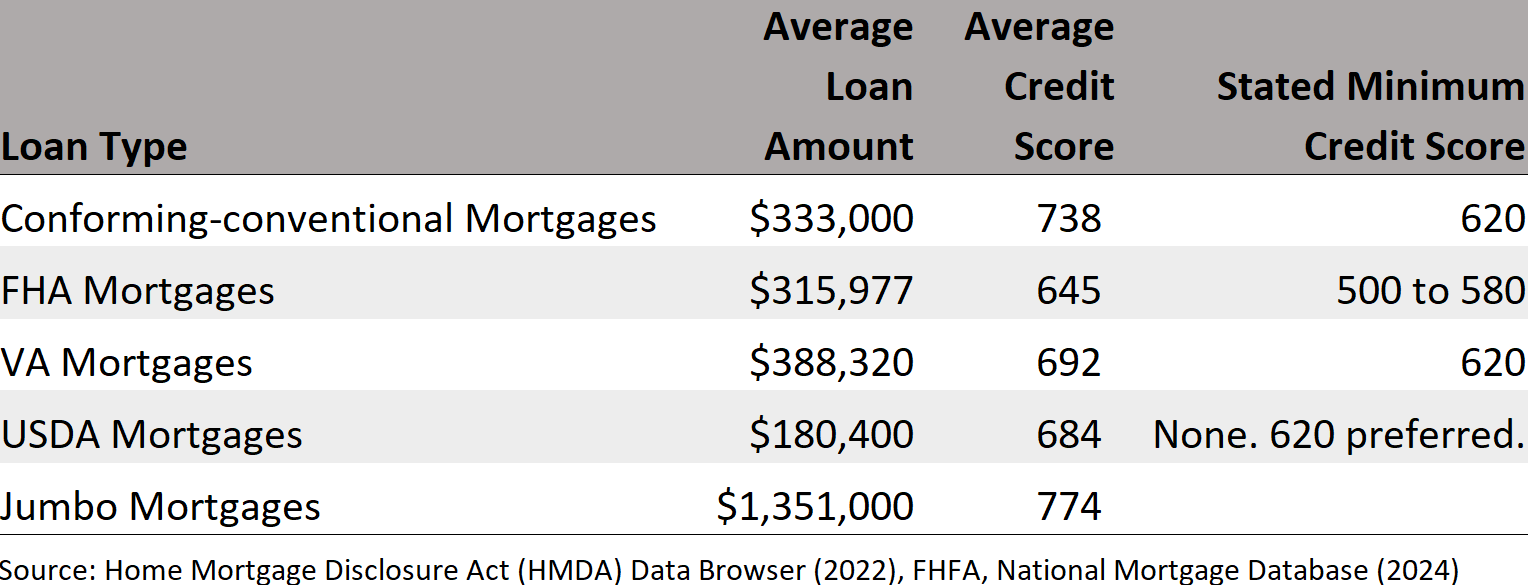

Figure 9.10 shows the average credit scores and average loan amount by loan type in 2024. The actual average credit scores were quite a bit higher than the stated minimum requirements for all loan types. The average loan amounts reflected the characteristics of each loan type. Since housing prices vary greatly in different parts of the country, so do the loan amounts.

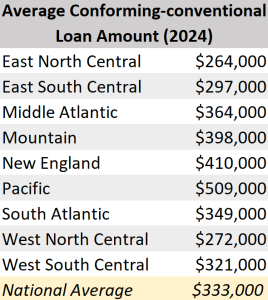

Figure 9.11 shows the average conforming-conventional loan size by region. Knowing the historic average numbers will help you with your financial planning and setting your expectations.

Figure 9.11

You have found out the median house price in your neighborhood in Exercise 9.1. In this exercise, you will research the average mortgage sizes and loan limits in your county (or state if county level data is not available).

Activities:

- Look up the conforming loan limit in your county. (https://www.fhfa.gov/data/dashboard/conforming-loan-limit-values-map)

- Look up the FHA loan limit in your county. (https://www.fha.com/lending_limits)

- Look up the average new mortgage loan amount in your county or state. If county or state data is not available, use the average regional loan amount from Figure 9.11.

Important Mortgage Attributes Affecting Your Monthly Payment Amount

For any given loan size, there are three key factors that affect the monthly mortgage payment amount. The first is the interest rate. Interest rate can be fixed throughout the life of the loan (fixed rate mortgage, FRM) or can change with market interest rate (adjustable rate mortgage, ARM). You can also pay points (sometimes called discount points) to get a lower interest rate. Points are stated as a percent of the loan amount and is paid up front. One point is one percent. You can think of points as prepaid interest. The second is the length of the loan, called loan term. The third factor is whether the loan is fully amortized. With a fully amortized loan, if you make the specified monthly payment, the loan will be paid off at the end of the loan term. This is because each payment contains a principal portion, also known as an equity portion, that reduces the remaining balance of the loan. Lenders are required by law to provide you with an amortization table showing all the monthly payments and their interest and principal (equity) portions, and remaining balances throughout the life of the loan. You can compute the same information using the following formulas. We will use an example to illustrate how to apply these formulas.

Monthly interest portion = Previous remaining balance x interest rate per year / 12

Monthly principal (equity) portion = Monthly payment – Monthly interest portion

New remaining balance = Previous remaining balance – Monthly principal (equity) portion

This example is based on a 30-year fixed rate mortgage with an interest rate at 6 percent per year. The initial loan amount is $300,000.

The first step is to compute the monthly payment amount using a spreadsheet function. Review Chapter 5 on how to compute fixed payment amounts if you need a refresher.

The spreadsheet formula is =PMT(0.06/12, 30*12, -300000).

Monthly payment = $1798.65

- Interest portion in the first month = $300000 x 0.06 /12 = $1500

- Principal (equity) portion in the first month = $1798.65 – $1500 = $298.65

- New remaining balance at the end of first month = $300000 – $298.65 = $299701.35

- Interest portion in the second month = $299,701.35 x 0.06/12 = $1498.51

- Principal (equity) portion in the second month = $1798.65 – $1498.51 = $300.14

- New remaining balance at the end of the second month = $299701.35 – $300.14 = $299401.21

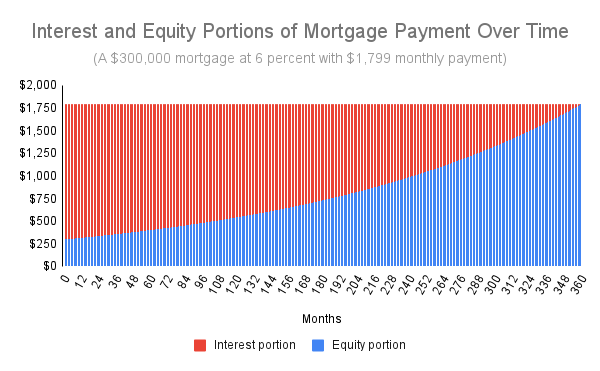

Notice that the interest portion is much larger than the principal (equity) portion in the above calculation. This is true in the early years of a mortgage. After 19 years, the principal (equity) portion will become larger than the interest portion. Figure 9.12 shows the interest and principal (equity) portions of the monthly mortgage payment overtime.

Computing the amortization table month by month is a tedious process and best handled by using a spreadsheet. Here is the link to a spreadsheet containing an amortization template. You can download the template or make a copy in Google Sheet and try out this example on your own.

Points or no points?

Your credit history, DTI ratio, and down payment percent will be the most important determinants of your mortgage interest rate. A high credit score (780+), low DTI ratio (< 30 percent), high down payment (20+ percent), and a long stable employment history will qualify you for the lowest interest rates. Is it worthwhile to pay points to get a lower interest rate? The answer depends on a number of factors. The most important factor is how long you plan to hold the mortgage. You may pay off a mortgage early because you sell the house or to refinance because the interest rate decreases. The second factor to consider is how much reduction in interest rate you will get per point. A point is one percent of the loan amount. One point on a $350,000 mortgage will be $3,500. In the past, one point will often reduce the interest rate by 0.25 percent. If this trend holds, a rule of thumb is that you will break even if you hold the mortgage for more than 7 years. This is assuming you pay the points up front and not roll them back into the mortgage, increasing the loan amount. If you roll them back into the mortgage, the break even time will be 12 years. Points must be paid up front. This means money that you spend on points can be used to increase the down payment. If your down payment is less than 20 percent and you have a conventional mortgage, you may be better off using the money toward down payment so you can eliminate PMI premium faster.

Fixed rate or adjustable rate?

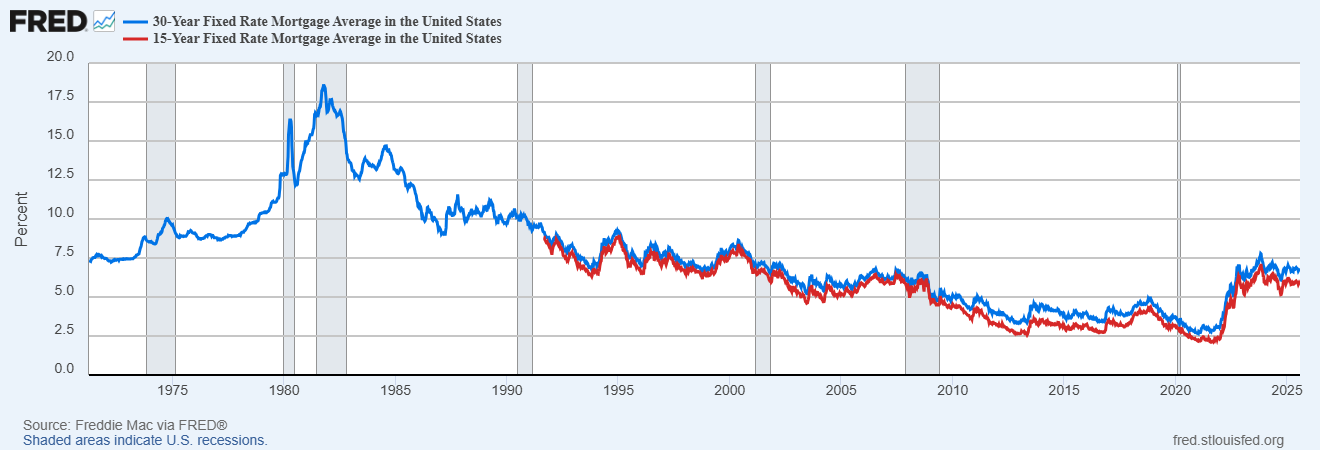

Fixed rate loans have dominated the mortgage market in the past decade because interest rates have been at their historic lows. Figure 9.13 shows 30-year and 15-year fixed mortgage rates since 1970. Adjustable rate mortgages (ARMs) were popular when interest rates were high. There are three important characteristics to consider when evaluating an ARM. The first is the length of the fixed period and adjustment frequency. The label for ARM includes 2 numbers, the first indicates the length of time the rate is fixed and the second indicates how often the interest rate will change after the fixed period ends. A 5/1 ARM means that the rate is fixed for the first 5 years and will change every year thereafter. A 3/6m ARM means that the rate is fixed for the first 3 years and will change every 6 months thereafter. The second characteristic of an ARM is the index and the margin. The interest rate on an ARM is the index rate plus the margin. The index is usually the Secured Overnight Financing Rate (SOFR), the Constant Maturity Treasury (CMT) rate, or the Moving Treasury Average (MTA) rate. These indexes are benchmarks used by financial institutions and published daily online. For instance, if the current index rate is 4 percent and the margin is 3 percent, the initial interest rate on a 5/1 ARM will be 7 percent. After 5 years, the interest rate can change, depending on the index rate. The last factor to consider is the caps. The first adjusted interest rate cap is how much interest can increase when the fixed period elapses. The subsequent adjusted interest rate cap is how much interest can increase at each adjustment frequency. The lifetime rate cap is how much interest rate can increase during the term of the loan. For instance, the above 5/1 ARM has an first adjusted cap of 2 percent, subsequent adjusted cap of 1 percent, and lifetime cap of 5 percent. After 5 years, the maximum interest rate possible will be 9 percent (7 percent initial rate + 2 percent first adjusted cap). The maximum interest rate possible for this loan is 12 percent (7 percent initial rate + 5 percent lifetime cap).

Initial Low Payment Options – Opportunity or trap?

Some mortgages are designed such that monthly payments in the first few years of the loan are lower than fully amortized loans. Interest-only mortgage allows borrowers to pay only interest on the mortgage initially. This means that the loan balance remains unchanged during this period. To fully pay off the loan, borrowers must make higher payments in subsequent years. A graduated payment mortgage is a mortgage where the payments in the early years are very low, often less than the interest on the loan, and rise to higher levels over time. This kind of mortgage has negative amortization, meaning the loan balance actually increases during the early years because the payment is not sufficient to cover interest due. It is similar to making only the minimum payment on a credit card and the balance continues to increase. A balloon mortgage is a mortgage whose monthly payment is computed assuming a 30-year loan but the loan and the remaining balance is due much sooner, usually 5 to 7 years. Remember that most of the payments during the first years of a 30-year loan go toward interest payments. Typically less than 5 percent of the loan would have been paid off after 5 years. If the homebuyer is unable to get another mortgage (refinance), they will lose the house when the balloon mortgage is due. These mortgages were popular before the 2008 financial crisis and many borrowers were lured into loans by the initial low payments. They found out that they could not truly afford these loans once the higher payments kicked in. These mortgages are considered riskier than fully amortized loans.

15 years or 30 years?

The most common loan term is 30 years with fixed interest rate and fully amortized. In 2023, 96 percent of conforming-conventional mortgages and 99 percent of VA/FHA/USDA mortgages were in this category. The advantages of a 15 year loan include lower interest rate and paying off the mortgage faster. The downside is higher monthly payment. Take a $300,000 loan. If the interest rate on a 15-year mortgage is 6 percent, the monthly payment will be $2,531.57. The total interest over 15 years will amount to $155,683. For the same loan, if the interest rate on a 30-year mortgage is 6.5 percent, the monthly payment will be $1,896.20. Over the 30 years, interest payments will total $382,633. You could save a lot in interest with the 15 year loan. Unfortunately few borrowers will be able to afford the higher monthly payment. If your budget improves and you can afford to pay more, you can make additional payment on a 30 year mortgage. If you pay $200 per month extra, you can reduce the interest costs to $244,800 and pay off the loan in approximately 23 years. When you make extra payment on your mortgage, use a separate check and clearly indicate that the money should be used to pay off the loan balance.

Example: Maya and Isis Chooses a Mortgage

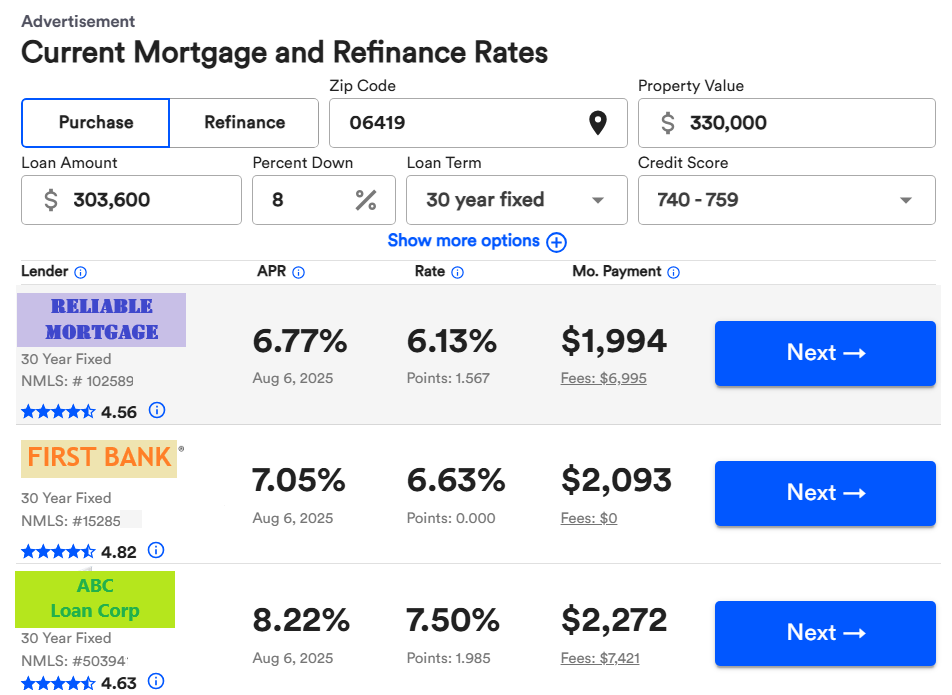

After deciding on a house budget of $330,000, Maya and Isis began shopping for mortgages. Their budgeted loan amount was $305,000. They expected to pay 0.60 percent in PMI and approximately $1,200 per month in other housing costs. They saw the following advertisement online (Figure 9.14).

They ruled out ABC Loan Corp because of the high interest rates and high fees. They liked the lower interest rates offered by Reliable Mortgage but noticed that it required points. The monthly payment for Reliable Mortgage would be $1,945 and for First Bank would be $1,846, both before the PMI premium. The difference was $99 per month. Reliable Mortgage charged 1.567 percent as points, which would total $4,757. It also charged $6,995 in fees whereas First Bank indicated zero fees. However, First Bank’s disclosed APR is 7.05 percent, higher than the advertised rate of 6.63 percent. Maya remembered from their personal finance course that APR included fees, points, and other loan costs. This suggested that First Bank might not use the term “fees” for these charges, but the amount was not zero. The APR from Reliable Mortgage was lower than the APR from First Bank. Maya and Isis knew from their car shopping experience that what was advertised almost always differed from the actual offer. They decided to contact both banks to obtain quotes with specific information on loan fees and closing costs. They requested interest rates on loans with zero points so they could make a better comparison. They also planned to visit their credit union to obtain the same information. Maya and Isis preferred to work with their credit union if the loan offers were comparable. They knew they needed to decide on a lender before getting a mortgage preapproval.

Anatomy of the Closing Costs

You now know that closing costs can be expensive. This section explains the details of closing costs, which have three main components. The first are fees charged by the lender for processing and underwriting the loan. These fees include origination fee, discount points, and other processing fees such as credit report and appraisal fee. Origination fees typically range from 0.5 percent to 1.0 percent of the total loan amount. We discussed points in an earlier section in this chapter. Other processing fees can vary from $1000-$1500. The second component is related to title and settlement fees. These include costs for title search and title insurance for the lender and the homeowner, recording fee and transfer tax paid to the local government, and escrow fee to the escrow company for handling the closing process and managing escrow funds. These fees can total $4000-$5000. You may be able to negotiate with the seller of the property to have them pay part of these fees such as transfer tax. Lenders should be able to provide you with the estimated costs of the first two components based on the loan amount without needing specific information on the property.

The last component includes prepaid expenses and escrows, which is often the least understood and warrants more explanation. Prepaid expenses consist of accrued interest, initial premium on homeowners insurance, and prorated property taxes due at the time of the closing. First let us take a look at accrued interest. Your first monthly mortgage payment is typically due at the beginning of the second month after closing. For instance, if you close on a mortgage on April 10, your first mortgage payment will be due on June 1. The June payment will cover interest for the month of May. At the time of closing, you need to pay the interest from April 10 through the end of April, called accrued interest. Most insurance companies require one year or 6 months of premium when you take out the policy. This amount is due at closing. Cities and towns usually assess property taxes yearly and require quarterly or bi-annual payments. When the closing occurs between payment dates, the taxes are prorated between the buyer and the seller. If the seller has prepaid taxes that cover a period beyond the closing date, the buyer will need to pay the seller for the portion of the taxes after the closing date and vice versa. Sometimes prorated property taxes are handled through the escrow account. The escrow account is managed by the escrow company independent of the lender. Its purpose is to cover the future payments for expenses such as property taxes and homeowners insurance premiums. The escrow account usually requires 2 to 3 months of these expenses to be deposited at the time of closing. Since property taxes and homeowners insurance premiums vary greatly by location, the amount needed for this component depends on the specific property.

More on Escrows (Avoid Unhappy Surprises)

As indicated in the last section, the purpose of the escrow account is to accumulate funds for future payments of expenses to protect the lender’s interest. The property is a collateral for the lender. If the homeowners fail to pay property taxes, the local government can sell off the property. After taxes have been paid off the amount left may not cover the loan balance. If the homeowners insurance policy lapses and the property is damaged, its value may drop significantly. Therefore, many lenders require estimated property taxes and homeowners insurance premium to be paid into an escrow account. In addition to prepaying 2 to 3 months of these expenses as part of closing costs, an estimated monthly amount is added to the mortgage payment. For many borrowers the mortgage payment has 4 components. The interest portion paid to the lender, the equity portion used to reduce the loan balance, the PMI/mortgage insurance portion paid to the mortgage insurer, and the escrow portion deposited into the escrow account.

When the homeowners insurance policy or property taxes are due, the escrow company pays these bills with money in the escrow account. If the actual amount is greater than the estimation, the escrow company will increase the future escrow payment, resulting in higher monthly payment. To avoid unhappy surprises, you can keep abreast of changes to property taxes and adjust your budget accordingly. If your homeowners insurance premiums increase significantly you can shop for another provider. We will discuss homeowners insurance in a later section of this chapter. On the other hand, if the actual amount of these expenses is less than the estimation, the escrow company will send you a check for the difference. This may seem like a happy surprise. You may not want to spend that money right away. There is a good chance that the excess may be due to a quirk in the proration calculation rather than a decrease in property taxes or insurance premium. If that is the case your next escrow adjustment will be revised upward again. You will be better off saving that money for future escrow revisions.

Important Lessons from the Financial Crisis

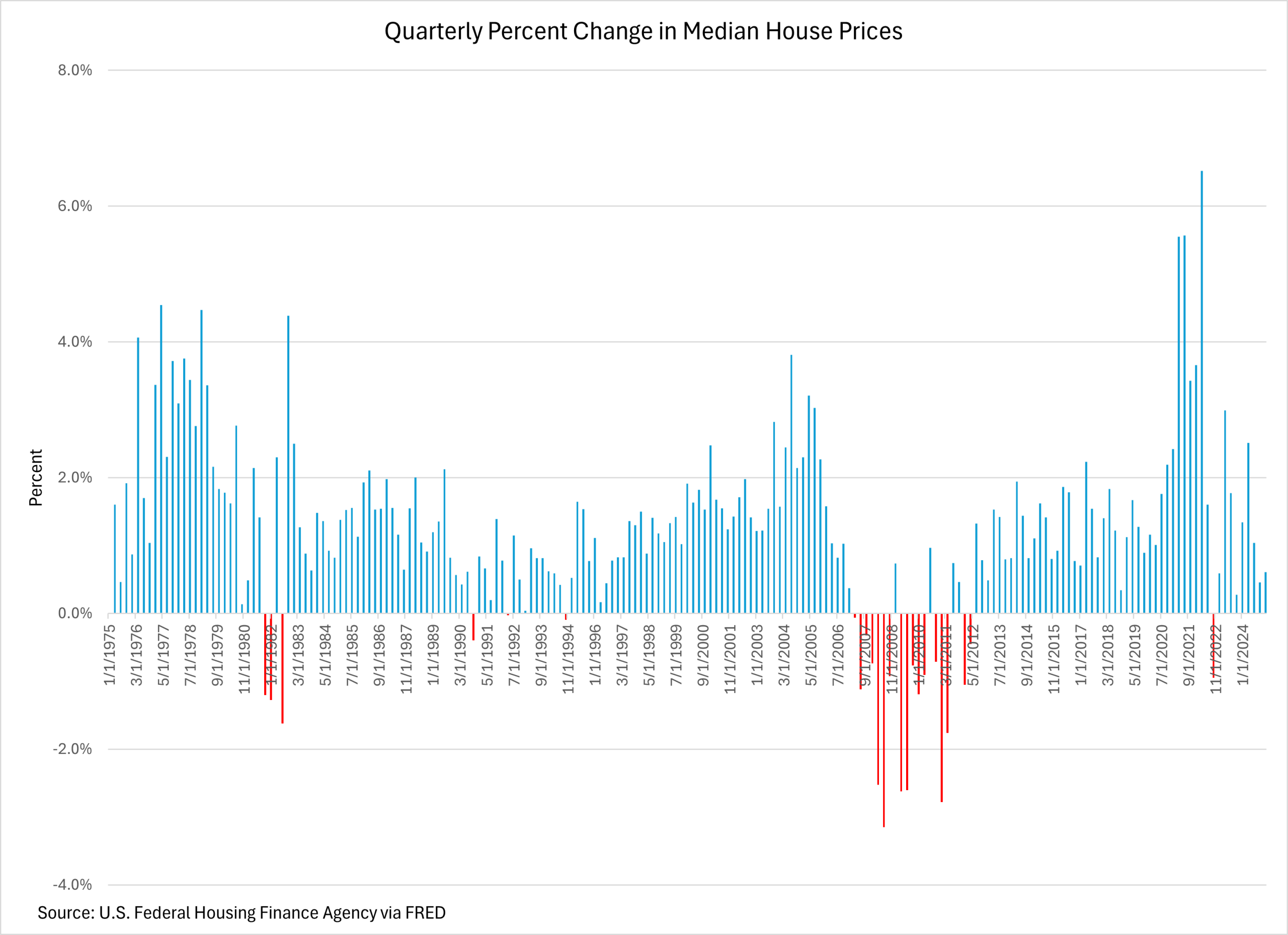

Many people believe that a house is a good financial investment. Like all financial investments, there is risk. Figure 9.15 shows the quarterly percent change in median house prices. In most years, house prices increase but not always. Homeowners discovered that economic downturn can result in significant drop in house prices. The cumulative decrease in median house prices between 2007 and 2011 amounted to 19 percent. In some areas, the price drop was much greater. Prices in Las Vegas fell by 59 percent in that period. A large number of homeowners ended up with a loan balance greater than the value of the house. Risky mortgages and mortgage related financial products were part of the causes of the 2008 financial crisis. Congress responded by passing laws to improve consumer protection in the mortgage application process. Lenders now must show that they have made reasonable effort to ensure that borrowers have the ability to repay the mortgages. This is called the Ability-to-Repay (ATR) standard. Many lenders meet the ATR standard by issuing “qualified mortgages”. Qualified mortgages have three main features. The first is that lenders verify income, assets, debt, and other obligations to ensure borrowers have the ability to make monthly mortgage payments based on DTI ratio or the APR of the loan. The second is that the mortgages must not have risky features such as negative amortization, interest-only payments, balloon payments, or loan terms longer than 30 years. Lastly, points and fees must not exceed 3 percent of the loan amount. Qualified mortgages are cheaper than non-qualified mortgages due to their lower risk. When shopping for mortgages, you can and should ask your lender whether a mortgage is qualified.

Another useful legal provision after the financial crisis is the standardized loan estimation form. Appendix 7.1 contains a sample loan estimate. The Consumer Financial Protection Bureau has a loan estimate explainer that helps you understand different parts of the form. A loan estimate should include the loan term, the interest rate type, the loan type, estimated monthly payments, and details on closing costs. Lenders are required by law to provide loan applicants with the standardized loan estimation form within 3 days after receiving the following information:

- your name,

- your income,

- your Social Security number (so the lender can pull a credit report),

- the property address,

- an appraised value of the property, and

- the desired loan amount.

Credit Unions, Banks, Online Only Lenders, and Mortgage Brokers – Which Is Right For You?

Many of the considerations discussed in Chapter 7 for choosing a bank also apply to choosing a mortgage lender. The key determinants are fees, in-person communication, physical location, and reliability. Credit unions tend to have lower fees, lower interest rates, and personal services. In addition to common mortgages such as conforming-conventional loans, FHA loans, and VA loans, credit unions may have some flexibility in considering alternative income sources such as self-employment income. Credit unions are less likely to sell the mortgages they originate than other types of lenders. This means that as long as the credit union remains the servicer, you can contact them throughout the life of the loan if you have questions. Credit unions are a good option for first-time homebuyers. The main advantage of national banks is to have a single app and physical location for all your financial services. They also have more mortgage product offerings, including jumbo loans.

Online only mortgage lenders who do not offer other banking services compete by reducing overhead costs or specializing in niche markets. These lenders often advertise fast preapproval and processing time because the entire process is done digitally. For some homebuyers, especially first-time ones, the house hunting and mortgage application process can feel overwhelming and the absence of in-person discussions can be a significant disadvantage.

Some of these online only lenders are able to offer lower interest rates and lower closing costs due to automation. A small number of them offer subprime mortgages or non-qualified mortgages to borrowers with poor credit history or lacking verifiable income. As discussed in an earlier section, FHA loans are usually a better option for those with poor credit. Most online only lenders sell their loans soon after origination because servicing loans add to their overhead. If you are comfortable with minimum guidance and value speed and digital convenience, online mortgage lenders may be right for you.

Mortgage brokers are licensed professionals who are not lenders. They work with multiple lenders and have access to a wide range of loan options. They manage the paperwork and maintain communication with the homebuyers throughout the application process. Since the mortgage brokers are not the lenders, they do not service the loan after the closing. Some brokers charge a fee directly to the borrower. Most brokers are paid part of the origination fee or a commission as their compensation. If you want a wide variety of loan choices or have unique financial needs, mortgage brokers are more likely to be able to find a mortgage that will fit your requirements.

Shopping For A Mortgage

Before shopping for a mortgage, you should do some preparation. This includes reviewing your credit report, checking your credit score, reviewing your budget, computing your DTI and house cost ratios, and gathering financial documents such as W-2s, payroll records, and bank statements. Next, decide on the loan term and the type of interest rate. For most people, a 30-year fixed rate mortgage is the best option. Start with zero point loans in your initial inquiry to make the comparison easier. Lastly, review the criteria for different types of mortgage including conforming-conventional, FHA, or VA loans. Decide which mortgage type best fits your situation.

When you are ready, obtain quotes from at least 3 lenders. If the loans are conforming conventional mortgages, ask the lenders whether these are qualified mortgages. Be sure to verify that the lenders only conduct soft inquiries to provide you with the estimates. Soft credit inquiries do not affect your credit score. Non-financial factors to consider include the lender’s reputation, availability of in-person service, and accessibility. The key financial factors are closing costs and interest rate. Lenders may not use the standardized estimation form in Appendix 7.1 for quotes, making the comparison trickier. Check that the quote includes all the closing costs listed on the standard form except property taxes and homeowners insurance premium. If you have a preferred lender but their quote is less competitive, you may be able to get them to match another lender.

Once you have chosen a lender, the next step is to get a preapproval, which usually requires a hard credit inquiry. Your credit score will go down temporarily after a hard credit inquiry. Check the preapproved loan amount against the amount you estimated based on the affordability criteria. If the preapproved amount is lower than your estimate, you need to revise down your house price range. Do not increase your house price range if the preapproved amount is greater than your estimate. You may consider paying a fee to lock in the interest rate if you are worried that the interest rate will go up before you close on the house.

Redlining, What is It and How May It Affect You

The term “redlining” originated from discriminatory practices in the 1930s. Color-coded maps were created by government agencies to assess the perceived risk of different neighborhoods for mortgage lending. Areas marked in red were deemed high-risk and unworthy of inclusion in homeownership and lending programs. These redlined areas were overwhelmingly Black neighborhoods, systematically denying Black Americans access to financial resources for homeownership and wealth building.

This practice created a stark disparity: white consumers disproportionately benefited from government housing programs and access to low-interest mortgages, enabling them to purchase homes and build equity. Black consumers were largely excluded, leading to segregated communities and a widening racial wealth gap that persists to this day.

In response, the Fair Housing Act was enacted in 1968 to eliminate discrimination in housing by prohibiting bias based on race, religion, national origin, sex, sexual orientation, gender identity, disability, and familial status. While the Act made redlining and other discriminatory housing practices illegal, research and investigations have repeatedly revealed ongoing, widespread, and unequal treatment in real estate services.

Even with legal protections in place, various forms of discrimination continue to disadvantage protected groups in their pursuit of homeownership:

- Steering: This practice involves real estate agents or brokers intentionally directing prospective homebuyers toward or away from specific neighborhoods or areas based on their characteristics[8]. For example, a Black homebuyer might be subtly discouraged from looking at homes in a predominantly white neighborhood, while a white homebuyer might be steered away from a diverse community.

- Bias in Home Appraisal: Appraisals can affect mortgage approval and loan amounts. Studies have found evidence of racial bias influencing home appraisals[9]. In one example, a home’s appraised value dramatically increased from $472,000 to $750,000 after a “whitewashing” experiment, where the Black homeowner removed personal items that could signal their race and had a white friend stand in during the appraisal.

- Bias in Mortgage Lending: Studies have consistently shown that Black and Hispanic borrowers continue to face discrimination in mortgage lending[10]. Even after controlling for risk factors such as credit scores and debt-to-income ratios, research indicates that these groups pay significantly higher interest rates on loans, including GSE FHA loans.

New technology relying on algorithms with no face to face interaction also showed bias. These modern forms of discrimination perpetuate the legacy of inequity in housing and homeownership.

Buying a House

Buying a house involves many steps. A real estate agent can help, especially for first-time homebuyers. However, remember that real estate agents work for the seller. Even buyer agents have incentive to close the deal or sell you a more expensive house because they work on commissions. Once you have determined your affordable house budget, stay in your price range. Tell the agent your target price range, not your loan preapproval amount. There are many hurdles in the home buying process. Do not get emotionally attached to a property too early. It is very common for an offer to be rejected or for an accepted offer to fall through.

Location, location, location! You and your family preferences are the key determinants in your location choice. Keep in mind commute time to work, school for children, and your own lived experience. Moving to a new environment means learning new skills and an adjustment period. Moving from the country to the city may mean learning the public transportation system or complex parking regulations. Moving from the city to the country may mean learning about septic systems and wells.

Your lifestyle and family situation will affect the type of housing you prefer. Single family houses are the most common form of housing in the U.S., especially outside of cities. They typically have more space than condos and townhouses and offer more privacy and freedom to modify and customize the property. Single family houses are usually more expensive and require more upkeep. You should budget 1 to 2 percent of the home value per year for regular upkeep. This amount will be higher for older homes. Condos tend to offer more amenities and much maintenance is usually done by the condo association. This convenience comes at the expense of more fees, less privacy, and more restrictions.

If you are buying a condo or a house in a homeowner’s association (HOA), be sure to review their bylaws. These bylaws govern many things, from yard maintenance standards to building materials and color choices. Most importantly, these bylaws specify what are considered common areas and common structures. The associations can levy special fees, in addition to regular monthly fees, to repair common structures. You may want to contact a board member of these associations and inquire whether there are pending major repairs and the status of reserve funds. Remember to update your budget with the monthly fees if they were not in your original analysis.

Making The Offer

Making the offer on a house means you are signing a purchase agreement. It is a legally binding contract and a deposit is required. The purchase agreement includes the offer price, which can be higher or lower than the asking price along with any stipulations (called contingencies). The most common contingencies are the approval of financing, a satisfactory home inspection, and an appraisal value at or above the offer price. Another frequent contingency is the home sale contingency, which gives the buyer time to sell their current home. Make sure you understand all the information in the purchase agreement before signing. You are likely making the biggest purchase of your life. Do not be pressured or rushed into it.

The seller can accept your offer, reject it, or make a counter offer. If the seller accepts your offer, both parties are committed. If you withdraw from the accepted agreement, you will forfeit the deposit. If the seller rejects your offer, you can make another one and the old offer is void. If the seller makes a counter offer, you can accept or reject it. Your old offer is also void.

After The Offer

The next steps following an accepted offer include home appraisal and home inspection. A home appraisal is a professional assessment of a property’s market value based on recent comparable sales, property condition and size, its features and amenities, and market trends. Lenders require an appraisal before formally approving a mortgage loan. The primary purpose is to protect the lender by ensuring the loan amount does not exceed the property’s actual worth. Ideally, the appraised value of the home will be equal to or greater than your offer price. If the appraised value comes in lower than your offer, you have three options. You can negotiate a lower price with the seller or walk away, assuming your contract has an appraisal contingency. The last option is to come up with more cash for down payment. However, buying a house above the appraised value is usually not a good idea.

Some lenders also require home inspection. In many states, home inspectors are licensed and regulated. The goal of a home inspection is to identify potential current and future problems with the property. This can include:

- Structural issues: Problems with the foundation, roof, or walls.

- Major systems: The heating, ventilation, and air conditioning (HVAC) system, plumbing, and electrical systems. For example, a 20-year-old furnace, while still operational, will likely need significant repair or replacement in the near future, representing a substantial potential cost.

- Appliance functionality: Checking major built-in appliances.

- Safety concerns: Issues like faulty wiring, carbon monoxide risks, or inadequate ventilation.

- Water intrusion: Signs of leaks or moisture problems in the basement, attic, or other areas.

In addition to a general inspection, some states or lenders may require specific inspections for:

- Pests: To certify the absence of termites or other wood-destroying insects.

- Radon: A naturally occurring radioactive gas that can accumulate in homes and is a health hazard.

- Mold: Identification and assessment of mold growth, which can cause health issues and structural damage.

The home inspection report provides a detailed overview of the property’s condition, often with photographs and recommendations for repair. If significant problems or defects are discovered during the inspection, the buyer typically has four options. You can ask the seller to fix the issues before closing. You can ask the seller for a credit at closing to cover the cost of repairs or negotiate a lower price. If the problems are too extensive or the seller is unwilling to negotiate, you can walk away, provided there is an inspection contingency.

After the lender receives copies of the appraisal and home inspection report, you should receive the final approval for the mortgage, assuming nothing significant has changed in your financial situation since the loan preapproval. The lender is required by law to provide you with the finalized loan estimate, including closing costs details. Check this information against the quote you have received. There should not be large differences. The mortgage approval will satisfy the financing contingency in the offer.

The closing is when the entire real estate transaction is finalized. At the closing, be sure to check that information in the closing documents matches the finalized loan estimate. You are signing a 30 year financial contract!

Preparation phrase

- Gather financial documents such as W-2s, payroll records, and bank statements.

- Review your credit report and check your credit score.

- Review your budget.

- Compute your DTI ratio.

- Compute your house cost ratios.

- Determine your target loan amount and house price range.

Mortgage shopping phase

- Decide on the loan term (how long) and the type of interest rate (fixed or variable).

- Decide which mortgage type (conforming-conventional, FHA, or VA loans) best fits your situation.

- Obtain quotes from 3 lenders. Be sure they do only soft credit inquiry.

- Negotiate with your preferred lender if necessary.

- Choose a lender and obtain a preapproval.

Home shopping phase

- Choose a real estate agent.

- Choose a location and type of housing.

- Stay within your target price range!

- Make an offer and include important contingencies.

- Negotiate if necessary.

- Be prepared for an offer to be rejected or an accepted offer to fall through.

- Obtain quotes and choose a homeowners insurance policy.

- Check loan and property documents carefully for accuracy at closing.

Red Flags to Watch Out For

Real estate agents

- Requesting loan pre-approval before showing you listings.

- Pushing you to make decisions more quickly than you are comfortable with.

- Pushing you to accept terms you do not fully understand.

Mortgage lenders

- Not requiring or doing a credit check.

- Making unrealistic promises.

- Rushing you through the process.

- Asking you to falsify or leave out financial or personal information.

- Dodging your questions.

- Offering lower interest rates without disclosing points.

- Printed documents differ from verbal promise.

Renting versus Owning

Perhaps you have heard that owning a home will build equity and long-term financial security whereas paying rent is like throwing money away. This statement is an over simplification. The financial reality is more complicated. Owning a home is actually more expensive than renting in a large number of scenarios. The New York Times (NYT) first created a “Rent vs. Buy Calculator” in 2007 and last updated it in 2024[11] The key factors used in the calculator include:

- Price of the potential home

- Potential monthly rent

- Years you plan to stay at the place

- Inflation rate

- Rate of return on investments

- Marginal tax rate

- Details about owning:

- Mortgage rate, length of mortgage, private mortgage insurance cost

- Down payment percentage

- Estimated house price growth rate

- Property tax rate

- Closing costs of buying a home

- Closing costs of selling a home

- Home maintenance/renovation cost

- Homeowners insurance

- Extra monthly utilities

- Common fees such as homeowner’s association fees or condo fees

- Details about renting:

- Rent growth rate

- Security deposit

- Renters insurance

The large number of factors used by the NYT Calculator reflect the complexity of the buy versus rent analysis. The saying that “all real estate is local” is true, making it difficult to come up with a simple rule of thumb calculation. Most people focus on the price of the home, and the monthly mortgage payment versus the monthly rent. An often overlooked, yet very important factor, is the opportunity cost of investment return on savings from renting.

As noted earlier, moving is much, much more expensive for homeowners than renters. Transaction costs of selling one house and buying another can total 12 to 16 percent of the home price. When you relocate to a new city or town, it may be a good idea to rent initially to get to know the neighborhood. If your chances of moving are high within 5 to 7 years, renting is the better financial choice.

Financial benefit is only one of many factors in the rent versus own decision. A home usually has more living space and amenities than a rental. It is difficult to find two identical units for the rent versus buy comparison. Your personal values affect whether home ownership will be a source of pride and a personal accomplishment. Owning your home often provides a sense of permanence and stability and of belonging within the community. These other benefits are valuable even though they cannot be measured in dollars. Only you can decide how much they are worth.

Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit, commonly known as a HELOC, is a revolving line of credit secured by your home. The interest rate is variable and tied to a benchmark rate such as SOFR. A HELOC has a draw period and a repayment period. During the draw period you can use money from this line of credit as needed, a bit like using a credit card to make purchases. The draw period typically lasts for 5 to 10 years. Interest is computed on the outstanding balance. You have to pay the minimum monthly payment during the draw period, which may be as low as just the interest amount.

Once the draw period ends, the repayment period begins and you can no longer borrow money from this HELOC. You must begin making the required monthly payments, which include both principal and interest. The payment term is usually 10 to 20 years. Since HELOCs have variable interest rates your monthly payments can fluctuate over time as benchmark interest rates change. There are interest rate caps similar to Adjustable Rate Mortgages (ARMs). Some HELOCs have early prepayment penalties. The closing costs for HELOCs are usually quite a bit lower than for mortgages. However, HELOCs often have annual fees, inactivity fees, transaction fees, and early termination fees.

What a HELOC is Good For

The primary advantages of a HELOC are its flexibility in borrowing and repayment during the draw period and often lower interest rates compared to unsecured loans like personal loans or credit cards. Some common uses include:

- Home Repairs: Home repairs can be very expensive. It is better to take out a loan to repair a leaky roof or flooding basement than to let the damages escalate.

- Educational Expenses: HELOCs can be a supplemental source of funding for college tuition.

- Debt Consolidation: If you have high-interest debts, such as credit card balances, a HELOC can be an option to correct your past spending mistakes. It is important to have a plan and budget to change your spending habits before doing a debt consolidation.

What to Watch Out For

Before taking out a HELOC, you should evaluate your ability to make the monthly payments, including those during the repayment period and the maximum potential interest rate based on the lifetime cap. Consider the following risks carefully when deciding whether to use a HELOC for financing:

- Your Home is the Collateral: If you are unable to make your payments, the lender can foreclose on your home.

- The Temptation to Overspend: The ease of accessing a large line of credit can lead to borrowing for non-essential purchases and accumulating more debt than you can comfortably repay.

- Low Initial Payments Can Be Deceiving: The low payments during the draw period may seem manageable. When the repayment period begins, your monthly payments will increase substantially as you start paying back the principal.

- Fees and Closing Costs: Be aware of potential costs such as application fees, appraisal fees, closing costs, annual fees, transaction fees, inactivity fees, and prepayment penalty.

- Risk of an “Underwater” Mortgage: If the value of your home declines, you could end up owing more on your mortgage and HELOC combined than your home is worth.

- Variable Interest Rates: If benchmark rates rise, the monthly payments can increase significantly.

Homeowners Insurance

The home is usually the most valuable asset and worth being insured. If you have a mortgage, the lender will require homeowners insurance. This section explains the terms used in homeowners insurance policies and the important factors to consider when choosing one. The key elements of a policy include the types of coverage, the types of perils, and actual cash value versus replacement cost.

Types of coverage include the dwelling and other structure such as a detached garage or barn, personal property, loss of use, and personal liability. The personal property component protects everything inside the home, from heating system, appliances, furniture to clothing, and can be supplemented with “floaters” to cover especially valuable items like jewelry or fine art. When your home is uninhabitable, the loss of use coverage pays for additional living expenses such as hotel stays. The personal liability portion covers legal fees and medical expenses if someone is injured on the property.